The first in, first out cost formula, better known as FIFO, assigns costs based on the cost flow assumption that inventory is used up or sold in the order in which it was purchased. Therefore, the costs associated with the earliestpurchases are assigned to the goods that are first used or sold. The costs associated with ending inventory are the most recent purchase costs.

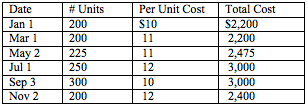

For example, consider a merchandising company that makes purchases throughout the year of the following amounts.

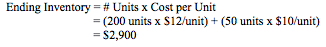

We also know the company had a beginning inventory of 200 units each worth $10.50, and an ending inventory of 250 units. To calculate the value of the ending inventory, we assume that 200 units are from the November 2nd order batch and 50 units are from the September 3rd order batch.

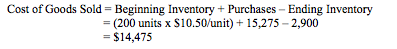

We can then calculate the cost of goods sold by adding our purchases to our beginning inventory and subtracting this value of ending inventory.

The FIFO cost flow assumption should be used when a firm typically sells its oldest inventory first. When this is the case, the FIFO method will reasonably approximate the specific unit cost method. At the same time, when a company adheres to the FIFO method, it prevents the manipulation of income because the costs that are charged to expenses each period must be determined the same way. Similarly, by valuing inventory based on the cost of the company's most recent purchases, the value of inventory under FIFO method closely resembles the actual replacement cost of inventory.

FIFOs basic disadvantage is that by valuing inventory at current prices, the value of cost of goods solds is based on the oldest costs. This may mean that current expenses are not matched against current revenues. This may distort gross profit and income, particulaly when prices are changing rapidly.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Purchases, Inventory and Cost of Goods Sold (COGS)

- /

- Inventory

- /

FIFO

BrainMass Solutions Available for Instant Download

Santanderio Inc.: Consolidated Financial Statements

Please assist showing the math. The below chart which is already completed attached is needed to complete. SANTANDERIO INC. 1.This small New York Company is a distributor of special electronic lamps. These lamps are purchased by laboratories and research centers throughout the country. Retained Earnings, 12/31/2000 (Be

Queue Discipline

1. Provide an example of when a first-in, first-out (FIFO) rule for queue discipline would not be appropriate. 2. a. The Dynaco Manufacturing Company produces a particular product in an assembly line operation. One of the machines on the line is a drill press that has a single assembly line feeding into it. A partially comple

FIFO costing method

Liquid Extracts Company produces a line of fruit extracts for home use in making wine, jams and jellies, pies, and meat sauces. Fruits enter the production process in pounds; the product emerges in quarts (1 pound of input equals 1 quart of output). On May 31, 4,250 units were in process. All direct materials had been added, and

Evaluating the Maple Company and Teague Company

Problem 1. Maple Company started the year with no inventory. During the year, it purchased two identical inventory items at different times. The first unit cost $800 and the second, $700. One of the items was sold during the year. Required: Based on this information, how much product cost would be allocated to cost of goods so

Materials Ledger Account: Journalize the summary entry to transfer materials to work in process.

Cost of Materials Issuances Under the FIFO Method An incomplete subsidiary ledger of wire cable for June is as follows: a. Complete the materials issuances and balances for the wire cable subsidiary ledger under FIFO. Received Issued Balance Receiv

Distinct feature of the FIFO process costing method

A distinct feature of the FIFO process costing method is that the: a Work done on beginning inventory before the current period is blended with the work done during the current period in the calculation of the equivalent units. b The work done on beginning inventory before the current period is kept separate

EVA Briggs & Stratton problem 10.30

Problem 10: 30 - EVA at Briggs & Stratton Briggs & Stratton Corporation is the world's largest maker of air-cooled gasoline engines for outdoor power equipment. The company's engines are used by the lawn and garden equipment industry. According to the company's annual report, the " management subscribes to the premise that th

FIFO Inventory Management and a Firms EBITDA

Please help with the following problem. In 2010, Jack's Art Gallery sold 200 original works of art for $1,240,520. The gallery acquired the works sold for $530,000. Each painting was framed using predesigned framing kits in the gallery's own workshop. The firm bought 100 kits in January for $50,000, 100 kits in March for $60

FIFO process costing cost of production report worksheet

Design a production report excel worksheet using FIFO process costing. Quantities: Beginning Inventory (80% complete) - 15,000 units Started during June - 110,000 units Transfered to Finished Goods - 118,000 units Ending Inventory (30% complete) - 7,000 units Beginning Inventory Costs: Materials - $23,175 Direct La

Waiting line theories and models

Waiting line theories are valuable tools in operations. One model is based on the Poisson arrival distribution, FIFO line discipline, and customers arrive at the rate of two per minute. This is a single phase operation and each server operates at the average rate of 160 customers served per hour. Management is concerned by th

Loading Dock Queuing

See the attachments. Deliveries clogging the loading dock area The specific details regarding the delivery process at the receiving dock. 1-Receiving dock open from 7am to 3pm, 8 hours, or 480 minutes. 2-The average number of arrivals on any given day is 28, which is 3.5 arrivals per hour, average. 3-The data we have c

Pantanal, Inc. - Process Costing- FIFO

See the attachment. Pantanal, Inc., manufactures car seats in a local factory. For costing purposes, it uses a first-in, first-out (FIFO) process costing system. The factory has three departments: Molding, Assembling, and Finishing. Following is information on the beginning work-in-process inventory in the Assembling Departme

