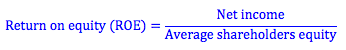

The return on equity (ROE) ratio is calculated by dividing net income after interest and taxes by average shareholder’s equity. We use net income because it gives us an idea about how much income the firm makes after it pays out what is owed to debt holders. What is left over is kept for the firm’s shareholders. It is important to know how much income is kept for the firm’s shareholders in relation to the amount that those shareholders have invested in the firm.

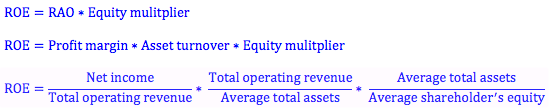

As a result, the difference between a firms return on assets and return on equity is due to the amount of leverage of the firm. We know that return on assets can also be found as a function of the firm’s profit margin and its asset turnover. As a result, the firm’s return on equity can be found as a function of the firm’s return on assets and its equity multiplier.

The intuition from these formulas is that a firm can increase its return on equity by increasing its return on assets or by increasing its equity multiplier. It can increase its return on assets by increasing its profit margin or its asset turnover. It can increase its equity multiplier and its asset turnover by reducing the amount of assets it uses. It can also increase its equity multiplier by reducing shareholder’s equity.

Return on Equity (ROE)

BrainMass Solutions Available for Instant Download

Adding debt and effect on ROE

a-If a firm's ROE is low and management wants to improve it, can adding more debt help improve the ROE? What might be some advantages and disadvantages of adding debt to the capital structure? b-Give some examples that illustrate how seasonal factors might distort a comparative ratio analysis.

Dupont Model and Return on Equity

Compute the ROE for 2013 and 2014 using the DuPont model based on Brown's 2014 annual report information below. Show work. 2014 Average Assets: $4,567.3 Average Shareholder's Equity: 3,545.6 Net Sales: 15,675.4 Net Income: 1,257.8 2013 Average Assets: $4,235.2 Average Shareholder's Equity: 2895.8 Net Sales:

The solution gives detailed steps on calculating a series of financial ratios from the income statement: liquidity ratios, efficiency ratios, asset turnover ratios, leverage ratios, coverage ratios, profitability ratios, component ratios and ROE. All formula and calculations are shown and explained in steps.

Modern Appliances Corporation has reported its financial results for the year ended December 31, 2011. Modern Appliances Corporation Income Statement for the Fiscal Year Ended December 31, 2011 Net sales ............................................................ $5,398,412,000 Cost of goods sold ..........................

Brand Equity from Consumer Standpoint

I need a research paper on brand equity on a consumers standpoint featuring a famous person. The paper has to be 2 pages long. It should entail how the brand evolved over time and how its changed over time. The second part of the paper should explain a celebrity that will endorse the brand and why they will beconnected to the br

Return on Equity and Leverage

As EBIT drops, the return on equity (ROE) of a levered firm drops, 1-the same as 2-relatively more than 3- relatively less than 4-more or less than (it cannot be determined) the ROE of an otherwise identical unlevered firm.

Major factors that affect domestic and international equity returns

What are a few key factors that affect domestic equity returns, and how would you rank them in importance/impact? What are key factors that affect international equity returns, and how would you rank them in importance/impact?

Princeton Equity, Langford Sweets.

Division B has a larger profit margin per dollar. 1. Princeton Corporation has assets of $384,000, current liabilities of $54,000, and long-term liabilities of $79,000. There is $36,800 in preferred stock outstanding; 20,000 shares of common stock have been issued. (a) Compute book value (net worth) per share. (Round your answ

Working Capital, ROE, ROI, Liquidity and Profitability

Case 3.18 LO 3, 4, 6, 7 Analysis of liquidity and profitability measures of Dell Inc. The following data (amounts in millions) are taken from the January 30, 2009, and February 1, 2008, comparative financial statements of Dell Inc., a direct marketer and distributor of personal computers (PCs) and PC-related products: . 10

Calculation of ROE: Technology Inc. Exercise.

Last year Technology Inc which was brought by My Space, had $256,392 of assets, $18,775 of net income and a debt ratio of 35%. Suppose the CFO increase the debt ratio to 45%. Sales and total assets will not be affected, but interest expenses would increase. The CFO believes that better cost controls would be sufficient to offset

Finance Calculations: Expected ROE

Question: You need $2 million of total assets to generate $3 million in revenues, with a profit margin of 5 percent. Consider two financing alternatives: 1) You can use all-equity financing by requiring each person to contribute his/her pro rata share. 2) Or, you can finance up to 50 percent of its assets with a bank

Accounting for Debt, Equity, ROA and ROE: The Blanz Corp.

