The cost flow method ‘last in, first out,’ otherwise known as LIFO, charges the most recent purchase costs to costs of goods sold. Similarly, older costs are assigned to ending inventory (ie. 'first in, still here').

LIFO works well when it truly matches the actual physical flow of goods. For example, imagine a hardware store that has buckets of screws for sale. When it purchases new inventory, new screws may be thrown on top of the old screws. Customers would then purchase newer inventory first, and old inventory will typically stay at the bottom of the bucket.

One advantage of LIFO is that it does a good job of matching the company's most recent costs with current revenue. As well, ending inventory values under LIFO are ordinarily lower than under FIFO, and are usually lower than net realizable value. As a result, company's that use LIFO rarely have to write down inventories in the event of a price decline; FIFO costs are more vulnerable to price declines, which can substantially reduce net income.

Disadvantages of LIFO include reduced earnings, inventory distortion, physical flow, inventory liquidation, and poor buying habits. Inventory distortion means that the costs included in ending inventory are typically old (lower) costs; as a result, ending inventory isn't valued at replacement cost. Physical flow refers to the idea that LIFO does not accurately match the physical flow of goods in most companies. Inventory liquidation refers to the strange results that occur when a company's sales are greater than its purchases and extremely old, low costs get transfered into cost of goods sold. Poor buying results from the fact that management may ensure purchases are greater than sales in order to ensure old costs are not charged to cost of goods sold.

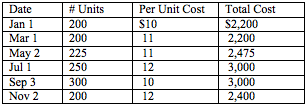

Consider a company that has the following purchases over the course of the year. The company also has 200 units in beginning inventory, each valued at $10.50, and 250 units in ending inventory.

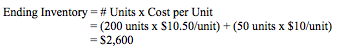

We can calculate the value of ending inventory by looking at the oldest costs first. Under LIFO, if we have 250 units in ending inventory, we assume that 200 of those units are from our beginning inventory, and 50 units are from our first order in January.

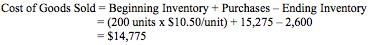

We can calculate cost of goods sold by subtracting our value for ending inventory from our total purchases plus beginning inventory.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Purchases, Inventory and Cost of Goods Sold (COGS)

- /

- Inventory

- /

LIFO

BrainMass Solutions Available for Instant Download

Gamble Company uses the LIFO method for inventory costing.

Gamble Company uses the LIFO method for inventory costing. In an effort to lower net income, company president Oscar Gamble tells the plant accountant to take the unusual step of recommending to the purchasing department a large purchase of inventory at year-end. The price of the item to be purchased has nearly doubled during th

Advantages and Disadvantages of LIFO

--FIFO means "first in, first out." This follows the assumption that the first items received into inventory are the first items sold. In some cases, this may not be true because companies often have to sell new items after old ones have become outdated. Businesses using FIFO show themselves as more profitable on paper. --LIFO

Effects of LIFO and FIFO inventory costing methods on earnings

In detail, compare and contrast the effects of LIFO (Last-In, First-Out) and FIFO (First-In, First-Out) inventory costing methods on earnings in an inflationary period. Please include how these differences will affect the cost of goods sold, and the cost of sales on the balance sheet.

Inventory profit and LIFO

What is inventory profit? How does the use of LIFO inventory costing help to reduce it?

Changing from Average Cost to LIFO

Wade Corporation has been your audit client for several years. At the beginning of the current year, the company changed its method of inventory valuation from average cost to last in, first out (LIFO). The change, which had been under consideration for some time, was in your opinion a logical and proper step for the company to

Principle Reason for Selecting LIFO Cost Flow Assumption

One of the principal reasons for selecting the LIFO cost flow assumption instead of the FIFO cost flow assumption in a inflationary economic environment is that: a) net income will be higher b) income taxes will be lower c) balance sheet inventory value will be higher d) a higher selling price can be established.

Dollar Value Calculations: LIFO Method

DOLLAR VALUE - LIFO METHOD The following information relates to the Choctaw Company. Ending Inventory Date (End-of-Year Prices) Price Index December 31, 2009 $70,000 100 December 31, 2010 88,200 105 December 31, 2011 95,120 116 December 31, 2012 108,000 120 December 31, 2013 100,000

Dollar Value - LIFO Method

Hello, I am using the dollar value LIFO method to compute the ending inventory for 2009 through 2013. I have Information provided below. I was able to compute the ending inventory for 2009 and 2010 shown below. After that I am not coming up with the right answers. Kindly help and advise me on how to compute the correct answers

How might LIFO be phased out without eradicating many small businesses?

How might LIFO be phased out without eradicating many small businesses? The following article discusses how a ten year phaseout would be detrimental to car dealerships. I personally believe ten years is a good time frame. http://www.larsonallen.com/Dealerships/LIFO_Repeal_Would_Create_Huge_Tax_Increases_for_Dealerships.

dollar-value LIFO method

Part A: Gant Company has a beginning inventory in year one of $300,000 and an ending inventory of $363,000. The price level has increased from 100 at the beginning of the year to 110 at the end of year one. Calculate the ending inventory under the dollar-value LIFO Part B:

Dollar-Value LIFO

(Dollar-Value LIFO) Presented below is information related to Dino Radja Company. Date Ending Inventory (End-of-Year Prices) Price Index December 31, 2004 $80,000 1 December 31, 2005 115,500 1.05 December 31, 2006 108,000 1.2 December 31, 2007 122,200 1.3 December 31, 2008 154,000 1.4 Decem

Turk's Toy Trains: Cost of Goods Sold Problem using LIFO

Turk's Toy Trains began 2008 with 1200 toy trains, which cost $9.00 each in its inventory. During the year it made the following inventory purchase of inventory. Date Units Purchased Cost per Unit Total Cost 3/18 500 $9.50 $4,750 6/4 700 $10.00 $7,000 8/28 400

Higgins Data System: Compute cost of goods sold under LIFO

At the end of January, Higgins Data System had an inventory of 600 units, which cost $16.00 per unit to produce. During February the company produced 850 units at a cost of 19.00 per unit. If the firm sold 1,100 units in February, what was its cost of goods sold. (assume LIFO inventory accounting)

Why is LIFO prohibited under IFRS standards

British Petroleum has been in the news lately and, like most companies in the oil refining business uses process costing. The choices when using process costing are FIFO method or Weighted Average method. International reporting standards (IFRS) prohibit the use of LIFO method. In the not too distant future, American based co

LIFO retail method

Memorial Book Store has decided to switch to the LIFO retail method for the period beginning 1/1/08. Instructions Prepare a schedule showing the computation of the 12/31/08 inventory under the LIFO retail method adjusted for price level changes (i.e., dollar-value LIFO Retail.) Without prejudice to your answer in requirement

Argue Against the Use of LIFO

Argue Against the Use of LIFO. See attached file for full problem description.