Short-term financing looks at the financial decisions that will impact the firm within the year. Managing cash and other current assets to ensure that the current portion of a firm’s liabilities can be met is crucial to the ongoing operations of a business.

The cash budget is the primary tool in short-term financial planning. It allows the corporate financial manager to identify short-term financing needs (where cash-shortfalls may exist) as well as opporunities when extra cash is on hand. The purpose of the cash budget is to identify the cash flow gap on the cash flow timeline (see: Working Capital Management).

You’re probably familiar with budgeting how to spend your own paycheck, and many people know the stress of “being a little short this month.” Short-term financial decision-making is needed because of the gap in time and value between a firm’s cash inflows and cash outflows. A successful business must be able to manage its cash in a way that it can meet all of its obligations when they come due.

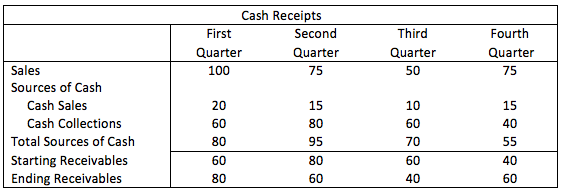

Sources of Cash

Sources of cash typically involve cash sales and cash collections from sales on account. For example, imagine a firm that expects to sell $100m in the first quarter, $75m in the second quarter, $50m in the third quarter, and $75m in the fourth quarter. 20% of its sales are typically for cash, and 80% of its sales are on credit. It allows 90 days for payment on account, so its cash collections for one period typically equal its sales on account from the previous period.

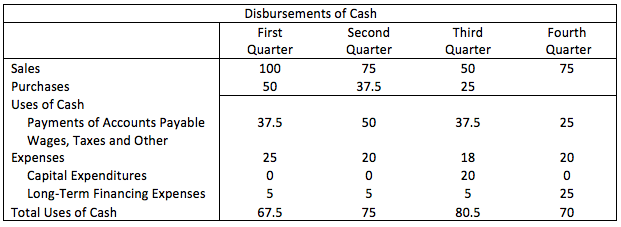

Disbursements of Cash

Disburesment of cash typically include the following categories:

1. Payments of accounts payable: Purchases of ray materials or merchandise inventory will typically reflect the business's sales forecasts. If a business has a raw materials cost equal to 50% of sales, its purchases will equal 50% of forecasted sales for the upcoming quarter. Imagine the same company above is given 90 day credit terms from its suppliers. Its payments of accounts payable will typically equal its purchases, then, from the previous quarter.

2. Wages, taxes and other expenses: This category includes all ordinary business expenses that must be paid in cash. For example, while depreciation is an ordinary business expense, it is not included on the cash budget because it requires no cash outflow. These numbers are also typically based on forecasted sales (or income).

3. Capital expenditures: These are cash payments made for new capital assets. Our hypothetical company is going to invest $20m in new manufacturing equipment in the third quarter.

4. Long-term financing: Interest payments, principle payments on maturing long-term debt, and dividend payments to shareholders also require cash during the year. Imagine our hypothetical company has interest payments of $5m a year, and will have to settle a $20m loan in the fourth quarter.

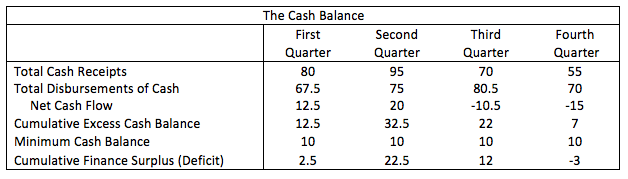

The Cash Balance

Knowing the business's sources of cash and disbursements of cash, we can then calculate the net cash flow from each quarter. We can add this net cash flow to our current cash balance to get our forecasted cash balance. Most firms have a minimum cash balance requirement; that is, they have a policy that requires them to keep a minimum level of excess cash in their bank account in case of contingencies. Using this information, we can calculate whether the firm will have a cash surplus of deficit; that is, whether they have excess cash they can invest or whether they will not have enough cash to meet their short-term needs, and will need to arrange borrowing.

Our hypothetical firm is going to need to arrange a small amount of borrowing in the fourth quarter to keep its minimum cash balance.

Photo by Christian Dubovan on Unsplash

© BrainMass Inc. brainmass.com June 30, 2024, 10:11 am ad1c9bdddf