Specific unit cost is a cost flow method that can be used when each unit of inventory is identifiable. Companies typically use specific unit cost when they sell a small number of expensive items, such as jewelry or automobiles. However, with the advent of computer inventory systems and better inventory tracking tools such as RFID tags, specific unit costing is becoming more popular.

Under specific costing, an accountant is able to trace the actual order batch and the actual cost paid for each unit of inventory. As a result, specific unit costing under the periodic inventory system values inventory the same way a perpetual inventory system would. Specific costing directly matches cost of goods sold to current revenues, and prevents manipulating the accounting statements. Despite this, specific costing may not be practical for a company that sells many units of inexpensive, homogenous, and unidentifiable goods.

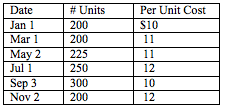

Consider a company that has the following purchases over the course of the year. The company also has 200 units in beginning inventory, each valued at $10.50, and 250 units in ending inventory.

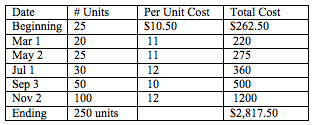

We also know that 25 units of ending inventory come from beginning inventory, 100 units come from the November 2nd order, 50 units come from the September 3rd order, 30 units come from the July 1st order, 25 units come from the May 2nd order, and 20 units come from the March 1st order. We can calculate the ending inventory by adding up the specific costs of the units in ending inventory from each batch.

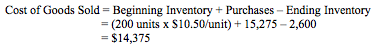

We can then calculate cost of goods sold by subtracting our value for ending inventory from our total purchases plus beginning inventory.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Purchases, Inventory and Cost of Goods Sold (COGS)

- /

- Inventory

- /