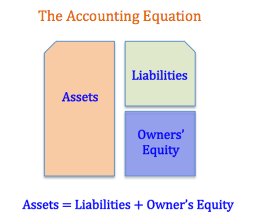

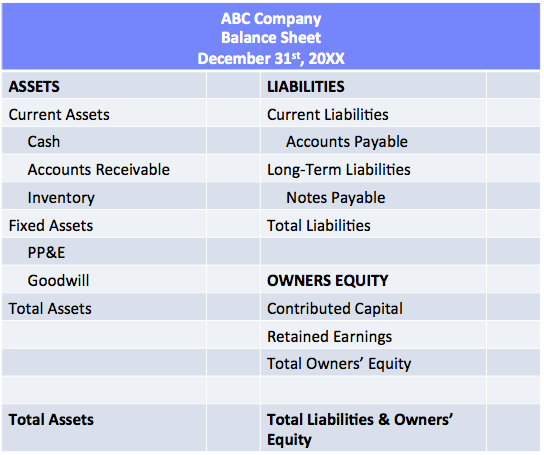

The financial statements are based on the accounting equation. This equation presents the assets of the business as well as the claims that investors, both debt and equity holders, have on the assets of the business. These claims are called liabilities (when the claim is from a debt holder) and owners' equity (when the claim is from an equity holder). The assets and the claims against them are presented in the Statement of Financial Position, otherwise known as the Balance Sheet.

Assets: Assets are the resources used by the business in order to generate sales and generate profits. We say that assets are invested in. The managers of a business are responsible for choosing how to invest in assets and how to effectively use the firm's assets to drive earnings and growth. Common types of assets include:

- Cash and Cash Equivalents

- Accounts Receivable

- Inventories

- Property, Plant and Equipment

Liabilities: Liabilities represent the claims that debtholders have on the assets of the business. Managers of a business are responsible for choosing how much of the firm's assets are financed by debt. As well, interest payments on a firm's debt are fixed. Manager's must ensure that the firm generates enough income from the use of its assets to pay this interest expense each period. Common types of liabilities include:

- Accounts Payable

- Line of Credit

- Bank Loan

- Bonds, or Notes Payable

Owners' Equity (also Shareholders' Equity): Owners' equity in a corporation is made up of two parts: contributed capital and retained earnings. Initially, shareholders will invest in a business in exchange for common shares, which represent proof of their ownership. These owners have a residual claim on the business's assets and income. When a firm earns an income, part of this income must be paid first as interest to debtholders. However, any income above and beyond is either kept as retained earnings or paid out to owners in the form of dividends. Retained earnings can be reinvested, increasing future earnings and returns for a business's owners.

(Owner's equity is not divided between contributed capital and retained earnings in a proprietorship or partnership. Owners of other forms of businesses can simply withdraw capital, rather than pay dividends).

Balance Sheet

BrainMass Categories within Balance Sheet

Current Assets

Current assets are short-term assets that will be converted to cash in the ordinary course of business typically within one year.

BrainMass Solutions Available for Instant Download

Reporting of securities

Weston Company has these data at December 31, 2017, the end of its first year of operations. Securities Cost Fair Value Trading $110,000 $122,000 Available‐for‐sale100,000 96,000 The available‐for‐sale securities are held as a long‐term investment. Instructions (a) Prepare the adjusting entries to report e

Payroll Accounting: Deductions

Employee received a paycheck for two weeks salary pay: Gross Pay $2,692.31 Automobile-allowance $161.54 Deductions: Insurance -$13.37 Federal Withholding - $273.00 Social Security - $176.11 Medicare -$41.19 Net Pay: $

Balance Sheet from ratios

Initially founded as a consulting business in 1984, Hummingbird quickly evolved into a dominant player in the connectivity market. To keep pace with increased demand and competition within the industry the company is expanding its activities since last year. One of the newly appointed management trainees, Miss Lily is prepari

Income Statement and Classified Balance Sheet

Using the attached data, help me to prepare an income statement and a classified balance sheet. Cru-Mart, a convenience store opened by UMHB graduates, has the following trial balance for the year ended December 31, 2013.Construct, in good form, an income statement and balance sheet, each on its own worksheet.

