In certain circumstance companies may need to estimate inventories. For example, in case of a fire, a company may need to report to their insurance company the value of inventory destroyed. A company using a perpetual inventory system would simply report the value of their lost inventory as show in the account balance. However, a company using a periodic inventory system wouldn’t have an up to date account balance for inventory. Other circumstances where a company may want to estimate inventories include estimating inventories for interim reports or testing the resonableness of the cost calculated by some other method.

In these circumstances there are two generally accepted ways of estimating inventories: the gross profit method and the retail inventory method.

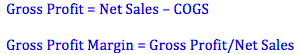

Gross Profit Method

The gross profit method estimates the current value of a company’s inventory using the company’s previous gross profit margin and current net sales and cost of goods sold.

For example, assume a company has a historical gross profit margin of 35%. We can calculate ending inventory by doing the following:

Step 1: Beginning Inventory + Purchases = Cost of Goods Available for Sale

Step 2: Current Sales x (1 - Historical Gross Profit Margin) = Estimated Cost of Goods Sold

Step 3: Cost of Goods Available For Sale – Estimated Cost of Goods Sold = Estimated Ending Inventory

Note: Sometimes we refer to (1 - Historical Gross Profit Margin) as the 'Cost of Goods Sold Percentage.' It is always the complement of the gross profit percentage.

Retail Inventory Method

Many retail businesses track both the purchase price of merchandise as well as the retail value of merchandise available for sale. We can estimate ending inventory using the retail value of costs available for sale and the amount of sales recorded.

Step 1: Goods Available for Sale (Retail Value) – Sales = Ending Inventory (Retail)

Step 2: Cost-to-Retail Ratio = Goods Available for Sale (Cost)/Goods Available for Sale (Retail Value)

Step 3: Ending Inventory (Cost) = Ending Inventory (Retail) x Cost-to-Retail Ratio

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Purchases, Inventory and Cost of Goods Sold (COGS)

- /

- Inventory

- /

Estimating Inventories

BrainMass Solutions Available for Instant Download

Finding cost of goods destroyed

Alan Legler requires an estimate of the cost of goods lost by fire on March 9. Merchandise on hand on January 1 was $35,300. Purchases since January 1 were $66,700; freight-in, $3,400; purchase returns and allowances, $2,400. Sales are made at 33 1/3% above cost and totaled $101,400 to March 9. Goods costing $11,200 were left un

Allocating A Lump-sum Purchase Price in a Bulk Purchase

Exercise 9-8 During 2014, Pretenders Furniture Company purchases a carload of wicker chairs. The manufacturer sells the chairs to Pretenders for a lump sum of $63,000 because it is discontinuing manufacturing operations and wishes to dispose of its entire stock. Three types of chairs are included in the carload. The three types

Return on Investment and Gross Profit Problem

Hi, I have the data in an Excel spreadsheet attached, I have calculated the Return on Investment and the Gross Margin, but I am not sure if it is correct? Could someone please help me ensure it is correct?

Gross Profit & Cash Dividends

Please show all work on problems, so I can understand similar situations. Thanks 1) Suppose sales for the coming year are forecasted to be $71,162 and the forecasted cost of sales to sales ratio is 73.00 percent. Calculate gross profit. 2) Suppose pretax income is $1,981, the effective tax rate is 40 percent, and the