Accounts receivables make up somewhere over 15 percent of all assets held by firms. As a result, decisions affecting how a company extends credit to consumers (consumer credit) and other firms (trade credit) have a significant impact on the financing activities of the firm.

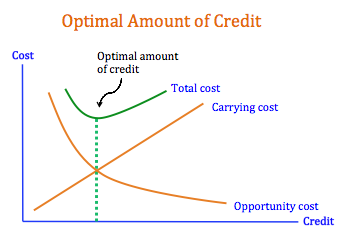

We look at the amount of credit a firm extends to its customers as an investment. The amount that a firm invests in accounts receivables is a function of the amount of credit sales the company makes as well as the average collection period. A financial manager will help the firm set out an optimal credit policy based on:

- The amount of sales extending credit will generate, or the opportunity cost of lost sales from not offering credit

- The carrying costs associated with granting credit including the extra time it takes to collect money from customers (from the time value of money concept), the losses from uncollectible accounts (bad debts), and the costs of managing customer credit such as the finance manager’s time and staff costs from the credit department.

A credit policy will typically include:

- Terms of sale: The terms of sale are laid out during the purchase of goods or services on credit and include things such as the length of time a customer has to pay and whether there is a cash discount for early payment. You’ll notice on many invoices terms such as 2/15, net 30. This suggests a 2% discount if paid within 15 days, and a total credit period of 30 days within which the customer has to pay.

- Credit analysis: To protect against losses from uncollectible accounts, firms try to distinguish between customers that are likely to pay, and those who will not. A policy that is too strict will turn customers away, but a policy that extends credit to everyone could result in losses from bad debts.

- Collection policy: A firm’s collection policy refers to how it obtains payment for past due accounts. Often collection efforts include (1) sending a delinquency letter to the customer, (2) telephoning the customer, (3) using a collection agency, or (4) taking legal action depending on the time and amount of the account outstanding. A financial manager may use an aging schedule to summarize the company’s position with respect to past-due accounts.

See also: Receivables Turnover

Photo by rupixen.com on Unsplash

© BrainMass Inc. brainmass.com June 29, 2024, 9:01 am ad1c9bdddf