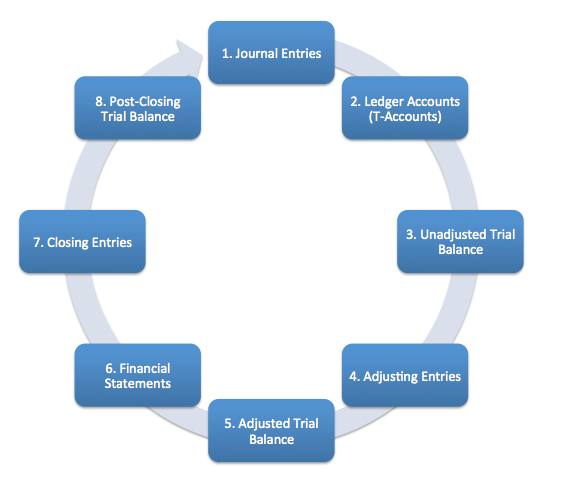

1. Journal Entries: The journal is a chronological record used to record all of the firm's transactions. The journalizing process requires three steps: (1) Each account that is affect by the transaction is listed, and each account is classified based on whether it is an asset, liability, shareholders' equity, revenue or expense. (2) The rules of debit and credit are used to determine whether each account increases or decreases as a result of the transaction. (3) The transaction is recorded in the journal with a brief explanation.

2. Ledger Accounts: After a transaction is recorded in the general journal, it must be copied into each individual T-account. For example, cash will have its own T-account, with the left hand side being the "debit" side and the right hand side being the "credit" side. A debit increases an asset account, a credit decreases an asset account. A credit increases a liability or shareholder's equity account, including revenue, a debit decreases them. Dividends and expense accounts are contra equity accounts. That means they behave the opposite. A debit increases a dividend or equity account, a credit decreases them.

3. Unadjusted Trial Balance: The trial balance is a list of all accounts and their balances in order, assets first, then liabilities, then shareholders' equity (including the revenue and expense accounts). The unadjusted trial balance is prepared to catch any mistakes that may have been made up until this point. After this trial balance, we typical make correcting journal entries for any accounting errors we may have found.

4. Adjusting Entries: Because companies are required to use accrual based accounting, the accounts at the unadjusted trial balance stage may not be ready for the financial statements. That is, adjusting entries may be required to ensure that deferrals, depreciation, accruals and perhaps inventory are properly recorded in the right period.

Deferrals: Deferrals may include prepaid expenses, such as prepaid rent or supplies, as well as unearned revenue.

Depreciation: Tangible capital assets such as land, buildings, furniture, machinery and equipment decline in usefulness and value over time. We spread this cost out over this time, and an expense for depreciation must be recorded each period.

Accruals: Accruals are expenses that have been incurred or revenues that have been earned, but which have not been paid or received in cash.

5. Adjusted Trial Balance: We finish the adjusting process by preparing an adjusted trial balance. We often use a worksheet to prepare the adjusted trial balance.

6. Financial Statements: From the adjusted trial balance we are able to prepare the financial statements: the income statement, the statement of owners' equity, the balance sheet and the statement of cash flows.

7. Closing Entries: The closing entries allow us to set the business's revenue and expense accounts to zero so that we can start the next period. We do this by transferring these balances to retained earnings. We first close the revenue and expense accounts to a temporary account called Income Summary. We close the income summary account to retained earnings. We then close out dividends to retained earnings. (For a sole proprietorship, we close income summary and withdrawals to owners' equity.)

8. Post-Closing Trial Balance: On the post-closing trial balance, the temporary accounts (revenue, expenses, gains, losses, dividends and withdrawals) should have balances of zero and are not listed. However, all non-zero accounts, including retained earnings, are included. The post-closing trial balance provides the opening balances of all the ledger accounts for the next period. We use the post-closing trial balance to make a list of all of these ledger accounts, and ensure that all of the debit balances equal all of the credit balances in the accounts.

