Current assets are short-term assets that will be converted to cash in the ordinary course of business typically within one year. Similarly, prepaid expenses are considered current assets, not because they expect to be converted to cash within the year, but because of the fact that if they were not paid in advance, they would require the use of current assets during the year.1 A business that has an operating cycle that is longer than a year, for example, in the tobacco industry, may classify an asset as a current asset if it is expected to be converted into cash in the ordinary course of business within one operating cycle.2

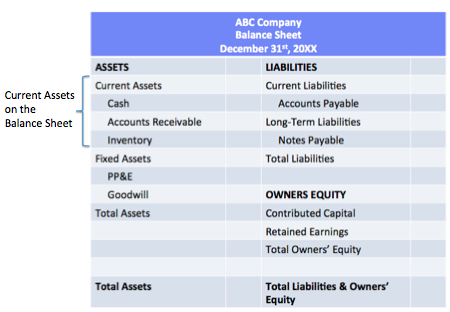

Current assets are listed on the balance sheet in order of their liquidity. As a result, business's typically list cash and cash equivalents, the most liquid current assets, first on the balance sheet. In many cases, U.S. issuers may agreggate cash and cash equivalents into one line item. According to U.S. GAAP, other current assets that a firm may hold include:

(a) Cash available for current operations and items that are cash equivalents

(b) Inventories of merchandise, raw materials, goods in process, finished goods, operating supplies, and ordinary maintenance material and parts

(c) Trade accounts, notes, and acceptances receivable

(d) Receivables from officers, employees, affiliated, and others, if collectible in the rdinary course of business within a year

(e) Installment or deferred accounts and notes receivable if they conform generally to normal trade practices and terms within the business

(f) Marketable securities representing the investment of cash available for current operations, including investments in debt and equity securities classified as trading securities under Subtopic 320-10.

(g) Prepaid expenses such as the following:

1. Insurance

2. Interest

3. Rents

4. Taxes

5. Unused royalties

6. Current paid advertising services not yet received

7. Operating supplies.3

Accounting for current assets includes specific techniques and methods used for recognizing current assets. For cash, we look at techniques and methods such as cash controls, performing a bank reconciliation, accounting for credit card sales, and using the petty cash fund. For short-term investments, we look at how cash equivalents and similar short-term investments are accounted for by a business. For receivables, we look at how to recognize receivables, how to account for bad debts, the issue of factoring receivables, and how to account for notes receivables. Although accounting for inventory should be a topic that falls under accounting for current assets at BrainMass.com, we look at it seperately to allow for clarity for students.

References:

1. FAS ASC 210-10-45-2

2. FAS ASC 210-10-45-3

3. FAS ASC 210-10-45-1