Accounting can be done on either a cash or accrual basis. A cash-basis means transactions are recorded when cash actually changes hands. An accrual basis means that transactions are recorded as they occur, even if no cash is received or paid out. Company's use an accrual basis for accounting because it gives us a better current snapshot of a firm's financial picture. For example, if a firm makes a sale on account, we record the accounts receivable as an asset on the balance sheet and the sale as revenue. If we waited until cash actually changed hands to record the transaction, we would be understating assets and sales in the meantime.

However, because we use an accrual basis, some accounts need to be reconciled at the end of the period. These accounting adjustments fall into three basic categories: deferrals, depreciation and accruals. At the end of the period, we make these adjusting entries in the general journal, post these entries to the ledger and then prepare an adjusted trial balance. We often use a worksheet for the preparation of the adjusted trial balance. The adjusted trial balance is then used to prepare the income statement, the statement of retained earnings and the balance sheet.

(1) Deferrals: Unearned Revenue and Prepaid Expenses

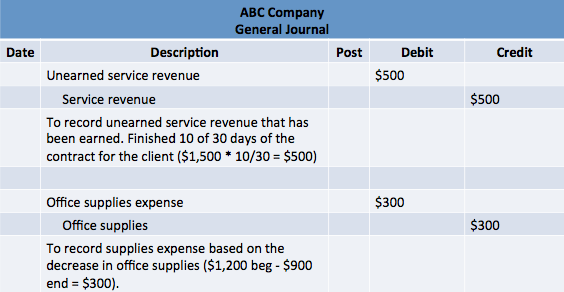

A deferral is an adjustments for which the business paid or received cash in advance. For example, a company typical purchases office supplies over the period. These are kept on the balance sheet as an asset. At the end of the period, we determine how how much supplies we have left. The decrease in supplies is then recorded as an office supplies expense. Deferrals include, for example, unearned revenue, cost of goods sold (under a periodic inventory system) office supplies, prepaid rent, and prepaid insurance. These adjusting entries may look like this:

(2) Depreciation

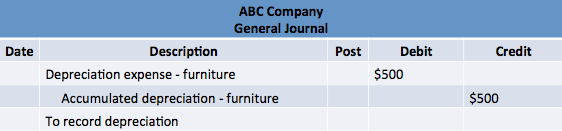

When we buy a capital asset, an asset that will last a long time, we do not expense it right away. We expense a portion of the asset every year we use it over its useful life. We call the portion of the asset that we expense depreciation, and we calculate the amount of depreciation for the period at the end of the period. We use a contra asset account called accumulated depreciation, and an expense account called depreciation expense to record depreciation. The amount of the capital asset less its accumulated depreciation is called that asset's carrying amount; this is the book value of the asset, or the net amount that the asset is still worth based on its historical cost.

(3) Accruals: Accrued Revenue and Accrued Expenses

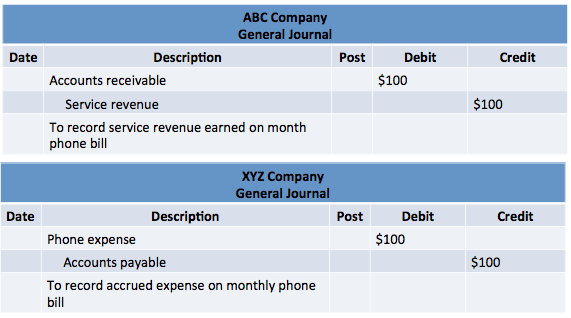

Over time, businesses accrue revenues and expenses that have yet to be received or paid. For example, your phone company accrues revenue over the month, and sends you a bill at the end of the month. On your end, you accrue a phone expense over the month, which becomes an account payable. At the end of the period, the phone company must make an adjustments for this earned revenue, even if the bill hasn't been mailed. At the same time, even if you haven't received the invoice, you know that you've incurred some phone expense based on your contract (maybe its $100/month all inclusive).

