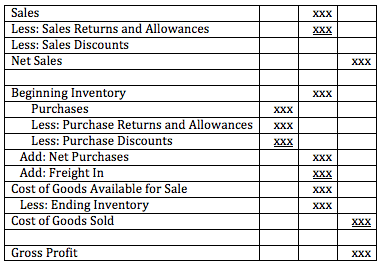

Purchases, inventory and cost of goods sold are intimately related in accounting. At the end of the period, manufacturing companies and merchandise retailers present these three items together on the income statement. Cost of goods avaialble for sale are calculated as the company's beginning inventory plus it's purchases. Cost of goods sold are calculated as the cost of goods avalailable for sale less ending inventory. Gross profit is calculated as sales less cost of goods sold.

Operating expenses, suches as selling, general and administrative (SG&A) are then subtracted from gross profit to calculate operating income. Service companies may use a similar layout for their income statement, recording costs of services and calculating a gross profit. This allows users of the financial statement to get a quick understanding of the inventontory consumed in the ordinary course of business and to compare it to the company's overhead.

When a periodic inventory system is used, the cost of goods sold depends significantly on the cost flow method chosen for valuing inventory and cost of goods sold. Because inventory amounts may be susceptible to maniupulation, the accounting professions is acutely aware of the need to ensure true and fair accounting methods and satisfactory internal controls are used for inventory.

Purchases, Inventory and Cost of Goods Sold (COGS)

BrainMass Categories within Purchases, Inventory and Cost of Goods Sold (COGS)

Inventory

Inventory is the short-term assets a company holds for sale in the ordinary course of business.

Cost of Goods Sold

The cost of goods sold is the cost of inventory consumed or sold over the ordinary course of business during the period.

Purchases

Purchases are equal to the price of purchased inventory multiplied by the number of units ordered. The purchases account informs the cost of goods available for sale.

BrainMass Solutions Available for Instant Download

Ending Inventory, COGS and Net Income Under the FIFO Method

Purchases: July 15 5500 units $9.00 per unit November 12 Spark Company's inventory records show the following data Inventory, January 1, 2013 6,000 units $10.00 3500 units $8.00 per unit A physical inventory on December 31 2013 shows 4,000 units on hand. Spark sells the units for $18 each. The company has an effec

Savannah Textiles Company: WIP Inventory

How do I calculate Cost of the September 30 Work-in-process inventory in the Weaving department? I am providing all of the information I have. Savannah Textiles Company manufactures a variety of natural fabrics for the clothing industry. The following data pertain to the Weaving Department for the month of September.

Assessing Budgets

7-28 Ronoco Products, a wholesaler of fishing equipment, budgeted the following sales for the indicated months: June 20X8 July 20X8 August 20X8 Sales on account $1,820,000 $1,960,000 $2,100,000 Cash sales 280,000 240,000 260,000 Total sales $2,100,000 $2,200,000 $2,360,000 All merchandise is marked up to sell at its in

Peabody Limited. Statement of Cost of Goods Manufactured, COGS, Fin Stmt

Peabody Limited. incurred the following costs during March: Raw materials purchased $46,800 Direct labor (9,200 hours) 156,400 Manufacturing overhead (actual) 83,000 Selling expenses 47,400 Administrative expenses 32,600 Interest expense 14,800 Manufacturing overhead is applied on the basis of $8.50 per direct labor h

PharmCo's Overstated Inventories

Identify the operational and behavioral issues in the following case Abstract A new internal auditor discovers that her company is falsifying inventories—and selling expired medications. When she refuses to ignore her findings, she receives a reprimand. As the family breadwinner, how can she uphold her professional ethics

Creative Products Inc: costs, COGS, net income

Creative Products Inc. incurred the following costs: Administrative Costs = $2,000 Advertising Costs = $1,000 Direct Material Used = $8,000 Direct Labor = $20,000 Factory equipment deprectiation= $1,000 Factory Rent

Cost Formula Using the High Low Method

The controller of Chittenango Chain Company believes that the identification of the variable and fixed components of the firm's costs will enable the firm to make better planning and control decisions. Among the costs the controller is concerned about is the behavior of indirect-materials cost. She believes there is a correlatio

Profit Percentage and Inventory Turnover

An acquaintance with an interest in investing says "I would not invest in Company A because their gross profit percentage is low and their inventory turnover ratio is high." Is your acquaintance correct in their concerns? Reply to your acquaintance.

Inventory, turnover ratio and gross profit ratio

Using the following information, calculate inventory turnover ratio, the average days in inventory and the gross profit ratio for Howard Company for the year ended December 31, 2011 (Rounded to two decimal places.) Explain each concept and show the relevant formula along with the solution. Sales

Park Company Exercise (Four Inventory Methods)

Park Company reported the following March purchases and sales data for its only product: *** See Attachment *** Park uses a perpetual inventory system. For specific identification, ending inventory consists of 240 units, where 100 are from the March 30 purchase, 80 are from the March 20 purchase, and 60 are fr

Fixed Order Quantity Inventory Model

A company is planning for its financing needs and uses the basic fixed-order quantity inventory model. What is the total cost (TC) of the inventory given an annual demand of 10,000, setup cost of $32, a holding cost per unit per year of $4, an EOQ of 400 units, and a cost per unit of inventory of $150?

