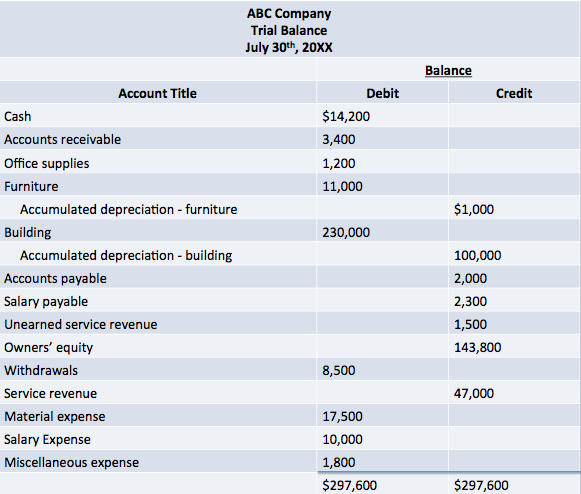

The trial balance, or unadjusted trial balance, can be prepared at any time, but is most often prepared at the end of the period. It is prepared after all of the day-to-day journal entries have been recorded, and all of these entries have been posted to the general ledger. For the trial balance, we take all of the balances in all of the T-Accounts in the general ledger and summarize them.

We list all of the T-accounts on one sheet, starting with the assets and then recording liabilities, and owners' equity accounts. We then add up the total debit balances and the total credit balances in two seperate columns. At the bottom, these two columns should add to the same amount. That is, because our debits always equal our credits when we record a transaction, when we prepare a trial balance, the debit balances should still be equal to the credit balances.

We prepare the trial balance to ensure that we have made no errors in recording our transactions over the period and that we've posted each transaction correctly to the general ledger. If the two columns do not add to the same amount, we probably made a mistake somewhere. Please see: Correcting Accounting Errors.

The revenue and expense accounts are considered to be part of owners' equity. A sole proprietorship will have two additional owners' equity accounts: one for owners' equity and one for withdrawals. A corporation will have three owners' equity accounts: one for common shares or contributed capital, one for retained earnings, and one for dividends. These accounts are listed last on the trial balance.

Trial Balance

BrainMass Solutions Available for Instant Download

What are the reasons for bank reconciliation?

Is bank reconciliation still relevant in business today?

Compute net income from the adjusted trial balance

The following items appeared on a company's December 31 work sheet for the current period. Based on the following information, what is net income for the current period? Cash Unadjusted Trial Balance Adjustments Debit Credit Debit Credit 975 Prepaid insurance 3,600 150 Supplies 180 70 Equipment 10,320

Village of AUI

I need help with this one, my team was hired as accountants for the Village of A. My team is being asked to do the the following: Your team has been hired as the accountants for the Village of A. Your team is being asked to do the following: • My team is provided with the adopted budget, as well as the preclosing trial bal

Tricam Engineering Trial Balance: Create Classified Balance Sheet

3. The December 31, 2013 post-closing trial balance for Tricam Engineering, an exploration company, is presented below. Account Title Debits Credits Cash ............................................................ 52,000 Accounts receivable ..................................... 223,000 Allowance for un

Preparing Financial Statements with Trial Balances

P4-26A. The adjusted trial balance of Jane's Tutoring Success Company October 31, 2009, is shown on the following page. Requirement: Prepare the income statement, statement of owner's equity, and classified balance sheet in account form for the month of October, 2009. See the attached pdf. for the trial balance and use

Adjusting the Trial Balance and Adjusting Entries

This Microsoft Power Point contains detail step by step information about each topic. Calculations and journal entries are included. The following topics are covered: What is accrual-basis accounting? What is cash-basis accounting? What is the time period assumption? What is the revenue recognition principle What is the

Completing a Balance Sheet

trial balance for the year 31st dec. particulars Debit credit cash 47,606.39 Petty cash 280.71 accounts receivable 0.00 Merchandise Inventory 11,762.10 office supply inventory 379.02 prepaid rent 2,000.00 vehicles 48,000.00 accumulated depreciation - vehicles 17,416.52 equipment 24,250.80 accumulated

Current Ratios, Trial Balances, Net Income

Using the following balance sheet and income statement data, what is the current ratio? Current assets $14,000 Net income $24,000 Current liabilities 8,000 Stockholders' equity 42,000 Average assets 80,000 Total liabilities 18,000 Total assets 60,000 Average common shares outstanding was 10,000. Answe

Journal Entries and Trial balance for Jack Smith's Computer Services

Using Microsoft Excel complete the following: A. Prepare general journal entries for each of the following transations. B. Post the journal entries from A. to the ledger accounts. C. Prepare a Trial Balance Hints: Only enter infromation in the cells with grey backgrounds. In the general ledger

Un-Adjusted Trial Balance

See the attached file. Intermediate Accounting 302 - Spring 2013 You have been given an un-adjusted trial balance. In addition, you have be given specifics of some of the transactions that occurred during the year There are transactions that do not have all the required information in order to properly record the event

Using a Trial Balance to determine financial reports and ratios.

Below, find a working trial balance for the Smith Company. Smith Company 31-Dec-12 Trial Balance (accounts in alphabetical order) Debit Credit Accounts payable 67,000 Accounts receivable 24

Preparing the Financial Statements from an Adjusted Trial Balance

Using the adjusted trial balance of Ladner Environmental Services at the end of its year, December 31, 2011: 1. Prepare Ladner Environmental Services 2011 income statement, statement of owner's equity, and balance sheet. List expenses in decreasing-balance order on the income statement and show total liabilities on the b

Journalizing Adjusting Entries to Account for Differences

Ladner Environmental Services's unadjusted and adjusted trial balances at December 31, 2011 are attached. Journalize the adjusting entries that account for the differences between the two trial balances.

