The time value of money is one of the underlying concepts in finance. It is a concept that is relied on to make our markets work efficiently.

In Ancient Greece, a theory of ethics in finance known as just price, advanced by Thoman Aquinas, was an argument against charging any rate of interest on loans. The term referred to making an unjust profit from a loan was known as usary.

Today, we view the use of money as a valuable service, and recognize that interests payments in return for this service are a key factor in regulating today's markets.

The general concept of time value of money relies on the fact that you would rather have money to use today then in the future. However, you would put off having money today if you were to get something in return, or earn interest on it. As a result, we say "the value of a dollar today is worth more than the value of a dollar in the future."

Time value of money concepts, such as present value and future value are used to determine how much money you would rather have today, or in the future, in markets where one can freely lend and borrow.

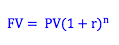

Future Value:

Future value measures the value of a present amount at a future date. Because a dollar that you have today can earn interest, the future value will be worth more than one dollar. In fact, it will be worth one dollar plus the amount of interest it could earn.

The value of a present amount at a future date found by compounding, that is, applying a compound interest rate over a specified period of time.

For example, if you had a dollar today and invested it at 5% interest, you would have the principle ($1) and the interest ($1 x 0.05 = $0.05) one year from now, for a total of $1.05. In two years you would have not only that initial $1, but you would also have interest from the first year, and 5% interest on $1.05 the second year ($1.05 x 0.05 = $0.525). Therefore, after two years you would have $1.1025 ($1 + 0.05 + 0.0525). The formula for future value for multiple years, or periods, can be simplified as follows:

Where: FV = Future value at the end of period n

PV = initial principle, or present value

r = interest rate, rate of return or discount rate

n = the number of periods

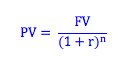

Present Value:

The present value is the value that an amount to be received in the future has in today's terms. To have $1 in the future, you would invest less than one dollar today and collect interest on it. The amount that you would need to invest today is called the present value, and the present value + the interest that could be earned equals the future value. As a result, the present value will always be less than the future value.

For example, companies often issue bonds in order to raise capital. If a bond is issued that is worth $1,000 one year from now, how much would a lender be willing to lend, or pay for that bond today? The present value formula can be found by rearranging the future value formula to get present value on the left hand side.

Photo by Gaelle Marcel on Unsplash

© BrainMass Inc. brainmass.com June 30, 2024, 10:06 am ad1c9bdddf