Fifo Method of Process Costing

Your company uses the fifo method in its process costing system. In the cutting department in june, units were 80% complete with respect to conversion in the beginnning work in process inventory and 33% complete with respect to conversion in the ending work in process inventory. Other date for the dept for june follws:beginnin

Cost Accounting: FIFO process costing, undercosting, ABC systems

1. The last step in the FIFO process-costing method is _____. a) assign total costs to units completed b) computer output in terms of equivalent units c) summarize total costs to account for d) compute costs per equivalent unit 2. Undercosting a particular product may result in _____. a) loss of market share b) lowe

Cost Accounting: Marcus Break even; Northenscold contribution margin; job cost, FIFO

1. Answer the following question using the information below. Marcus intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 per customer. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Marcus for an

Process costing-FIFO

You use process costing. In dept b, units transferred in from dept a are added at the beginning of the process, additional materials are added all at once when the process is 70% completed and conversion costs are added uniformly and continuously during the process. On Oct 1 in dept b, beginning inventory is 50 units which are

Equivalent Units of Production - FIFO

The following information concerning the work in process at its plant: Beginning inventory was partially complete (materials are 100 percent complete; conversion costs are 59 percent complete). Started this month, 69,900 units. Transferred out, 60,000 units. Ending inventory, 29,500 units (materials are 100 percent complet

FIFO and Weighed Average for Falcon's Television sets in three categories

Falcon's Televisions produces television sets in three categories: portable, midsize, and flatscreen. On 1/1/07 The company's January 1 inventory consists of: January 1 Inventory Category Quantity Cost per Unit Total Cost Portable 6,000 100 600,000 Midsize 8,000 250 2,000,000 Flatscr

FIFO Production Cost Report

The following information is available for the Molding department for January. Work in process beginning: Units in process 22,000 Stage of completion for materials 80% Stage of completion for labor and overhead 30% Costs in work in process inventory: Materials $168,360 Labor 67,564 Overhead 17,270 Tota

Cost of Goods Sold using FIFO

Scuba Styles began their business in June with 50 wetsuits that cost $45 each. During June the store made the following purchases. Date Units Purchased Cost Per unit Total Cost 10-Jun 90 $46.00 $4,140.00 21-Jun 50 $48.00 $2,400.00 27-Jun 120 $47.50 $5,700.00 Total

FIFO Process Costing for Pancocha Company: Equivalent units and costs

See file attached. Additional Information that is needed: Materials are added at the beginning of the production process and conversion costs are incurred uniformly. They use the FIFO method Pacocha Company manufactures bicycles and tricycles. For both products, materials are added at the beginning of the production proces

Lifo, Fifo, Perpetual method - Intermediate 2

Smith Company had the following information during the past year: Beginning inventory cost $40,000 Cost of net purchases $400,000 Ending inventory cost $52,000 Smith Company's cost of goods sold for the year was $___________.

Lifo, Fifo, Perpetual method

ABC Co.'s gross profit is consistently 30% of sales. During the most recent accounting period its beginning inventory had a cost of $60,000 and it made purchases with a net cost of $340,000. ABC's sales amounted to $500,000. The estimated cost of its ending inventory using the gross profit method is $___________.

Intermediate 2 - Lifo, Fifo, perpetual method

A retailer's beginning inventory had a cost of $24,000 and a retail value of $30,000. During the period the retailer purchased merchandise that had a cost $376,000 and a retail value of $470,000. Sales during the period were $450,000 at retail. The cost-to-retail ratio is _________% The ending inventory at cost is $_____

Transferred-In Costs using FIFO Method: Example Problem

See attachment for information. Transferred-in costs, FIFO method. Refer to the information in Problem 17.38. Suppose that Publish, Inc. uses the FIFO method instead of the weighted-average method in all of its departments. The only changes to Problem 17.38 under the FIFO method are that total transferred-in costs of begin

Equivalent Units for Direct Materials and Conversion Costs

Spunky Corporation uses a process costing system. All direct materials are added at the beginning of the process. Spunky's production quantity schedule for May is reproduced below: Units Work in Process on May 1 (conversion 60% complete)............... 1,000 Units started during production.

Inventoriable Costs

E8-1 (Inventoriable Costs) Presented below is a list of items that may or may not be reported as inventory in a company's December 31 balance sheet. 1. Goods out on consignment at another company's store. 2. Goods sold on an installment basis (bad debts can be reasonably estimated). 3. Goods purchased f.o.b. shipping point

Good Foods, Inc Process Costing: Using FIFO, prepare a process cost report

Canned fruits and vegetables are the main products made by Good Foods. Inc. All direct materials are added at the beginning of the Mixing Department's process. When the ingredients have been mixed, they go to simmered for 20 minutes. When cooled, the mixture goes to the Canning Department for final rocessing.

Study Guide 2

I need help please so I can make sure I study properly. 1. Total stockholders' equity represents a. a claim to specific assets contributed by the owners. b. the maximum amount that can be borrowed by the enterprise. c. a claim against a portion of the total assets of an enterprise. d. only the amount of earnings that hav

Compute the Cost of Goods Sold under FIFO

A firm has beginning inventory of 300 units at a cost of $11 each. Production during the period was 650 units at $12 each. If sales were 700 units, what is the cost of goods sold (assume FIFO)?