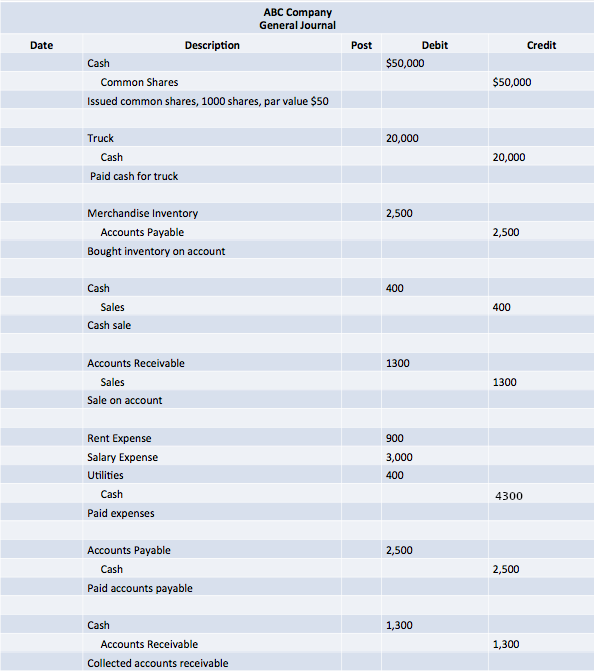

Every company has a general journal which is used to start the accounting cycle. The general journal is a chronological record used to record all of the firm's transactions. It could be an actual book, or a part of a computerized accounting system. Either way, when a transaction occurs, the first step in the accounting cycle is to record the transaction in the company's general journal.

Journalizing a transaction

(1) First, we decide which accounts are affected by the transaction and whether each account is an asset, liability, shareholders' equity, revenue or expense account.

(2) The rules of debit and credit are used to determine whether each account should increase or decrease as a result of the transaction.

(3) The transaction is recorded with a brief explanation.

Debits and credits

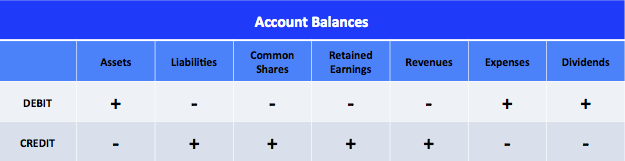

We use the accounting equation to understand the rules of debit and credit. We know that Assets = Liabilities + Owners' Equity. When we have a transaction, we need some way of determining which side of the equation the parts of the transaction affect, and in which direction. As a result, accountants developed the rules of debit and credit. Our assets on the left hand side of the equation are assigned a normal "debit" balance. Our accounts on the right hand side of the equation, liabilities and owners' equity, are assigned a normal "credit" balance.

Therefore, on the left hand side, a debit will increase assets and a credit will decrease them. On the right hand side, a credit will increase owners' equity and a debit will decrease it. These are opposites! In this way, we can always ensure that after every transaction our assets will still equal liabilities plus owners equity - as long as our debits equal our credits. See also: Posting to Ledger Accounts (T-Accounts).

A quick summary of how debits and credits either increase (+) or decrease (-) each type of account is provided below. Revenues, expenses and dividends are accounts that are closed out to retained earnings at the end of the period. Because expenses and dividends will decrease the amount available for retained earnings, we call these contra accounts. That is, these accounts exist on the right hand side of the accounting equation, but have a debit normal balance not a credit one. In this way they offset retained earnings, which has a credit balance.

As a result, under the rule of debits and credits we can expand the accounting equation:

Assets = Liabilities + Owners' Equity + Revenue - Expenses - Dividends

Sample entries

Below are some sample entries with description for typical transactions that would occur during the month.