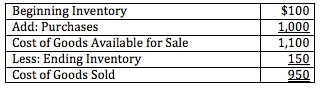

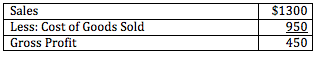

A company’s beginning inventory and purchases are typically referred to jointly as the cost of goods available for sale. Similarly, consumed inventory costs are typically referred to as cost of goods sold. The cost of goods available for sale is equal to beginning inventory plus purchases. The cost of goods sold is equal to the cost of goods available for sale less ending inventory. Gross profit is equal to net sales less the cost of goods sold.

The calculations shown above are typically included on the income statement for a merchandising company. Cost of goods sold is subtracted from net sales in order to find gross profit.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Purchases, Inventory and Cost of Goods Sold (COGS)

- /

Cost of Goods Sold

BrainMass Solutions Available for Instant Download

Cost, contribution and profit analysis

PROBLEM 7-18 Relevant Cost Analysis in a Variety of Situations [LO 7-2, LO 7-3, LO 7-4] Andretti Company has a single product called a Dak. The company normally produces and sells 60,000 Daks each year at a selling price of $32 per unit. The company's unit costs at this level of activity are given below: Direct materials......

Inventory Methods Explanations

Discussion Questions 1) Distinguish between the periodic and perpetual methods. Expand on response 2) Discuss the inventory cost flow methods. Which is the most accurate? Why? Expand on response 3) Define the LCM rule. Is it more or less applicable in 2016. Explain. Textbooks Introduction to Financial Accounting, 11/E

Plan value, earned value, actual cost and cost variance

JLB Construction has been contracted to provide a security enclosure for a Water Distribution facility for a major metropolitan area. The structure is in the shape of a pentagon and is a wall. One side of the wall contains a secure gate for exit and entry. Total project cost is estimated at 1 million dollars. The wall wil

Creation of the Cost of Goods Manufactured Statement for a manufacturing firm.

Please help me with the following assignment: Cost of Goods Manufactured Statement Denny Corporation, a manufacturing company, produces a single product. The following information has been taken from the company's production, sales, and cost records for the just completed year: Production in units 51,000 Direct lab

Cost of Goods Manufactured: Calculating Unknowns

The following information was taken from the accounting records of Tomek Manufacturing Company. Unfortunately, some of the data was destroyed by a computer malfunction. (View attachment) Required: Calculate the unknowns indicated by the question marks.

Sears Co: Cost of Goods Sold

The following table summarizes the beginning and ending inventories of Sears Co. For the month of October: Sept. 30 Oct. 31 Raw Materials $ 29, 700 $31,000 Work-in-process

PROBLEM 2-14 Wollogong Group Ltd. Cost Classification; PROBLEM 2-18 Meriwell Company Schedule of Cost of Goods Manufactured

PROBLEM 2-14 Cost Classification [L02, L03, L06, LOS] Wollogong Group Ltd. of New South Wales, Australia, acquired its factory building about 10 years ago. For several years, the company has rented out a small annex attached to the rear of the building. The company has received a rental income of $30,000 per year on this spac

The total manufacturing costs for the year were $683,000; the goods available for the sale totaled $740,000; and the cost of goods sold totaled $660,000.

Selected account balances for the year ended December 31 are provided below for Superior Company: Selling and administrative salaries . . . . . . . . . . . . $110,000 Purchases of raw materials . . . . . . . . . . . . . . . . . . $290,000 Direct labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ? Advertising

Schedule of Cost of Goods Manufactured

Dalton Brothers Manufacturing, Inc. began business in July 2011. The firm makes mud boats for retail sale. Following are data taken from the firm's accounting records that pertain to its first month in operation. Direct material purchased on account-----$900,000 Direct material issued to production-----377,000 Direct labo

Baker Fine Foods will report cost of goods sold equal to:

Baker Fine Foods has beginning inventory for the year of $12,000. During the year, Baker purchases inventory for $150,000 and ends the year with $20,000 of inventory. Baker will report cost of goods sold equal to: 1. $150,000 2. $158,000. 3. $142,000 4. $170,000

Cost of goods manufactured for Fossil Furniture Company

Manufacturing information for 2001 for the Fossil Furniture Company is provided below. On January 1, 2001, raw materials inventory included direct materials with a cost of $20,000. During the year, the firm purchased direct materials costing $50,000. At year-end, the account included direct materials, with a cost of $5,000

Santa Cruz, Inc: Total manufacturing costs, cost of goods sold for March

Given the following information: The following information comes from the accounting records for Santa Cruz, Inc., for March: Direct material inventory, March 1 $ 18,900 Direct material inventory, March 31 15,000 Work-in-process inventory, March 1 8,200 Work-in-process inventory, March

Karlana Corporation: Compute cost of goods manufactured

The following data (in thousands of dollars) have been taken from the accounting records of Karlana Corporation for the just completed year. Sales $916 Raw materials inventory, beginning $95 Raw materials inventory, ending $15 Purchases of raw materials $120 Direct labor $124 Manufacturing overhead $188 Administra