Trial Balance: Costa Company.

Costa Company You will use the information provided below for Pickett Company for this application. Below find a working trial balance for Pickett Company. This format is often used during the preparation phase of the financial statements since it provides a good overview. The module 2 background information has a very simple

Statement of Retained Earnings and Balance Sheet

1. Journalize the data above, prepare an Unadjusted Trial Balance on the Worksheet + finish the whole Worksheet taking the below-mentioned adjustments into account (see attached file). 2. Prepare the Income Statement, the Statement of retained Earnings and the Balance Sheet in their correct formats.

Preparing closing entries, t accounts and a post-closing trial balance

Accounting is very difficult for me to understand, and it doesn't help that my instructor doesn't seem to answer my question in a manner so I can understand the process better. I need to prepare closing entries, t accounts, and a post-closing trial balance from the partial worksheet provided on pg 177 of Financial Accounting.

Month-End Adjusting Entries and Adjusted Trial Balance

See the attached file. The trial balance of Padre Paradise at December 31, 2008, and the data needed for the month-end adjustments follow: a. Insurance coverage still remaining at December 31, $300 b. Supplies used during the month, $200 c. Depreciation for the month, $900 d. Accrued advertising expense at December, 31,

Journalizing entries and creating a trial balance.

Income statement and Balance Sheet. Journalize the March transactions. (1) Four Oaks Minature Golf and Driving Range Inc. was opened on March 1 by Tiger Woodley. These selected events and transactions occurred during March. Mar. 1 Stockholders invested $50,000 cash in the business in exchange for common stock of the corpo

Logistics Company had the following items listed in its trial balance at 12/31/11

Logistics Company had the following items listed in its trial balance at 12/31/11: Balance in checking account, Bank of the East $442,000 Treasury bills, purchse on 11/1/11, mature on 1/30/12 20,000 Loan payable, long-term, Bank of the East 300,000

Smiths Inc Dec 31 2011 Adjusted Trial Balance: Create financial statements

Prepare a multiple step income statement, statement of retained earnings, and classified balance sheet with common-size financial information (balance sheet and income statement) based on the attached adjusted trial balance. Smith, Inc. Adjusted Trial Balance December 31, 2011 Debit Credit Accounts rec

Formed a corporation called Cyclo Equipment Rentals

Adam and Beth formed a corporation called Cyclo Equipment Rentals on December 1st, 2011. This new business is an equipment rental company and it could begin operations immediately by purchasing the assets. The corporation adjusts accounts monthly and closes entries annually on Dec 31st. The followings are the accounts that Cyclo

Analyzing and journalizing adjustments

Galant Theater Production Company unadjusted and adjusted trial balances at December 31, 2012, follow. (see attachment) Journalize the adjusting entries that account for the differences between the two trial balances.

Posting to T-accounts: Doris Stewart started her practice as a design consultant on September 1, 2012.

Journalizing transactions, posting to T-accounts, and preparing a trial balance Doris Stewart started her practice as a design consultant on September 1, 2012. During the first month of operations, the business completed the following transactions: Sep 1 Received $42,000 cash and gave capital to Stewart. Sep 4 Purchase

Trial balance

Prepare the corrected trial balance at May 31, 2012. Journal entries are not required. Cash is understated by $4,000. b.A $2,000 debit to Accounts receivable was posted as a credit. c.A $1,200 purchase of supplies on account was neither journalized nor posted. d.Equipment's cost is $87,700, not $88,000. e.Salary expense is ov

The Unadjusted Trial balance for STONED LOEHAND

The Unadjusted Trial balance for STONED LOEHAND, a sole proprietorship, at year end, December 31, is presented as follows: Dr. Cr. Cash $ 8,651.00 Accounts Receivable $ 61,214.00 Inventory $ 3,900.00 Prepaid Insurance $ 3,300.00 Supplies $ 728.00 Store Equipment $ 15,500.00 Accum

Financial accounting

Work through the Demonstration Problem at the end of Ch. 3 (p. 131) of Financial Accounting. What did you find to be the most challenging part of the problem? Explain why. Bob Sample and other student investors opened Campus Carpet Cleaning, Inc. on September 1, 2007. During the first month of operations the following transactio

Tom Smith Opened XYZ Cleaning Services

See attached Excel file. Tom Smith opened XYZ Cleaning Services, Inc. on July 1, 2012. During July the following transactions were completed. July 1 Issued 15,000 shares of common stock for $15,000 cash. 1 Purchased a truck for $12,000 , paying $2,500 cash and the balance on acco

Journalize and post April transactions; prepare trial balance

See attached file. Problem from the book Financial Accounting, Name of Author Weygandt/Kimmel/Kieso, 2010 custom edition, E1-14, page 37 for The Lake Theater. Journalize and post April transactions; prepare trial balance.

Prepare entries, general ledger, trial balance, adjustments

During its first month of operation, the Parkview Landscaping Corporation, which specializes in residential landscaping, completed the following transactions: July 1 Began business by making a deposit in a company bank account of $24,000, in exchange for 4,800 shares of $5 par

Ledger and Adjusted Trial Balance

P3-2A (a) Journalize the adjusting entries on August 31 for the 3-month period June 1ââ?¬"August 31. (b) Prepare a ledger using the three-column form of account. Enter the trial balance amounts and post the adjusting entries. (Use J1, see attached, as the posting reference.) (c) Prepare an adjusted trial balance o