Lowells' Country Music Bar Balance Sheet

Lowells' Country Music Bar balance sheet missing pieces, see attached document. Why are GAAP financial statements (externally reported financial statements) required to be prepared according to specific rules and formats while internally presented managerial accounting reports are not? How can a misstatement in one financi

Orange Corporation: Comparative Balance Sheets

Presented below is a condensed version of the comparative balance sheets for The Orange Corporation for the last two years at December 31: [see the attached file for the table] During 2012, investments were sold at a loss of $9,000; no equipment was sold; cash dividends paid were $20,000; and net income was $150,000. Pr

Phototec, Inc: Balance Sheet

The balance sheet of Phototec, Inc., a distributor of photographic supplies, as of May 31 is given below: Phototec, Inc. Balance Sheet May 31 Assets Cash $ 10,950 Accounts receivable 73,000 Inventory 36,500 Buildings and equipment, net of depreciation 609,550 Total assets $ 730,000 Liabilitie

Statement of Cash Flows, Balance Sheets

Presented below is the Statement of Cash Flows for Marstore, Inc., for the year ended December 31, 2007. Also shown is a partially completed comparative balance sheet as of December 31, 2007 and 2006. Complete the balance sheet. MARSTORE, INC.

Balance Sheet Accrual

Can someone help? At work we received an invoice for $100k for a timeshare project and it was decided the cost can be setup as prepaid and amortized over the life. However the invoice was not processed for payment in time for May's month end close. The manager still wants the cost to be accrued for but what account would make

Prepare a Common Size Balance Sheet

Refer to the consolidated balance sheets. Required: Prepare a common size balance sheet at December 27, 2008, using the following caption: Total current assets Property, plant, and equipment (net) Marketable equity securities and other long-term investments Goodwill and other long-term assets Total assets Total cur

Balance Sheet and Statement of Operations

1. View the list of account balances for Currie Hospital as of December 31, 2013. Prepare a balance sheet as of December 31, 2013, in proper form. (Hint: You will need to compute the net assets account. Assume that all net assets at the beginning of the year are unrestricted.) 2. View the list of accounts for Currie Hospital

Balance Sheet/Inventory

The following informatiom pertains to item #AB345 of inventory of ABC Educational Systems INC: Cost $45 per unit Replacement cost $46 per unit Selling price $52 per unit The physcial inventory indicates 900 units of item #AB345 on hand. What amount will be r

Financial Accounting Balance Statements.

The case requires you to analyze the balance sheet for the two companies in more detail. Is there a difference in approach to valuation by US GAAP and IFRS? Discuss and note two or three specific differences. In addition, briefly: Distinguish between an expense (expired cost) and an asset. Distinguish between current and

Additional Paid-In Capital on the Balance Sheet

Additional paid-in capital is most likely to appear on the balance sheet of a corporation that: a) has par value stock b) has no-par value stock c) has issued stock at different dates d) has issued stock dividends

Balance Sheets of Assets and Liabilities

Assume that Banc One receives a primary deposit of $1 million. The bank must keep reserves of 20 percent against its deposits. Prepare a simple balance sheet of assets and liabilities for Banc One immediately after the deposit is received. Assets Acct Name $$ Liabilities Acct Name $$

Balance Sheet and Financial Analysis

Assets Cash and cash equivalents $90 AR $175 Plant & equipment $216 $481 Liabilities AP $198 Debt $122 Declared dividends $87 $407 Owner's Equity Stock $58 Retained Earnings $16 $74 Total liabilities and owner's equity $481 Xenon is buying $24,000

Opening balance sheet from a cash flow forecast

Hi, I am attaching a cash flow forecast which has been filled. I have tried filling the opening balance sheet but can not seem to get around it. All the figures should be extracted from the cash flow forecast in order to fill out the opening balance sheet. The opening balance sheet is attached.