Calculate prime costs; cost of goods manufactured for month

Please select the correct answer in the two exercises below and explain briefly how you calculated it. 1. The following costs were incurred in August: Direct materials $21,800 Direct labor $19,100 Manufacturing overhead $19,400 Selling expenses $14,500 Administrative expenses $20,400 Prime costs during the mon

Maroon Corporation - Schedule of Cost of Goods Manufactured

The following data (in thousands of dollars) have been taken from the accounting records of the Maroon Corporation for the just completed year. Sales-1,150 Raw materials inventory, beginning--- 15 Raw materials inventory, ending--- 40 Purchases of raw materials--- 150 Direct labor--- 250 Manufacturi

Prepare Schedule of Cost of Goods Manufactured

The following data (in thousands of dollars) have been taken from the accounting records of the Maroon Corporation for the just completed year. Sales 1,150 Raw materials inventory, beginning 15 Raw materials inventory, ending. 40 Purchases of raw materials.. 150 Direct labor.. 250 Manufacturing overhead. 300

Information required to forecast cost of goods sold

Now you have made your best prediction of next year's sales you want to estimate next year's cost of goods sold. Pick two pieces of information you definitely want to obtain in order to help you with this task being sure to explain why they will be helpful.

Average daily sales, cost of goods sold, purchases

1. Using the information in exhibit 1 and 2, calculate McGhee's average daily sales, average daily cost of goods sold, average daily purchases, and average operating expenses. How much control does the firm have over each of these iteams? *Exhibit 1: McGhee Corporation. Balance Sheet, December 31, 2003.

Cost of goods made, work in process

Please see attached file for the problem Problem I First, inc. Has the following account balances at the end of march, 2001 Administrative expenses $ 53,000 Direct labor 56,000 Direct material beg. Inv. 12,000 Direct material end. Inv. 10,000 Direct material purchases 55,000 Finished goods be

Cost of goods manufactured schedule

Please fill in the yellow cells (attached) and provide an explanation on how the answer was obtained so I can complete these questions without assistance. MADLOCK MANUFACTURING COMPANY Cost of Goods Manufactured Schedule For the Year Ended December 31, 2005 Work in process (1/1) $210,000 Direct materia

Calculating the Cost of Goods Manufactured: Naze Inc. Example

See attached file. Calculate the cost of goods manufactured. Calculate the difference between cost of goods manufactured and cost of goods sold. Prepare a traditional (absorption) income statement.

Cost of good manufactured, prime costs, conversion costs, etc

The following information is taken for the accounts of the Apex Manufacturing Company: Account Balances: 1/1/07 12/31/07 Matierial $20,000 $10,

Dayton Dairy: Cost of Goods Sold if 38,000 gallons sold.

Dayton Dairy is a milk distributor that stores all of its milk in a large tank before it is bottled into individual gallon-sized containers. The dairy uses the average cost method to account for inventory. The company began the month of May with 6000 gallons of milk at an average cost of $1.90 and made the following purchases

Compute net sales, cost of goods sold, operating expenses

30. The following information was taken from the financial statements of Adam Company: 2007 2006 Gross profit on sales $700,000 $765,000 Income before income taxes 230,000 221,000 Net income 160,000 153,000 Net income as a percentage of net sales 12% 11% Instructions (a

Total cost of good transferred from work in process to finished goods

Violet Enterprises uses weighted average based process costing for inventory valuation purposes. At the beginning of the period there were 2,000 units in work in process (WIP) that were 30% complete. During the period 12,000 new units were started. Ending WIP was 3,000 units that were 40% complete. Direct materials are added at

What items make up cost of goods sold?

What items make up cost of goods sold? How does beginning and ending inventory affect cost of goods sold? How does school organization calculate cost of goods sold?

Statement of Cost of Goods Manufactured

As the management accountant for Ace Enterprises, Inc., you have been asked to prepare a statement of cost of goods manufactured at the end of the first quarter. Account balances at that time were as follows: ---------------------------------------------------------------------------- Materials inventory, January 1, 20xx

Cost of goods sold

I have pasted a file below with a problem that I need help with filling in the blanks. Below is a series of cost of goods sold sections for companies B, F, L, R. B F L R Beginning inventory

Two questions

1. Which statement is true? A. When the cost of goods sold as a percentage of sales increases the gross margin percentage will increase. B. It is possible for cost of goods sold in dollars to increase while cost of good sold as a percentage of sales decreases. C. If gross margin percentage is the same for the current an

Cost of Goods Financial Statements

1. The financial statement for a company shows the following: Cost of good sold $750,000. Merchandise Inventory has a beginning balance of $45,000 and ending balance of $45,000. Account Receivable has a beginning balance of %53,000 and an ending balance of $50,000. Accounts payable has a beginning balance of $37,000 and an endin