The weighted average cost method calculates the cost of goods sold based on, as the name suggests, the weighted average cost of goods available for sale during the period. We call this system ‘weighted’ because it takes into account the different volume of goods purchased at each price level.

Weighted-Average Cost

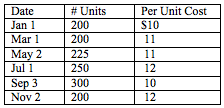

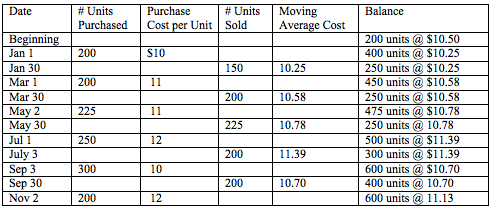

Consider a company that has the following purchases over the course of the year. The company also has 200 units in beginning inventory, each valued at $10.50, and 250 units in ending inventory.

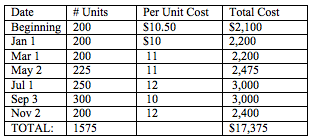

In order to find the cost of the ending inventory, we would add together the cost of are purchases for the year, as well as our beginning inventory, and divide this number by our total units.

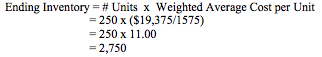

The weighted average cost per unit is equal to the total cost divided by the total number of units available for sale. The ending inventory is equal to the # of units in ending inventory multiplied by the weighted average cost per unit.

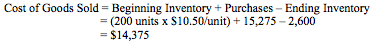

We can then calculate cost of goods sold by subtracting our value for ending inventory from our total purchases plus beginning inventory.

Moving-Average Cost

When the weighted average cost method is used for a perpetual inventory system, we call this the moving average cost method. Under this method, inventory records are kept in both units and dollars. A new average unit cost is calculated each time a purchase is made because the cost of goods sold at average cost has to be recognized at the time of each sale.

Consider the above example. We can expand the table to show the number of units and the moving average cost per unit in the balance column.

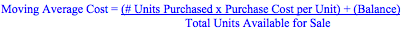

When we make a purchase, the purchase price informs a new moving average cost for the units of inventory we have on hand (in the balance column). We calculate the new moving average cost after each purchase using the following formula:

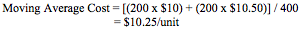

In our example above, we would calculate the new moving average cost after our January 1st purchase by adding the total cost of our purchase to the inventory balance and dividing by the total number of units on hand.

The moving average cost only changes when purchases are made. It does not change when sales are made. However, sales change the total number of units available in our balance column. Since the average is a weighted average, the total number of units available affects how our previous costs are weighted when calculating our moving average each time a purchase is made. Therefore, the moving average cannot be calculated without keeping track of both purchases and sales together.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Purchases, Inventory and Cost of Goods Sold (COGS)

- /

- Inventory

- /

Weighted-Average Cost

BrainMass Solutions Available for Instant Download

Explaining Weighted Average Cost of Capital

Research Weighted Average Cost of Capital and discuss in 1000 words.

Weighted-Average Methods for Peace Mfg Company

Please show solution- see attached Peace Mfg. Co. incurred the following costs in January: Direct Labor $ 40,000 Advertising Costs $ 1,000 Factory Utilities 15,000 Factory Rent 4,000 Administrative Salaries 8,000 Factory Depreciation 2,000 Raw Materials Purchased 10,000 Administrat

Weighted Average Process Costing Method: Byrnes Corp

The Byrnes Corporation is a manufacturer of a chronograph wristwatch and uses the weighted-average method of process costing. Materials are added to production at the beginning of the manufacturing process, and overhead is applied to each product at the rate of 70 percent fo direct labor cost. There was no finished goods invento

Managerial Accounting: Straightforward Weighted-Average Process Costing

Problem 4-26 Straightforward Weighted-Average Process Costing, Step-by-Step Approach Piscataway Plastics Company manufactures a highly specialized plastic that is used extensively in the automobile industry. The following data have been compiled for the month of June. Conversion activity occurs uniformly throughout the prod

Equivalent Units in Weighted Average Process Costing

Andromeda Glass Company manufactures decorative glass products. The firm employs a process costing system for its manufacturing operations. All direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. The company's production schedule for August follows.

Osaka Corporation: Units Completed and Transferred Out (Cost of Goods Manufactured)

I need assistance with the "Units Completed and Transferred out (Cost of Goods Manufactured)". 1. Data for Osaka Corporation for the month of June 20xx are as follows: Beginning work in process inventory: Operations for the month of June: Units - 800 Units started- 14,000

Cost Accounting: Weighted-Average Method

Bio Doc Corporation is a biotech company based in Milpitas. It makes a cancer-treatment drug in a single processing department. Direct materials are added at the start of the process. Conversion costs are added evenly during the process. Bio Doc uses the weighted-average method of process costing. The following information for J

Calculate the average cost per unit: Dyna Distribution.

Dyna Distribution markets CDs of the performing artist King James. At the beginning of March, Dyna had in beginning inventory 1,500 King James CDs with a unit cost of $7 During March, Dyna made the following purchases of King James CDs. March 5 3,500 @ $8 March 21 2,000 @ $10 March 13 4,000 @ $9 March 26 2,0

Weighted Average - Process Costing

Comas Corporation manufactures metal roofing in two departments: Pressing and Painting. Sheets of metal material are formed in the Pressing Department before being transferred to the Painting Department. The following information was taken from the company's general ledger and cost accounting records on June 30... Please see

Inventory

it there was no beginning work in process inventory and no ending work in process inventory under the weighted average process costing method, the number of equivalent units for direct materials, if direct materials were added at the start of the process, would be: a equals to the units started or transferred in.