You are given the following selected financial information for The Blanz Corp. Income Statement Balanace Sheet COGS $750 Cash $250 Net Income $160 Net fixed assets $850 Ratios ROS 10% Current Ratio 2.3 Inventory Turnover 6.0 X ACP

Equity and Rate of Return

Southern Healthcare and BestWell are for-profit HMOs that operate in Florida and Georgia. Currently, both are identical in every respect except that Southern is unleveraged while BestWell has $10 million of 5 percent bonds. Both HMOs report an EBIT of $2 million and pay corporate tax at a rate of 40 percent. The cost of equity

Financial statement ratios support informed judgments and decision making most effectively

Financial statement ratios support informed judgments and decision making most effectively: a. When viewed for a single year. b. When viewed as a trend of entity data. c. When compared to an industry average for the most recent year. d. When the trend of entity data is compared to the trend of industry data. The

Asset Turnover, ROE, Ethical issues, highly leveraged

A. Fixed assets total............100,000 Accum depr total.............(50,000) Net Assets....................50,000 (assume this is the average assets) Net Sales.....................100,000 1. What is the Asset Turnover Ratio of this firm? 2. If you were buying this company would you perceive this to be good or bad? 3

Valuation of ROE and IRR

Valuation by ROE and IRR with an example. List advantages and disadvantages.

Financial Accounting: Pacific Capital Bank

Pacific Capital Bank is looking at using the return on equity model and the DuPont formula to measure the performance of certain capital investments. - The Return on Equity looks at net income after tax in relationship to shareholder equity. - The DuPont formula looks at net profit margin in relationship to total asset turnove

Sustainable Growth rate - Universal Theme Parks (UTP)

UNiversal Theme Parks (UTP) reported the following data in its most recent annual report: Sales $42.5 million Net income $3.8 million Dividends $1.1 million Assets $50.0 million UTP is financed 100% wi

Return of Equity Calculation

Blue Ridge Bank has a PM of 12%, an interest income to total assets ratio of 6.00% and a noninterest income to assets ratio of 1.50%. Blue Ridge also has $9 in assets per dollar in equity capital. Blue Ridge's ROE is ?

Calculating ROE Using DuPont Method for Yahoo and Google

Using the annual report information available on each of the company's websites: compute the ROE for Yahoo and Google. Please use the DuPont Method =(Net Profit Margin) x (Asset Turnover) x (Equity Multiplier) for Year End 2010 for each company. Please show calculations.

ROE Calculation - Return on Equity

Look at Yahoo and Google. Using the annual report information available on each of the company's websites, compute the ROE for each company.

Journal Entries for Common Stock Transaction and Effect of Transactions on the Stockholders Equity of the firm

Common Stock Transaction and Stockholders Equity P1. On March 1, 2011 Dora Corporation began operations with a charter from the state that authorized 50,000 shares of $4 par value common stock. Over the next quarter, the firm engaged in the transactions that follow. Mar. 1 issued 15,000 shares of common stock, $100,000. Mar.

Determination of change in Return on Equity (ROE)

. Quigley Inc. is considering two financial plans for the coming year. Management expects sales to be $301,770, operating costs to be $266,545, assets to be $200,000, and its tax rate to be 35%. Under Plan A it would use 25% debt and 75% common equity. The interest rate on the debt would be 8.8%, but the TIE ratio would have to

What is a company's "ROE" and "IRR "and how do you calculate it?

When you measure how much earnings a company generates from its assets, Return on Equity (ROE) is an investor's gauge of that company and its ability to create profit generating efficiencies. Investors can gather information from the ROE that determines if the company being assessed is a profit making entity or a bad investment.

Normal EPS for GE based on the method of average ROE

see attached Refer to the following data to answer the following questions below. GEN ELECTRIC CO - Report History General 12mos(2) 2006 2005 2004 2003 2002 2001 Total Revenues, $M: NA 163391.0 148019.0 151300.0 132890.0 130685.0 125679.0 Depreciation & Amort, $M: NA 9158.0 8538.0 8385.0 6956.0 5998.0

Debt vs. Equity: Advantages of More Debt Than Equity

Financing the firm is one of the most difficult processes and decisions we encounter as business managers. So, how can we do it? Well, there are many ways. Lets start with comparing debt versus equity. What is the difference between the two? Also, what are the advantages of using more debt than equity to finance your firm?

Apple Inc. financial health: Current, debt, return on equity

Discuss the trend for each ratio and what it tells you about Apple Inc. financial health. o Current o Debt o Return on equity o Days receivable Use annual report and SEC filings for the past 2 years.

What is the return on equity

I need help with the following study question. Company taxable income is $1,760, tax rate of 38%, and owners' equity: $400 in stock, $200 in capital surplus, $200 in retaining earnings. What is the return on equity ROE?

Return on Equity (ROE) and Internal Rate of Return (IRR)

You know that when expanding and investing in projects overseas as Acme plans to, it is essential to understand such things as return on equity (ROE) and internal rate of return (IRR). Gather information on ROE and IRR. Post a two to three paragraph explanation for each of these terms and the advantages and disadvantages of usin

Compute Google's ROE and ROA

Need help to calculate ROE & ROA for Google based on the figures in the link below. I just need an excel spreadsheet with the formula/calculation shown in detail for both so I may understand it. The Return on Equity is provided on the page 19.16% Return on Assets is provided on the page as well 12.99% http://finance.ya

What is the rate of return on common stock equity for 2011?

The following data are provided: December 31 2011 2010 Cash $ 375,000 $ 250,000 Accounts receivable (net) 400,000 300,000 Inventories 650,000 550,000 Plant assets (net) 2,000,000 1,625,000 Accounts payable 275,000 200,000 Taxes payable 50,000 25,000 Bonds payable 350,000 350,000 10% Prefe