Working capital management in corporate finance may also be referred to as short-term financial planning. Working capital managment involves decisions related to short-term assets and short-term liabilities, and these decisions typically will have an impact on the firms operations within a year. This is in contrast with long-term financial planning, which involves decisions such as capital budgeting, paying dividends, and capital structure. These types of decisions are considered part of long-term financial planning because they will affect the operations of the business for a period of more than one year.

The term net working capital is frequently associated with short-term financial planning. Net working capital is calculated as the firm's current assets minus its current liabilities. It represents the operating liquidity available to the organization. Working capital plus fixed assets (such as property, plant and equipment) equal the firm's operating capital.

Current assets: Current assets are assets that are expected to be converted to cash within the year. They are listed on the balance sheet in order of their liquidity, and typically include: cash, marketable securities, accounts receivable, and inventory.

Current liabilities: Current liabilities are liabilities which are expected to be settled within the year. They include items such as accounts payable, notes payable, wages payable, taxes payable, drawings on a short-term line of credit, and the current portion of long-term debt that is expected to come due within the year.

Working capital management involves managing short-term assets: cash budgeting, accounts receivable management, and inventory management. It also involves managing receipts and disbursements, such as payments to accounts payable, and managing other short-term liabilities, such as securing a short-term line of credit for the firm that will cover its seasonal financing needs.

Working capital management ensures that the firm has sufficient cash flow to continue its operations, to satisfy maturing debt claims and to meet upcoming operational expenses and interest payments.

Short-Run Operating Decisions

1. How much inventory or raw materials should we order (inventory management)?

2. Can the firm pay cash for its purchases or buy them on account, effectively borrowing short-term from their suppliers (part of management of receipts and disbursements)?

3. What technology and method should a firm use to manufacture its products? For example, seasonal production is less risky, but may have higher costs, than level production.

4. How much credit should we extend to customers who purchase our products (accounts receivable (credit) management).

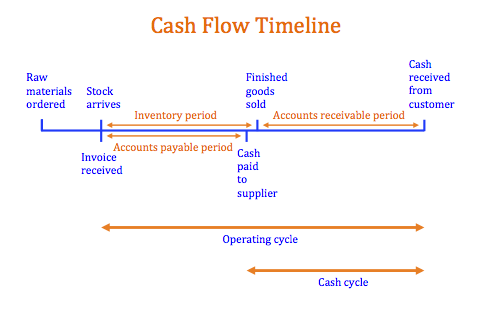

Cash Flow Timeline - Information that Supports Short-Run Decision-Making

We then use information about the timing of a company's cash flows to make decisions about our short-term financing needs.

Operating Cycle: The operating cycle is the amount of time it takes between when new inventory or raw materials are purchased and when cash is received from customers after the good are sold and accounts receivables are collected.

Cash Cycle: Most suppliers offer companies credit terms for raw materials or inventory purchases. This means that a company may have 30 or 60 days after they purchase raw materials to make a payment. As a result, we subtract the length of time of a firm’s accounts payable period from its operating cycle to get what we call the cash cycle.

Photo by Kelly Sikkema on Unsplash

© BrainMass Inc. brainmass.com June 27, 2024, 6:48 am ad1c9bdddf