Accounting for Inventories and cost flow methods

Explain the basis of accounting for inventories and apply the inventory cost flow methods under a periodic inventory system (in less than 230 words).

Hamada equation and cost of equity

Simon Energy Services Co. is trying to estimate its optimal capital structure. Right now, Simon has a capital structure that consists of 20 percent debt and 80 percent equity, based on market values. (Its D/S ratio is 0.25.) The risk-free rate is 6 percent and the market risk premium, rM - rRF' is 5 percent. Currently the compan

Inventory-As order size increases, total?

As order size increases, total: inventory costs will increase, reach a maximum and then quickly decrease. inventory cost will decrease, reach a minimum and then increase. ordering costs will initially increase while total carrying cost will continue to decrease. carrying cost decreases while the

Inventory-Rose Arena

Rose Arena is the production manager for a manufacturing firm that produces buggy whips and other items. The annual demand for a particular buggy whip is 1,600 units. The holding cost is $2 per unit per year. The cost of setting up the production line is $25. There are 200 working days per year. Rose decided to produce 200 units

Intermediate Financial Accounting - Inventories

1- Many companies use the lower-of-cost-or-market method to value inventory. They compare the current value of their inventory with its historical cost and adjust the value, if necessary, to ensure the inventory is booked at the lower of the two values. Why do you think inventories are valued using the lower-of-cost-or-market me

Bullock changes to the average cost method for inventory

Bullock Inc. has been in operation for 3 years and uses the FIFO method of pricing inventory. During the fourth year, Bullock changes to the average cost method for all its inventory. How will Bullock report this change?

Preparation of a Schedule of COGM and COGS and more....

Please refer to the spreadsheet attached to the question: 1. If Eccles produces 10,000 units what is the unit cost and total cost for direct material and factory rent? 2. Assume that Eccles doubles their production, how will that effect the 2 cost item above?

Statement of Cost of Goods Manufactured (COGM) vs COGS

Discuss the Statement of Cost of Goods Manufactured (COGM) in relation to COGS and the income statement. What specifically does the statement of COGM reflect? Which accounts, and what type of accounts are they (assets, expenses, liabilities, etc)? What goes into each account? Provide an example.

Dave Corporation's Spending Variance for Supplies Cost

Dave Corporation's cost formula for its supplies cost is $1,120 per month plus $11 per frame. For the month of June, the company planned for activity of 611 frames, but the actual level of activity was 607 frames. The actual supplies cost for the month was $8,150. The spending variance for supplies cost in June is?

Explaining Various Inventory Methods

Do certain products fit particularly well with either FIFO, LIFO, or average inventory methods. Please explain how the three methods are used.

How does beginning and ending inventory affect cost of goods

How does beginning and ending inventory affect cost of goods sold?

Quantitative Analysis of Inventory Control Models

The Hardware Warehouse is evaluating the safety stock policy for all its items, as identified by the SKU code. For SKU M4389, the company always orders 80 units each time an order is placed. The daily demand is constant, at 5 units per day; the lead time is normally distributed, with a mean of 3 days and a standard deviation of

Compute the cost of goods manufactured and COGS

Compute the cost of goods manufactured and cost of goods sold? In its first year of operations, Gilmore manufacturing company purchased $44,000 of direct materials and incurred $7,600 of direct labor costs during the year. Indirect labor amounted to $3,000 while indirect materials totaled $5,200. Factory depreciation totaled $1

Cost Flow Methods

Jones Company had 100 units in beginning inventory at a total cost of $10,000. The company purchased 200 units at a total cost of $26,000. At the end of the year, Jones had 80 units in ending inventory. Instructions: (a) Compute the cost of the ending inventory and the cost of goods sold under: (1) FIFO, (2) LIFO, and (3) a

Computing Ending Inventory Using Dollar-Value LIFO

Presented below is information related to Martin Company: Ending inventory Date (End-of-year prices) Price index 12/31/07 $ 80,000 100 12/31/08 111,300 105 12/31/09 1

Operation Management: Yasuko's Art Emporium (YAE)

Could you please help me with this problem: Yasuko's Art Emporium (YAE) ships art from its studio located in the Far East to its distribution center located on the West Coast of the United States. YAE can send the art either via transoceanic ship freight service (15 days transit) or by air freight (2 days transit time). YAE s

Cost Formula

Jo builds and sells robots using component parts purchased from a supplier and assembled and painted in Jo's factory. The boats sell for $1,200 each. Component parts cost $400 per boat, and each boat requires 12 labor hours to assemble at a cost of $14 per hour. Jo's factory is rented for $2,000 per month, which includes util

Beverly Hospital :Using the high-low method, estimate the cost formula for X-ray costs.

The number of X-rays taken and X-ray costs over the last nine months in Beverly Hospital are given below: Month X-Rays Taken X-Ray Costs January 6,600 $21,120 February 13,800 $35,460 March 13,100 $34,576 April 11,100 $29,808 May 8,500 $27,200

Financial statement disclosure, inventory method to maximize profit, interpret ratios

List the financial statements a business most disclose and define each. Discuss how inventory should be used by the manager to maximize profit. Select two ratios and discuss how to interpret and utilize the ratios.