Closing the books refers to preparing the books for the beginning of the next period in the accounting cycle. We do this by setting the revenue, expense and withdrawals accounts back to zero. These accounts are called temporary accounts because they relate only to one period. We only close temporary accounts in the closing process. The entries we make in the general journal to close our temporary accounts are called closing entries. We typically make a new account, called income summary, during the closing process. This account will have a balance of zero at the end as well.

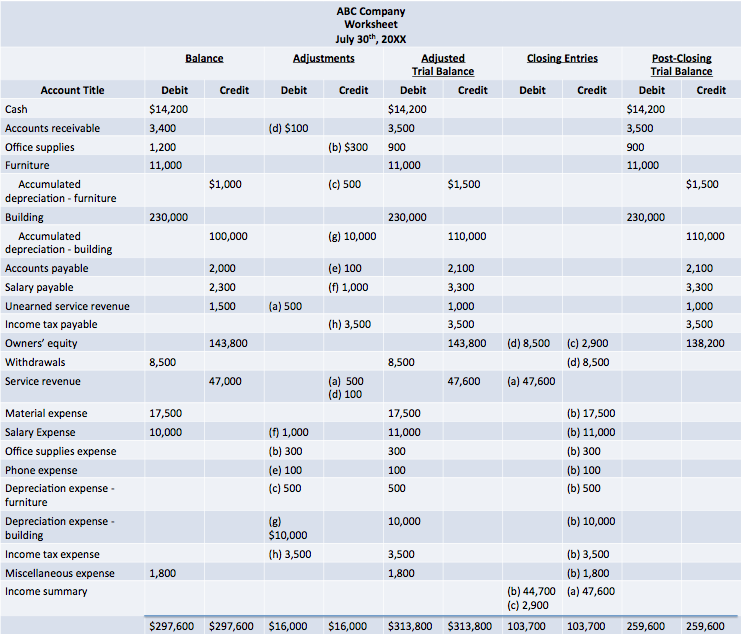

To see how this works, we are going to use the same trial balance we used before (see: The Adjusting Process), or see the worksheet below.

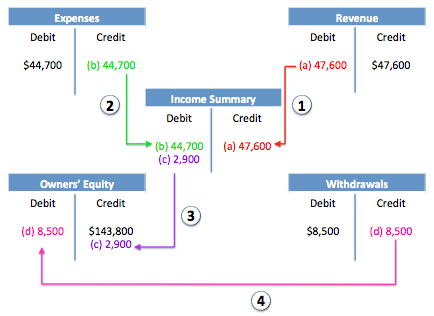

The Closing Process:

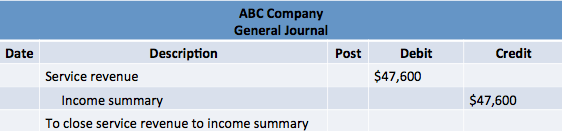

(1) Close revenue accounts to income summary.

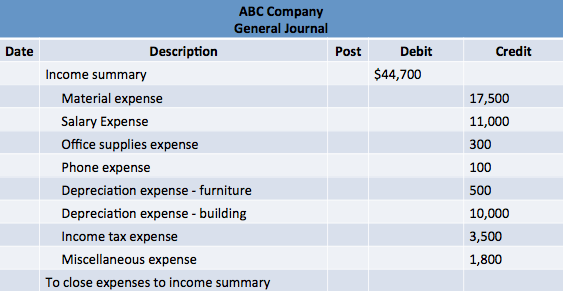

(2) Close expense accounts to income summary.

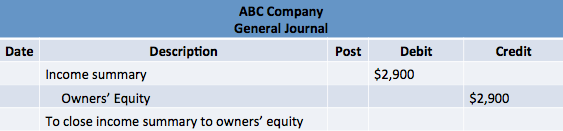

(3) Close income summary to owners' equity (or retained earnings in a corporation).

(4) Close withdrawals to owners' equity (or close dividends to retained earnings in a corporation).

(5) Prepare a post-closing trial balance to make sure accounts balance before we begin the next period. We can continue working with our worksheet from before (see: The Adjusting Process) to prepare this last trial balance.