The Accounting Cycle

BrainMass Solutions Available for Instant Download

Good Eats Tax Project

Although Lloyd Jones and his best friend Donna Taylor both studied biology at school, they ended up pursuing careers in professional cake decorating. Their company, Good Eats, specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. Lloyd and Donna formed the business at the beginning of 2021 and eac

Cash Versus Accrual Net Income

Sweet Catering completed the following selected transactions during May 2016: May 1: Prepaid rent for three months, $2,100 May 5: Received and paid electricity bill, $130 May 9: Received cash for meals served to customers, $830 May 14: Paid cash for kitchen equipment, $2,500 May 23: Served a banquet on account, $2

Accounts Receivable Structured Manners

1) Why does the allowance method require an estimate of the uncollectible accounts at year-end? Expand on response...NO PLAGARISM 2) Compare and contrast the allowance and write-off methods. Expand on response...NO PLAGARISM 3) Identify two accounts receivable ratios. Provide a numerical example for each. Expand on response.

different concepts in financial accounting

1. Describe how the financial statements (the income statement, statement of retained earnings, balance sheet and statement of cash flows) are interrelated. Provide at least two examples. If you were an investor, would you place more emphasis on any one particular financial statement? Explain your answer. 2.Describe how th

Capitalizing Operating Leases

Capitalizing Operating Leases McDonald's Corp. was the lessee at 14,139 restaurant locations through ground leases at December 31, 2011. The lease terms are generally for 20 years. The company is also the lessee under noncancelable leases covering certain offices and vehicles. The company's footnotes also revealed that at ye

State of South Carolina Entities

Write a paper of no more than 500 words that answers the following questions for The state of South Carolina: •What is the mission and purpose of the organization •What are the primary sources of funding for each •What are the primary expenditures for each •How successful is each entity in terms of meeting its mis

Pension Fund

Revise the example paper of no more than 1,050 words that answers the following questions for each state: (use the example paper attached as a reference) • What type of pension fund does the state provide to employees • How is the pension fund actually funded - who pays for it • Is the pension fully funded • What p

Differences between COBIT and the ISO 27000 series

In 480 words please, explain the most important differences between COBIT and the ISO 27000 series in relation to information security, and clearly identify and explain at least 3 important differences.

Lean Accounting and Waste

Please response to question one in 250 words and question two in 150 words 1. Lean manufacturing processes, such as Six Sigma or Kaizen, are popular because they reduce waste, thereby increasing profits. Still, accountants face several issues when switching to a lean manufacturing system. To begin, read the article The Lo

Applications of the Time Value of Money

Part#1: The main TVM problems relating to healthcare are: a) present value of a lump sum b) present value of an annuity stream c) future value of a lump sum d) future value of an annuity stream. Provide an example of each of these TVM problems. Part#2: Answer the following questions, show your calculations 1) You have ju

Capital leases, sale leaseback, pension worksheet, EPS, DEPS

Leases Corp Inc signed a lease for equipment with an expected economic life of seven years and a fair market value $380,00. The lessor is the leasing subsidiary of a national bank. The terms of the lease are as follows: - The lease term begins on April 30, 2005 and runs for 3 years. - The lease requires payments of $108,700 e

Calculating net operating cycle

Question: Below are part of the financial statements ABC Corp. provided, presented in millions of US dollars. please calculate the net operating cycle based on the information provided. Sales 400,000 Cost of Goods Sold 350,000 Inventories as of 12/31/12 40,000 I

Different Accounting Methods Described

Can someone please help me compare and contrast the different inventory methods. If possible include a discussion of FIFO, LIFO, specific identification, retail inventory, lower-of-cost-or-market and net realizable methods. Provide examples of companies that choose LIFO/FIFO as the better approach and explain why. Thank you!

Time Value Of Money Examples

What is the time value of money? Why should accountants have an understanding of present and future value concepts? How can these concepts be applied to business decisions? Provide examples of how these concepts can be used in business and personal finances please!

Back-loading Pensions

What is the "back-loading" of pension plans? Do some research and discuss issues related to this problem

Taxable Income and Tax Liability - Shimmer Inc.

