The statement of owners' equity or the statement of shareholders' equity is the fourth financial statement. It shows the users of the financial statements how the owners' equity in the business has changed over the year.

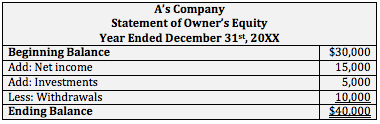

Statement of Owner's Equity

The statement of owner's equity is for a sole proprietorship. It shows the owner's beginning capital, adds net income for the year (or deducts net loss), adds the amount that the owner invested in the business during the year and deducts the amount that the owner withdrew for his or her personal use over the year. The final number is the owner's ending capital for the year. The balances in the "investment," "withdrawals," and "net income," accounts should be closed out the the capital account during the closing entries at the end of the year.

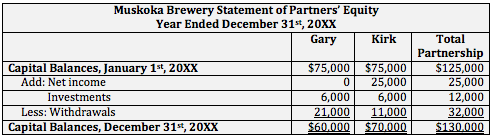

Statement of Partners' Equity

The statement of partners' equity or the statement of owners' equity (which is the plural of "owner") shows how the capital balances of the partners equity changed over the year. It contains the same accounts as the statement of owner's equity; however, has multiple columns for each partner. Net income is shared between the partners based on a ratio determined by the partnership agreement. In most cases, and if the partnership agreement is silent on the issue, net income is shared equally between the partners. The ending balance of each partner's capital account appears in the quity section of the balance sheet.

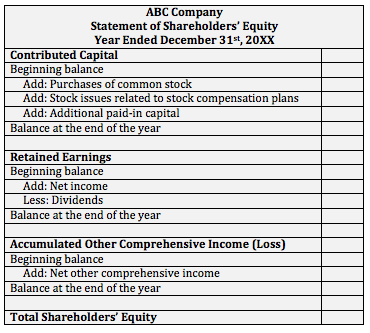

Statement of Shareholders' Equity

The statement of shareholders' equity shows how the book value of the shareholders' investment in the firm changed over the year. It starts with shareholders' beginning equity and adds paid in capital, retained earnings, and accumulated other comprehensive income in order to get the ending balance of shareholders' equity. The ending balances of common shares, preferred shares, additional paid-in capital, retained earnings, and acumulated other comprehensive income all appear as separate lines in the equity section of a corporation's balance sheet.

Statement of Owners' Equity

BrainMass Solutions Available for Instant Download

Statement of retained earnings

See the attached file Comparative statements of retained earnings for Renn-Dever Corporation were reported in its 2016 annual report as follows. At December 31, 2013, common shares consisted of the following: Common stock, 1,855,000 shares at $1 par $1,855,000 Paid-in capital—excess of par 7,420,000 Infer fr

Preparing a Statement of Retained Earnings

Company B began 2013 with a $110,000 balance in retained earnings. The following events occurred during the year: 1. Cash dividends of $18,500 were declared. 2. 4,500 shares of callable preferred stock were recalled and retired for a price of $225 per share. The stock was originally issued for $150 per share. 3. N