At the beginning of each accounting period, some accountants use reversing entries to cancel out some adjusting entries from the previous period. Reversing entries can only be made for accruals; that is, accrued revenues and accrued expenses. There is no need for reversing entries that reverse adjusting entries for deferrals (unearned revenue that has since been earned, or prepaid expenses), nor for depreciation.

Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. They also make it more likely that mistakes won't be made, if the accruals from the previous period are accidentaly forgotten.

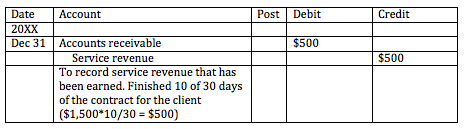

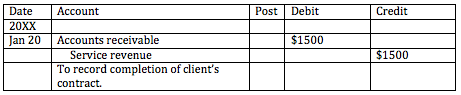

Considering the following adjusting entry that was made to record service revenue earned on a portion of a contract performed, but not yet paid.

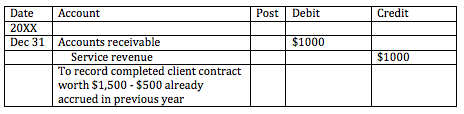

Typically, when we complete the contract, we would have to remember that a portion of the contract has already been accrued, and subtract it from our January entry.

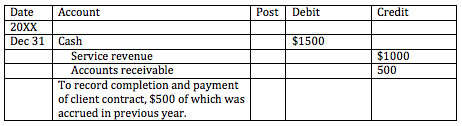

Or we could do a compound entry like this to show that the contract has been completed and paid, and that a portion of the contract was accrued in the previous period.

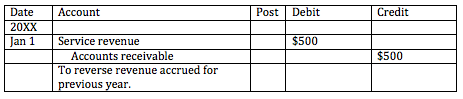

The reversing entry takes place on January 1st, and reversing the accrued revenue. When we do these, we do not have to remember that we accrued revenue from the previous period, we can simply record the transactions as we normally would in the new year.

After the reversing entry, the accountant can record the completion of the contract as usual.

Reversing Entries

BrainMass Solutions Available for Instant Download

Reversing a performance decline

When an organization takes the initiative to reverse a performance decline and reinvigorate growth towards profitability it is said that this is a turn around strategy. To accomplish this strategy, firms must consider pursuing at least 2 out of the next 3 known efforts: 1) external analysis to identify market segments or custome

This post addresses reversing accounting entries.

Reversing entries are useful when the company will book the entire expense when the invoice comes in. Some companies chose not to use reversing entries, but to post the difference between the accrual and actual invoice. For example, if the company accrued $100 for the electric bill but the invoice came in at $85, the company wou

Reversing Entries Required

What are reversing entries? Why are reversing entries needed? What would be the effect if not made? What are the pros and cons of using reversing entries? What types of transactions may require reversing entries?

Nathan Company: Prepare Reversing Entry

...reversing entries..... On Oct 31, Nathan Company made an accrued expense adjusting entry of $1,400 for salaries. Prepare the reversing entry on Nov 1, and indicate the balances in Salaries Payable and Salaries Expense after posting the reverse entry.

Prepare closing and reversing entries

See attached file for full problem description. On December 31, the adjusted trial balance of Garg Employment Agency shows the following selected data. Accounts Receivable $24,000 Commission Revenue Interest Expense $7,800 Interest Payable Analysis shows that adjusting entries were made to (1) accrue $ 4,200

Reversing Entry and Adjusting Entry

Please distinguish between a reversing entry and an adjusting entry., Are reversing entries required?

Closing, Reversing, Adjusting, T accounts, etc...

(See attached file for full problem description)

Effects of reversing entries

Please see attachment SE1: Resequence the following activities to include the usual order of the accounting cycle. b. Analyze the transactions f. Record the transactions in the journal c. Post the entries to the ledger h. Prepare the initial trial balance e. Adjust the accounts d. Prepare the financial statements a.

Financial Statements and Reversing Entries

What are the steps in completing the accounting cycle? What is the component that links the three main financial statements? Explain how? Why does GAAP require more than one financial statement? What are the pros and cons of using of reversing entries? Are reversing entries required? Why or why not?