Shimmer Inc is at calendar year end. This year its sells the following long term assets: Assets Sales Price Cost Acc. Depr Building $230,000 $200,000 $52,000 Equipment $ 80,000 $148,000 $23,000 Shimmer does not sell any other a

Accounts Receivable and Bad Debt Journal Entries

Prepare example journal entries to account for transactions related to accounts receivable and bad debt using both percentage of sales and the percentage of receivables methods.

Pension Expense, Journal Entries: pension-related amounts

Pension Expense (Pension Expense, Journal Entries) Ultra-Home Corporation provides the following information related to its defined-benefit pension plan for 2010. Pension liability (January 1) $ 500,000 Accumulated benefit obligation (December 31) 1,250,000 Actual and expected return on plan assets 15,000 Contrib

Eight steps for the accounting cycle

What are the eight steps in the accounting cycle and how do they affect the financial statements? What happens if one is missing?

Completing the accounting cycle

Name the steps in completing the accounting cycle and explain how they impact the financial statements. What happens is a step is missed? Explain.

Acquiring Shares & Paying Dividend: Company ABC Journal Entries

On 1/1/2012 Company ABC acquires 20,000 shares of company XYZ at cash price of $10 per share. Company XYZ has 300,000 shares issued and outstanding. On 6/15/12, Company XYZ declares dividends of $2 per share. These dividends are paid on 7/1/12. For the period of 1/1/12 to 12/31/12 Company XYZ has a net loss of $600,000 and the m

Sorter Co journal entries write off accounts receivable

At the end of 2010 Sorter Company has accounts receivable of $900,000 and an allowance for doubtful accounts of $40,000. On January 16, 2011, Sorter Company determined that its receivable from Ordonez Company of $8,000 will not be collected, and management authorized its write-off. Prepare the journal entry for Sorter Company to

Journal Entries to Record the Issuance of Bonds

On the first day of the current fiscal year, $1,000,000 of 10-year, 7% bonds, with interest payable semiannualy were sold for $1,050,000. Present entries to record the following transactions for the current fiscal year: (a) Issuance of the bonds (b) First semiannual interest payment (c) Amoritization of bond discount for t

Quark Spy Equipment: Work in Process journal entries

Quark Spy Equipment manufactures espionage equipment. Quark uses a job-order cost system and applies overhead to jobs the basis of direct labor-hours. For the current year, Quark estimated that it would work 100,000 direct labor-hours and incur $20,000,000 of manufacturing overhead cost. The following summarized information rela

Stocks, Equity and Journal Entries

The Cosmo Company was started by issuing 800 shares of $10 par value stock at an average market price of $20 per share. The company repurchased 100 shares at a market price of $15 per share. The company later sold 50 shares at a market price of $25 per share. At the end of the first year of operations the company has $2,600 of r

Debit, Credit, and Journal Entries

Woodcross LLC had the following events occur during the month of July. 1. Received $40,000 from investors for contributed capital 2. Borrowed $15,500 from bank 3. Paid $4,000 in rent 4. Made sale on account for $12,500 5. Made cash sales to customers totaling $29,700 6. Repaid part of bank loan for $6,000 7. Purcha

Intercompany Journal Entries

I need help understanding how these work. If one division sells another division 50 pc of equipment and records postage and depreciation on the items, how does the receiving division record the entry? I don't think they would be concerned with postage and depreciation on the receiving end - just a straight receipt, correct?

The Importance and Usefulness of the Accounting Cycle

Please discuss the value of the accounting cycle to a company including: Normal length of the cycle Integration with required governmental reporting Computer software verses handwritten records Level of education and expertise in the steps of the cycle Applying the cycle to manufacturing as well as retail and service comp

Flow of Production Costs and Journal Entries

Edison Company - cost of goods manufactured and sold - 14 Nov, 2012 Edison Company manufactures wool blankets and accounts for production costs using process costing. The following information is available regarding its May inventories. Beginning Inventory Ending In

Journal Entries Concerning Stockholders' Equity

Markus Industries is authorized by its corporate charter to issue 10,000 shares of preferred stock with a 7% dividend rate and a par value of $10 per share, and 25,000 shares of common stock with a par value of $2 per share. On January 15, 2011, Markus Industries issued 400 shares of its preferred stock for $14 per share and 5,0