1. Closing the Revenue Accounts

2. Closing the Expense Accounts

3. Closing the Income Summary Account

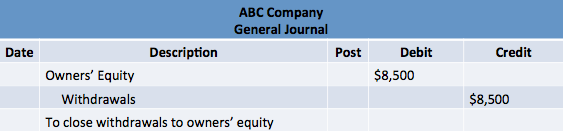

4. Closing the Withdrawals Account

5. Post-Closing Trial Balance

We can use the worksheet to record the closing entries and quickly build the post-closing trial balance. Also see Financial Statements for information on how the same worksheet can be used to prepare the financial statements.

The Closing Process

BrainMass Solutions Available for Instant Download

Foreign Currency Transactions Structure

1. (1 page) Final Project: Project Scope Statement and Work Breakdown Structure During Week 3, you developed a project charter for the St. Dismas Assisted Living Facility case study. This week, you will develop a Scope Statement and Work Breakdown Structure (WBS) for this project. Pages 123 and 124 of the PMBOK describe

Closing Entries and Owner's Equity Balance

On December 31, 2008. Kings Bait and Tackle had the following ending account balances after all adjusting entries were completed. Cash $35,000 Inventory 29,000 Supplies

Closing a Deal in Japan

One of your firm's U.S. managers just returned from business meetings in Japan without having closed the business deal for which he was sent. When you spoke about it together, he said that he was sure the Japanese counterparts would sign the contract at the end because they had been so pleasant up until that point, but they said

Closing the Digital Divide

See the attachments. In a brainstorming session at WidgeCorp, where no idea is too outrageous, you're discussing penetration in the school lunch market. Ideas around school lunch subsidies, Internet subsidies, and Internet target marketing are being discussed. At the end of the meeting, the group asks you to prove or disprove

Creating Financial Statements and Closing Entries

The following requirements are for the balance sheet of Fugazy Investment Advisers, Inc. which is attached. 1. Enter the account data in the Trial Balance columns of a worksheet, and complete the worksheet through the Adjusted Trial Balance. Key each adjusting entry by the letter corresponding to the data given. Leave a blank

Identifying and Journalizing Closing Entries.

1. Journalize Klein Photography's closing entries at December 31, 2012. 2. Determine Klein Photography's ending Retained earnings balance at December 31, 2012. Attached are adjusting entries for Klein Photography accounts.

Preparing a Worksheet, Financial Statements, and Closing Entries

The trial balance of Fugazy Investment Advisers at December 31, 2012, follows: (see attachment) Adjustment data at December 31, 2012: a. Unearned service revenue earned during the year, $500. b. Supplies on hand, $1,000. c. Depreciation for the year, $6,000. d. Accrued salary expense, $1,000. e. Accrued service revenu

Closing Journal Entries

What are the four closing journal entries? Why are they necessary?

Prepare the closing entries. Use J14 for the journal page.

From the attached worksheet and income statement, complete the following: (c) Prepare the closing entries. Use J14 for the journal page. (d) Post the closing entries. Use the three-column form of account. Income Summary is account No. 350.

Closing Entries

Prepare the necessary closing entries based on the following selected accounts: Accumulated Depreciation $10,000 Depreciation Expense 7,000 Owner's Capital 20,000 Owner's Drawings 12,000 Salaries and Wages Expense 18,000 Service Revenue 31,000

Add Introduction and Closing

See attached case file. Please provide an introduction and conclusion only for the paper being written.

Retained Earnings: Provide the Missing Closing Entry

Retained earnings at 1/1/10 was $170,000 and at 12/31/10 it was $200,000. During 2010, cash dividends of $50,000 were paid and a stock dividend of $40,000 was issued. Both dividends were properly charged to retained earnings. You are to provide the missing closing entry. Please indicate DR (debit) or CR (credit) to the l

Prepare journal entries to record budget, transactions, closing

The budgeted and actual revenues and expenditures of Seaside Township for a recent year (in millions) were as presented in the schedule that follows: 1. Prepare journal entries to record the budget 2. Prepare journal entries to record the actual revenues and expenditures. Assume all transactions resulted in increases or d

Retained earnings: Prepare the closing entry

Retained earnings at 1/1/10 was $100,000 and at 12/31/10 it was $210,000. During 2010, cash dividends of $50,000 were paid and a stock dividend of $40,000 was issued. Both dividends were properly charged to retained earnings. You are to provide the missing closing entry. Please indicate DR (debit) or CR (credit) to the left

Why is closing the sale important? When might you use the different types of closing?

Why is closing the sale important? When might you use the different types of closing? How might selecting the wrong approach adversely affect the close? Provide examples. If a closing is not effective, what are your options?

Closing entries for a company

Following are selected accounts and their balances for a company after the adjustments as of May 31, the end of its fiscal year. All accounts have normal balances.) J. Mark, Capital 30,000 J. Mark, Withdrawals 6,000 Fees earned 20,000 Salaries expense 7,000 Insurance expense 350 Utilities expense 75 Supplies exp

Purpose of closing entries

The purpose of closing entries is to transfer: A. Accounts receivable to retained earning when an account is fully paid. B. Balance in temporary accounts to a permanent account. C. Inventory to cost of goods sold when merchandise is sold. D. Assets and liabilities when operations are discontinued.

Forest Adventures: record adjustments, closing entries; prepare financial statements

Forest Adventures has the following account balances on August 30, 2008 Accounts payable: 10,875 Accounts receivable: 11,625 Accumulated amortization - equipment: 32,250 Cash: 3,750 Cost of goods sold: 342,375 E. Correa, Capital: 181,875 E. Correa, Withdrawals: 7,500 Equipment: 90,000 Interest earned: 3,000 Inventory

Closing a division

Baldwin Division earns a contribution margin of $200,000 and has a division margin of $70,000. If Baldwin Division is closed, the firm can eliminate all of the direct division expenses and $110,000 of common expenses. These facts indicate that closing the division will cause the firm's operating income to: Increase by

Closing Entries: Bixby Village General Fund

Selected ledger account balances of Bixby Village General Fund on June 30, 2006, were as follows: DEBIT CREDIT Appropriations

Closing Entries for Town of Irving, General Fund

From the following ledger account balances for the Town of Irving General Fund on June 30, 2006, the end of the town's fiscal year, prepare closing entries: Appropriations $1,520,000 Encumbrances

Rand Company: Prepare closing entries and determine Retained Earnings balance

See attachment please. Presented below is an adjusted trial balance for Rand Company, at December 31, 2007. Cash $ 19,700 Accounts payable $ 15,000 Accounts receivable 20,000 Notes payable

Closing Entries for Income Statements

Closing Entries The income statement for Quality Plumbing, Inc., for the year ended December 31, 2006, is as follows: Quality Plumbing, Inc. Income Statement For the Year Ended December 31, 2006 Sales revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $623,400 Less expenses: Cost

Closing Entry - Roberts Enterprises

Need assistance with a closing entry. See the attached file. Closing Entry The income statement for Roberts Enterprises for the year ended June 30, 2006, is provided. Roberts Enterprises Income Statement For the Year Ended June 30, 2006 Sales revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

How to prepare a closing entry

Given are the adjusted account balances as of December 31st, 2001: cash $45,000 capital $85,000 accounts payable $33,000 service revenue $84,000 depreciation expense-building $12,000 salary expense $29,000 unearned service revenue $24,000 pre paid rent $9,000 supplies expense $6,000 note payable $70

Closing a Department Decison

Company ABC is a one-stop home decorating company that sells paint, carpet and wallpaper at a single store location. Although the company has been very profitable over the years management has seen a significant decline in wallpaper sales and earnings. Much of the decline had been due to online Internet companies offering de

Preparing Closing Entries

Preparing Closing Entries 1) Prepare the necessary closing entries at 12-31-08. 2) What is the balance in the Retained earnings account after closing entries are posted? Accounts Receivable $128,000 Accounts Payable 7,500 Advertising expense 2,500 Accumulated Depreciation 12,500 Cash 18,300 Certificate of Depos