THE WORKSHEET

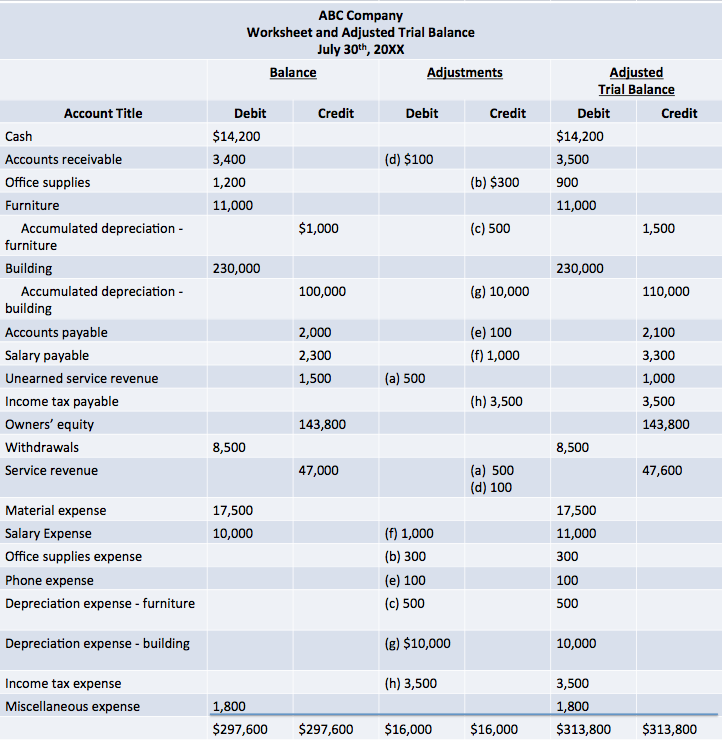

We typically use a worksheet to help us prepare the trial balance from the adjusting entries. Below is an example of a worksheet. We started with the unadjusted trial balance we used before (see: Trial Balance) and added two columns for our adjusting entries. Adjusting entries (a) through (e) are the five types of entries from above. We also included entries for accrued salaries (f), building depreciation (g) and accrued taxes (h). We also added two more columns for our adjusted trial balance. We simply add the adjusting entries in the middle to columns to the balances in the first two columns to get the balances of the adjusted trial balance.

*Note: in our examples above, two different companies were used to show how accrued revenue for one company is an accrued expense for another. In our worksheet, we wanted to show both of these entries (since all companies accrue both revenues and expenses). To simplify things, we pretended our accrued phone expense was for ABC company as well, and included it on the worksheet.

The Adjusting Process

BrainMass Categories within The Adjusting Process

Reversing Entries

At the beginning of each accounting period, some accountants use reversing entries to cancel out some adjusting entries from the previous period.

BrainMass Solutions Available for Instant Download

Identification of transactions and adjusting entries

Divtek's Variety Store is completing the accounting process for the year just ended on December 31, 2017. The transactions during 2017 have been journalized and posted. The following data with respect to adjusting entries are available: a.Wages earned by employees during December 2017, unpaid and unrecorded at December 31, 2

Prepare a Partial Worksheet

The ledger of Walters Company includes the following unadjusted balances: Prepaid Insurance $3,000, Service Revenue $60,000, and Salaries and Wages Expense $25,000. Adjusting entries are required for (a) expired insurance $1,800; (b) services provided $1,100, but unbilled and uncollected; and (c) accrued salaries payable $900. E

Journal Entries to Adjust the Accounts at the End of the Period

The following data is given for Zrada Ltd on March 31, 20XX. The firm adjusts its accounts on a monthly basis. a. Depreciation $1,000 b. Prepaid rent expired, $2,200 c. Interest Expense Accrued, $990 d. Employee Salaries owed for Monday through Wednesday for a five day work week; weekly payroll $150,000. e. Unearned Servic

Year-End Journal Entry Adjustments

Journal Entry Adjustments - Al Gerome's Services Example Please adjust the following entries: Data for the year-end adjustments for Al Gerome's Courier Services are as follows: 1). Insurance expired during the year ($950.00) 2). Depreciation