Entries Balance Sheet, Statement of Revenues, Expenditures

Please help me understand this problem. This is my second time posting this. Thanks in advance for your time! The trial balance for the General Fund of the City of Monte Vista as of December 31, 2012, is presented here: (see attached workbook for values) Transactions of the General Fund for the year ended December 31, 2

Treasury Management: Off Balance Sheet Activities

What special problems do off-balance sheet activities present to bank regulators, and what have they done about it?

Costa Company, Pickett Company,effect of the errors, profits

Need some help creating a simple income statement and balance sheet. Pleas use the information provided below for Pickett Company for this application. Below find a working trial balance for Pickett Company. This format is often used during the preparation phase of the financial statements since it provides a good overview. .

Analysis of Comparative Balance Sheets

Please see and provide help with the attached questions about analyzing comparative balance sheets. ** Please see the attached file for the complete problem description ** Exercise 17-2 An analysis of comparative balance sheets, the current year's income statement, and the general ledger accounts of Solomon

This addresses the balance of wages payable at month end.

Wages payable had a balance of $1,520 at the beginning of the month. During the month, $6,200 of wages were paid to employees. Wages Expense accrued during the month totaled $7,800. Calculate the balance of Wages Payable at the end of the month.

Expected Calculations and Expected Payments

I need help with the following assignment because I have no idea where to start. Environmental Landscaping Inc. is preparing its budget for the first quarter of 2008. The next step in the budgeting process is to prepare a cash receipts schedule and a cash payments schedule. To that end the following information has been colle

Balance Sheet for Current Assets

BestCare HMO Balance Sheet June 30, 2007 (in thousands) Assets Current Assets Cash $2,737 Net premiums receivable 821 Supplies 387 Total current assets $3,945 Net property and equipment $5,924 Total assets $9,869 Liabilities and Net Assets Accounts payabl

Determining profitability from a balance sheet

When examining the balance sheet, a company can tell their permanent accounts (sometimes referred to as "real" accounts) and the balances present. However, a company cannot tell their temporary account (sometimes referred to as "nominal" accounts) balances nor activity. There is a way to determine if the company has been profita

Prepare Trial Balance for Willow Turenne Company

1. The steps in the accounting cycle are listed in random order below. List the steps in proper sequence, assuming no worksheet is prepared, by placing numbers 1-9 in the blank spaces. a. Prepare a trial balance. b. Journalize the transactions. c. Journalize and post-closing entries. d. Prepare financial statements. e. Jo

Determining WACC for Shi Importer

Shi Importer's balance sheet shows $300 million in debt, $50 million in preferred stock, and 40%, rd=6%, rps =5.8%, and rs =12%. If shi has a target capital structure of 30% debt, 5% preferred stock, and 65% common stock, what is its WACC? I need step by step solutions.

Accounting_balance sheet

Indicate the section of the balance sheet (current assets, fixed assets, investments, current liabilities, long-term liabilities, stockholders' equity) in which each of the following is reported: (a) Note receivable due in 3 years (b) Note receivable due in 90 days (c) Allowance for doubtful accounts

Sherman Company: Compute a budgeted cash balance

Sherman Company has a cash balance on January 1 of $123,219. Given the following data, compute Sherman's budgeted cash balance on March 31. Round all amounts to the nearest dollar. Past and budgeted future activity, in $000: Sales Operating expense November 1,625 525 December 1,790 460 January 1

Sapp Trucking's balance sheet shows a total of noncallable $45 million long-term debt with a coupon rate of 7.00% and a yield to maturity of 6.00%. This debt currently has a market value of $50 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is $65 million. The current stock price is $22.50 per share; stockholders' required return, rs, is 14.00%; and the firm's tax rate is 40%. The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate. What is the difference between these two WACCs? a. 1.55% b. 1.72% c. 1.91% d. 2.13% e. 2.36%

Sapp Trucking's balance sheet shows a total of noncallable $45 million long-term debt with a coupon rate of 7.00% and a yield to maturity of 6.00%. This debt currently has a market value of $50 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity (c