Accounting is the system we use to present, and make sense of, the operations of a business in financial terms. To do this, the business records information on each of the business's financial transactions. These transactions are recorded using a double-entry bookkeeping system.

The objective of financial reporting is to provide information that is useful to investors, lendors and other creditors. Because accounting information about individual transactions is so detailed and complex, we recognize that it must be presented in an aggregate form in the financial statements. The financial statements therefore sacrifice detail for understandability.

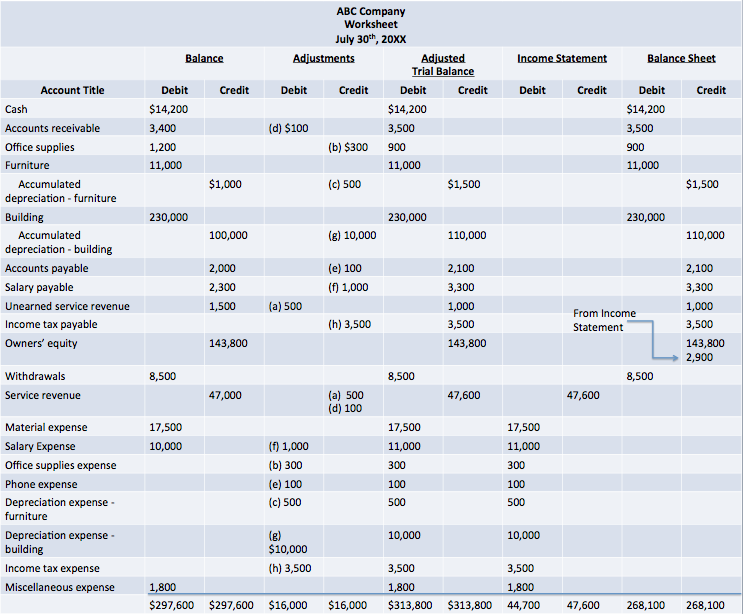

Preparing the financial statements is the sixth step in the accounting cycle. We prepare the income statement, the statement of retained earnings and the balance sheet from the adjusted trial balance. The worksheet is a tool that helps us do this. The worksheet itself is not a financial statement.

There are four elements of financial statements according to FASB Concept Statement No. 8: recognition, measurement, presentation and disclosure. The main questions an accountant must ask are: (1) when should a change in an asset, liability, revenue, expense or the like be reported on the financial statements? (2) how should this item be measured? (3) how should the financial statements be presented? and (4) what material information isn't recognized on the financial statements but should be disclosed along with the financial statements?

US GAAP requires companies to prepare four key financial statements:

(1) The Income Statement: When we make a sale, typically we earn revenue (such as cash), incur an expense known as cost of goods sold, and consider the difference to be our profit. This profit is then used to cover other expenses such as overhead. The amount of profit that the business keeps after all expenses have been paid is called income. Income is an abstract theory that represents the change in capital of the business over the period. Operating income is generated from operating activities such as ordinary sales. Other gains, such as gains on the sale of property or from interest from investments, contribute to a business's income. When income is negative, we call it a loss. All of this information is reported on the income statement, which presents the business's net income or net loss.

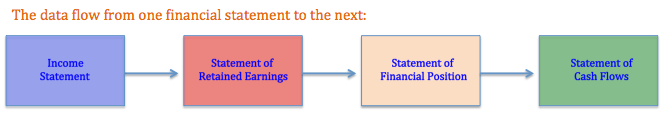

(2) The Statement of Owners' Equity: A business's capital is made up of two parts. A firm recognizes contributed capital as the amount that shareholders have invested over time in the company by purchasing shares from the company. Retained earnings are equal to the amount of income the business has accumulated over time and can reinvest. We calculate the ending balance of retained earnings by taking the beginning balance of retained earnings, adding the income from the current period, and subtracting dividends. The income statement is important because it presents the change in capital resulting from the businesses operations. These earnings are what drive value for shareholders. The statement of owners' equity shows the accumulated income over the life of the business.

(3) The Balance Sheet (or Statement of Financial Positon): The balance sheet is a snapshot of the business's financial position on a specific date. When we use the double-entry bookkeeping system, our debit and credit entries must equal. That is, all accounting transactions follow the accounting equation, where Assets = Liabilities + Owners' Equity. For example, and entry that increases cash must also increase a liability (if the cash is borrowed) or owners' equity (if the cash is earned). Each transaction is like this. The balance sheet lists a business's assets, liabilities and owners equity. It gets its name from the fact that assets must always balance out liabilities and owners' equity.

(4) The Cash Flow Statement: Cash is the oxygen of the business, and is needed for the business to survive. Business's get cash (or spend cash) from operating activities (such as sales), investing activities (such as buying property) and financing activities (such as selling shares or borrowing money). We take the amount of cash on the balance sheet from the beginning of the period and add or subtract the cash used from these three activities to determine the amount of the cash we should have at the end of the period. This amount should match the amount of cash at the end of the period in our bank account. Financial managers use information about how the firm generates and uses cash to ensure that proper financing decisions are made so that the firm doesn't run out of cash.

The Worksheet

The worksheet is a tool that we use to help us prepare the finanancial statements. we start the accounting cycle by recording transactions in the general journal and posting them to the ledger accounts. After this, we prepare a trial balance, correct mistakes, do our end-of-period adjustring entries, and prepare an adjusted trial balance. Using the figures from the adjusted trial balance, we can easily see how the income statement and balance sheet are prepared. We start by preparing the income statement. We can then use net income to prepare a statement of retained earnings. The information about owners' equity from this statement is then used on the balance sheet. The cash flow statement must be created last, since it uses information for all of the other financial statements and other sources to prepare.

Below we've provided an example of the worksheet we've been using up until this point. Please refer to 'The Adjusting Process' to see how this worksheet was built.