Stein Corporation Weighted-Average Process Costing

Stein Corporation manufactures in separate processes refrigerators and freezers for homes. In each process, materials are entered at the beginning and conversion costs are incurred uniformly. Production and cost data for the first process in making two products in two different manufacturing plants are as follows.

Honey Butter, Inc. Weighted Average Process Costing

Honey Butter, Inc. Manufactures a product that goes through two departments prior to completion- the Mixing Department followed by the Packaging Department. The following information is available about work in the first department. The Mixing Department, during June. Percent Completed Units Materials Conversions Work in P

Weighted-Average Contribution Margin and Break-even

Jamal & Co. makes and sells two types of shoes, Plain and Fancy, Data concerning these products are a follows: Plain Fancy Unit selling price $20.00 $35.00 Variable cost per unit 12.00

weighted-average method of process accounting

Porter Handcraft is a manufacturer of picture frames for large retailers. Every picture passes through two departments: the Assembly Department and the Finishing Department. This problem focuses on the Assembly Department. The process-costing system at Porter has a single direct-cost category (direct materials) and a single indi

Weighted average cost

see attached U3A1 U3A1 Problem 3 3 LifeBlod Corporation uses the Weighted Average Cost System. Determine the cost of ending work in process inventory and of the units transferred in June. Percentage Complete Units Materials conversion Work in process, June 1 5,000 100% 100%

Solve Using the Weighted Average Method

Cooperative San José of southern Sonora state in Mexico makes a unique syrup using cane sugar and local herbs. The syrup is sold in small bottles and is prized as a flavoring for drinks and for use in desserts. The bottles are sold for $12 each. (The Mexican currency is the peso and is denoted by $.) The first stage in the prod

Cost Reconciliation Report - Weighted-Average Method

Maria Am Corporation uses a process costing system. The Baking Department is one of the processing departments in its strudel manufacturing facility. In June, in the baking department, the cost of the beginning work in process inventory was $3570, the cost of the ending work in process inventory was $2860, and the cost added t

Weighted average cost of capital solution

Hanson Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,680,000 on March 1, $1,260,000 on June 1, and $3,044,000 on December 31. Hanson Company borrowed $1,167,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addit

Process Costing using the Weighted Average Method

Toronto Titanium Corporation manufactures a highly specialized titanium sheathing material that is used extensively in the aircraft industry. The following data have been compiled for the month of June. Conversion activity occurs uniformly throughout the production process. Work in process, June - 40,000 units: Direct mate

Weighted average common shares outstanding, basic, diluted EPS

I am having problems with calculating the weighted average common shares outstanding. I'm also having trouble with what to do with the cumulative convertible stock and the stock options. I know that there should be a formula for this but I can't find it anywhere. --------------------- 18. For the year ended December 31, 2

Straightforward Weighted-Average Process Costing

Moravia Company processes and packages cream cheese. The following data have been compiled for the month of April. Conversion activity occurs uniformly throughout the production process. Work in process, April: 10,000 units: Direct material: 100% complete, cost of : $ 22,000 Conversion: 20% complete, cost of : 4,500 Bala

Unit production costs for materials and conversion costs

I have a multiple choice problem that I need help with... A department adds materials at the beginning of the process and incurs conversion costs uniformly throughout the process. For the month of May, there was no beginning work in process; 20,000 units were completed and transferred out; and there were 5,000 units in the en

Price-Weighted Divisor for the Price-Weighted Index

There is a stock index that holds only three stocks known as A, B and C. In sequential order they sell for $50.00, $100.00 and $150.00. a) If B undertakes a 2 for 1 stock split, what is the new divisor for the price-weighted index? b) If B undertakes a 3 for 1 stock split, what is the new divisor for the price-weighted in

Weighted-average number of shares outstanding

Can you help me get started with this assignment? E16-14 (EPS: Simple Capital Structure) On January 1, 2008, Wilke Corp. had 480,000 shares of common stock outstanding. During 2008, it had the following transactions that affected the common stock account. February 1 Issued 120,000 shares March 1 Issued a 10% stock dividen

Average Markup Percentage Calculations: full cost, variable cost,

Problem 1 - Nancy Company has budgeted sales of $300,000 with the following budgeted costs: Direct materials $60,000 Direct manufacturing labor 40,000 Factory overhead Variable

Weighted Average Method Conversion, Materials & Inventory Problems

--attached Shelby Company utilizes the weighted-average method in its process costing system. During September, the beginning inventory in the first process department summed up to 750 units. The costs and percentages completion of these units in the beginning inventory were as follows: Cost Percent Complete Material

Average cost per unit and budgeted direct materials

1. A soft drink company has three bottling plants throughout the country. Bottling occurs at the regional level because of the high cost of transporting bottled soft drinks. The parent company supplies each plant with the syrup. The bottling plants combine the syrup with carbonated soda to make and bottle the soft drinks. Th

Weighted-average cost of capital

Test: Basic Finance: A Introduction to Financial Institutions, Investments and Management. Chapter 21; page 396; problem #3. "A firm's current balance sheet is as follows: Assets $100 Debt $10 Equity $90 a. What is the firm's weighted-average cost of capital at various combinatio

equivalent production-weighted average method..

Study Guide Practice Exercise Why is a process cost system not appropriate for company that produce items that are distinctly different form one another? What is the weighted average method of determining equivalent units? Why is it used? What are its weaknesses? Process costing: determining equivalent units and allo

Equivalent production-weighted average method.

I need help with these problems; please I want detail of every step. Process costing: determining equivalent units In March 2006, Martinez Corporation's battery plant had 1,500 units in its beginning work in process inventory. During March, the company added 18,000 units to production. At the end of the month, 6,000 units