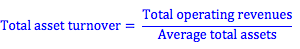

The total asset turnover ratio is calculated by dividing the firm’s total revenue from operations by the firm’s average total assets.

That is, the total asset turnover ratio looks at how much revenue the firm is generating from day-to-day operations as a percentage of the value of the firm’s assets used for generating this revenue. We exclude other sources of revenue, such as a gain from the one time sale of an asset, because we are only interested in the earnings of the business that can be repeated. If a firm can generate more revenue using less assets on an ongoing basis, the more likely it is that the firm is using its assets efficiently to generate sales.

This ratio varies between industries. Some firms may have high fixed assets, such as manufacturing firms, and show a low asset turnover. However, if these firms have low variables costs, they will be generating good earnings. On the other hand, some firms such as retail firms will have few fixed assets and little overhead. These firms may have a high asset turnover ratio. However, if variable expenses are high, these firms may not show the same amount of earnings.

We must also be careful in using the total asset turnover ratio when we look at firms with older assets. Because the book value of assets depreciates, firm’s with older assets may have a higher asset turnover then similar firms with recently purchased assets.

Asset Turnover

BrainMass Solutions Available for Instant Download

Ways to reduce turnover 540 words with reference

If a person says to you, "It's easy to reduce turnover, just pay people more money," what is your response? If you contend that paying more money is not the solution, what recommendations would you make to reduce turnover? 540 words with reference

Analyzing Turnover

You have some very good ideas in your suggestions about analyzing turnover. Are you conducting this survey with former employees, current employees, or as exit interviews? Would you put a different spin on it depending on the employee's current status?

Reducing Turnover at Bubba Gump Shrimp Co

Read and respond to the Reducing Turnover at Bubba Gump Shrimp Co. Applied Case Study.

How can hospitals work together to reduce nurse turnover?

How can hospitals work together to reduce nurse turnover?

Fade Rates, Asset Turnover, RNOA,

See the questions in the attached file: Other questions: FADE RATES: What would determine (or influence) the fade rate for sales growth for a firm? How would an external analyst estimate this fade rate? UNARTICULATED STRATEGY: As an outside analyst, how could you determine if the firm has an unarticulated strategy?

Receivables Turnover/Average Collection Period

Below is the problem and attached is the table. The president of Ferman Enterprise Ltd., Angela Ferman, is considering the impact that certain transactions will have on the company's receivable turnover and average collection period ratios. Prior to the following transaction, Ferman's receivables turnover was 6 times, and it

Division's turnover 16

Question 16: (2 points) Beade Industries is a division of a major corporation. Last year the division had total sales of $18,260,000, net operating income of $770,960, and average operating assets of $5,850,000. The division's turnover is closest to: 2.87 3.12 3.47 4.37

Eban Wares margin, turnover; Adam Co special order: accept order?

See attached file for full problems details. Eban Wares is a division of a major corporation. The following data are for the latest year of operations: Required: a. What is the division's margin? b. What is the division's turnover? c. What is the division's return on investment (ROI)? d. What is the division's resid

Deriving Insights from Employee Turnover Data

In statistical analysis, we are always in need of data to analyze. However, we don't always have the perfect data, so we may have to use "proxy data" meaning numbers or measurements that give us some insight. So, my question is, what data could you record that might give some "potential insight" into company's ethics or even a

Explanation of the turnover rate

Can you please define turnover rate and provide an example of such?