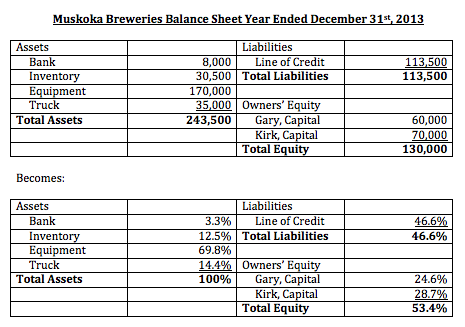

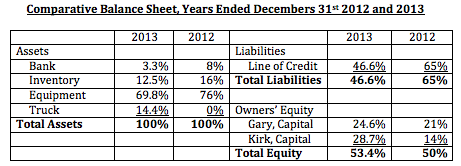

A comparative financial statement is used to compare the financial statements of the same company over different periods of time or the financial statements of different companies. There are two important characteristics of a comparative financial statement. The first is that all accounts are converted from numbers to percentages. The "total assets" line on the balance sheet, and the "total revenue" line on the income statement should be given a value of 100%. All of the other lines on the balance sheet should be reported as a percentage of total assets (this means that the liabilities section plus the owners' equity section should total 100% as well). Similarly, all of the other lines on the income statement should be measured as a percentage of total revenue.

The second important characteristic is that each line of the financial statement should be in line with the corresponding line from the financial statement from other years or another company. This makes the financial statements easiy comparable at a quick glance. This may require you to combine some accounts. For example, if one company has seperate accounts for both machinery and equipment and the other company has a one account, the accounts for the first company should be merged and reported together.

Comparative Financial Statements

BrainMass Solutions Available for Instant Download

Comprehensive Annual Financial Report Briefing

Select a government entity of your choice. It can be a state, county, city, town, school district, or any other government entity. Obtain the Comprehensive Annual Financial Report (CAFR) for the entity you selected. You should be able to find the CAFR on the web site for the government entity. If not, contract the entity f

Localized regulations and laws pertaining to the reporting

Governments around the globe have adopted localized regulations and laws pertaining to the reporting of financial statements. However, as a global economy evolves, standardization of these reports is becoming increasingly important. Investors and suppliers looking toward foreign companies as investment opportunities or business

Debt Service Funds

Debt Service Funds In addition to general funds and special revenue funds, debt service funds are an important facet of governmental accounting. In an effort to control fund usage and accountability, debt service fund activities are documented through the following: journal entries, statements of revenues, expenditures, and f

City of Angels: Government Accounting

Analyze financial data of a government entity - the City of Angels - in order to create financial statements. Download the City of Angels financial data and when you have completed your review, provide the following and submit your work in a single Word document: Journal entries for approved budget for City of Angels for 2010

Accounting Questions: Financial accounting and reporting

Q1: ABC Car Wash, Inc. washed 100 cars this past month. They charge $7 per car for a wash. The company's only expenses during this month were $83 utilities/water, $300 wages and $31 for soap. The wages were paid during the month, but the utility bill and soap bills were not. What is ABC's income or loss for this month? Q2: AB

Johnson & Johnson and Coca-Cola financial statements and ratios

I have identified two corporations, Johnson & Johnson and Coca-Cola. I need assistance finding their financial statements, income statement, balance sheet, and statement of cash flows. I need help identifying the statement of cash flow if the corporation uses the indirect or direct method. Determine how much cash was generated f

Analysis of Financial Statements and Preparation of Income Statements

1. Prepare an income statement for the month of February. Compute the ratio of total operating expense to total revenue and operating income to total revenue. 2. Compute the per unit cost of repairing one windshield. 3. The manager of The Windshield People must keep unit operating cost below $50 per w

An Overview and Analysis of Nestle's Financial Statements

Choose a public company in the food industry. Analyze the financial statements and assess whether the financial performance has improved or declined year-over-year. Analysis techniques include the following: Comparative financial statements Trend analysis Ratio analysis Percentage analysis

GAP Inc

Access the most recent GAP Inc Form 10-K or Annual Report. (Please follow the below link) Analyze and examine the company's financial statements and derivative footnote. Based on your analysis, create a 2- to 3-page report in a Microsoft Word document, that includes answer to the following questions: - How is the information r

2010-2012 Annual Report Target, liquidity, horizontal analysis, and comparison to Walmart

I need help doing: Drafting a Financial statement analysis of Target Retail Stores Can you help me with the questions? !).What industry is it in?, What are its main products or services, Who are its competitors? 2).Do a three-year horizontal analysis of the income statement and balance sheet of Target Retail Stores.

City of Scottsdale -reconciliation between the governmental fund

Answer the following questions based on Scottsdale, AZ CAFR year ending June 30, 2012. //www.scottsdaleaz.gov/finance/cafr A. Find the reconciliation between the governmental fund balances and the governmental-type activities net assets. This might be on the governmental fund Balance Sheet or in a separate schedule in the b