Mother Corporation Consolidation Case: Son Corp Daughter Corp Equity Method Noncontrolling Interest

You should provide a list of all journal entries that you record as part of putting together the consolidated financial statements with a clear indication of where the journal entries are posted. They could be posted to Mother Company's books, or in the Consolidation Worksheets (all entries needed for Son and Daughter Company we

Adjusting Entries Using the Aging Analysis Approach

At the end of 2011, Geisel, Inc has a $1,000 debit balance in the Allowance for Doubtful Accounts, before adjusting entries were prepared. Credit sales for 2011 totaled $510,000. Sales returns for 2011 were $10,000. Credit Sales for 2010 were $610,000. Sales returns for 2010 were $10,000. The following aging analysis of Accoun

Adjusting Entries and Income Statements

Using Microsoft Excel complete the following: A. Calculate the amounts of the adjusting entries and enter them in the adjustments column. B. Enter the amounts in the adjusted trail balance column. C. Prepare the Income Statement D. Prepare the Statement of Owner

Adjusting Entries for Partner Admission

Would you be interested in helping me with problem? Problem: The CAB Partnership, although operating profitably, has had a cash flow problem. Unable to meet its current commitments, the firm borrowed $34,000 from a bank giving a long-term note. During a recent meeting, the partners decided to obtain additional cash by admi

Adjusting Journal Entries and Deferred Expense

From Accounting: Republic Corporation purchased supplies at a cost of $12,215 during 2012. At January 1, 2012, supplies on hand were $10,312. During the year, the company used $14,000 of supplies. Republic accounting year ends on December 31. A) What adjusting entry is prepared at December 31, 2012? Dec. 31 - show adjus

Making adjusting entries to a company's financial accounts.

Journalizing adjusting entries Laughter Landscaping has the following independent cases at the end of the year on December 31, 2014. a) Each Friday, Laughter pays employees for the current week's work. The amount of the weekly payroll is $7,000 for a five-day workweek. This year December 31 falls on a Wednesday. b) Details

Maine Department Store: Create adjusting and closing entries.

Maine Department Store is located near the Village Shopping Mall. At the end of the company's fiscal year on December 31, 2012, the following accounts appeared in two of its trial balances. see attached for better formatting Unadjusted Adjusted Unadjusted Adjusted Accounts Payable $79,300 $79,300 Interest Payable $

Financial account: cost vs. expense, adjusting entries, fraud triangle, impact on assets

14. What is the difference between a cost and an expense? When does a cost become an expense? Do all costs become expenses? Explain. 15. Why are adjusting entries necessary in an accrual accounting system? What are some common examples? 16. Describe the difference between temporary and permanent accounts, and state which o

Adjusting entries for corporate income tax expense

Complete the work sheet. In completing the worksheet, compute State of Illinois corporate income taxes at 41/2% of pretax income. The state income tax is deductible on the federal tax return, and the federal tax is not deductible on the Illinois return. Assume federal corporate income tax on income subject to federal tax is as f

prepaid expenses, adjusting entries

1. In the case of a prepaid expense, the adjusting entry required at the end of a period consists of a credit to Prepaid expense. True False 2. The entry to record depreciation includes a debit to which account? Equipment Cash Accumulated depreciation Depreciation expen

Klein Photography Adjusting Entries

Identifying and journalizing closing entries: The accountant for Klein Photography has posted adjusting entries (a)-(e) to the following selected accounts at December 31, 2012. (See attatchment) Requirements 1.Journalize Klein Photography's closing entries at December 31, 2012. 2.Determine Klein Photography's ending K

Adjusting and closing entries: Example

Explain the purpose of adjusting entries. How is net income affected if adjusting entries are not made? Describe the four closing entries and explain their purpose.

Maine Department Store: Create adjusting and closing entries.

Create adjusting and closing entries. Maine Department Store is located near the Village Shopping Mall. At the end of the company's fiscal year on December 31, 2012, the following accounts appeared in two of its trial balances. Unadjusted Adjusted Unadjusted Adjusted Accounts Payable $79,300 $79,300 In

Adjusting entry for earned but unpaid rent

Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $3000 per month, starting on November 1, 2011. The rent was paid on time on November 1, and the amount received was credited to the Rent Earned account. However, the tenant has not paid the December rent. The company has w

This post addresses adjusting entries for insurance premiums

An analysis of the company's insurance policies provided the following facts. Policy Date of Purchase Months of Coverage Cost A April 1, 2010 24 $11,640 B

Correcting Intangible Asset Account

1As the recently appointed auditor for Hillary Corpoation, you have been asked to examine selected accounts before the 6-month financial statements of June 30, 2012, are prepared. The controller for Hillary Corporation mentions that only one accont is kept for intangible assets. Prepare the entry or entries necessary to corre

Bank Reconciliation and Adjusting Entries..

Deposits in transit at August 31 are $6,061, and checks outstanding at August 31 total $2,472. Cash on hand at August 31 is $494. The bookkeeper improperly entered one check in the books at $148.96 which was written for $177.96 for supplies (expense); it cleared the bank during the month of August. (a) Prepare a bank reconci

Explain why adjusting entries are necessary

YOU are an accountant in a medium sized manufacturing company. you have been asked to mentor an accounting clerk who is new to your accounting department. Explain why adjusting entries are necessary. Describe the 4 types of adjusting entries, and provide a manufacturing industry example of each. Describe how these entr

Solis Partnership: Journalize adjusting entries for the withdrawal of a partner in various situations. Assume that the bonus method is used to account for the withdrawal.

The December 31, 2008, balance sheet of the Solis Partnership is shown below. Solis Partnership Balance Sheet December 31, 2008 Assets Cash $ 80,000 Accounts Receivable 80,000 Inventory 62,000 Equipment 290,000 Total Assets $512,000 Liabilities and Partners' Equity Accounts Payable $ 60,000 Notes Payable to

Journal Entries for Klein's Stock; Entries for Leary's Bonds

26. Klein Corporation's stockholders' equity section at December 31, 2010 appears below: Stockholders' equity Paid-in capital Common stock, $10 par, 50,000 outstanding $500,000 Paid-in capital in excess of par 150,000

Which adjusting entries would be appropriate on International Galleries' books?

As of December 31, International Galleries, Ltd.'s general ledger account for Prepaid Advertising Expense had a balance of $10,000. However, an analysis of the account showed that $6,000 of that amount was for ads in the Daily Tribune newspaper that had been published during December. As of December 31, Tribune Newspaper Publish

Adjusting Entries Cash and Non-Cash Transactions

Adjusting entries are needed: 1. Whenever revenue is not received in cash 2. Whenever expenses are not paid in cash 3. Only to correct errors in the initial recording of business transactions 4. Whenever transactions affect the revenue or expenses of more than one accounting periods.

Crimson Tide Music Academy: Prepare adjusting entries for year end

See attachment. Crimson Tide Music Academy offers lessons in playing a wide range of musical instruments. The unadjusted trial balance as of December 31, 2012, appears below. December 31 is the company's fiscal year-end. Required: Record the necessary adjusting entries on December 31, 2012

Preparation of a work sheet, financial statements, and adjusting

See attached P 4. At the end of fiscal year, the trial balance of Reed delivery service appeared as shown below. Reed delivery service Trial balance August 31, 2010 Cash $10,072 Accounts receivable 29,314 Prepaid insurance 5,340 Delivery supplies 14,700 Office supplies 2,460 Land 15,000 Building 196,

Posting Adjusting Journal Entries and Financial Statements

The adjustments columns of the worksheet for Pear Corporation are shown below. Adjustments Account Titles Debit Credit Accounts Receivable 900 Prepaid Insurance 650 Accumulated Depreciation 770 Salaries and Wages Payable 1,200 Servi

Conti Company Preparing Adjusting Entries

See attached file for the problem. On June 30, the end of the current fiscal year, the following information is available to Conti Company's accountants for making adjusting entries: a. Among the liabilities of the company is a mortgage payable in the amount of $260,000. On June 30, the accrued interest on this mortgage amou