From a legal standpoint, there are three basic procedures that a firm can use to acquire another firm. Often these three variations are not distinguished, so we typically use the term merger/acquisition regardless of the actual form of the acquisition:

1. Merger/Consolidation: In a merger, the acquiring firm gets all the assets and liabilities of the acquired firm, the acquired firm ceases to exist, and the acquiring firm keeps its name and identity. In a consolidation, the two pre-existing firms cease to exist and become part of a new business entity.

2. Acquisition of Stock: A tender offer is a public offer made directly to the shareholders of the target corporation to buy their shares for either cash or securities. These offers are often contingent on the acquiring company’s ability to purchase a desired total number of voting shares.

3. Acquisition of Assets: An acquisition of assets involves the acquiring firm purchasing all of the assets of the firm. This form of acquisition involves transferring title of the assets to the purchasing firm, which can be a costly legal process. A formal vote of the shareholders of the selling firm must also be held.

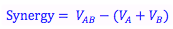

Mergers and acquisitions often occur because of the synergy that can be created when two firms become one. We often hear the expression ‘the sum is greater then its parts’. Synergy is created when the value of the new firm, after an acquisition, is greater than the sum of value of the two firms individually.

The increase in the value of the firm often comes from increased cash flow such as:

(1) marketing gains: co-branding, better distribution, monopoly power

(2) cost savings: economies of scale, replacing inefficient managers

(3) tax gains: shared operating losses, unused debt capacity

(4) reduced costs of capital

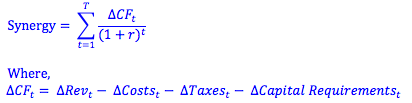

Using the discounted cash flow model we can represent the synergy as the change in future cash flows between the old firms and the new firm discounted to present value.

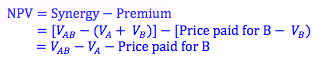

We can also use this synergy to calculate what the net present value of the merger is to the acquiring firm.

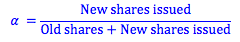

Often the acquiring firm offers its own securities instead of cash to the shareholders of the target firm. In this way, existing shareholders of the target firm become owners of the new firm. An exchange ratio between old shares and new shares can therefore be determined.

Photo by John Lockwood on Unsplash

© BrainMass Inc. brainmass.com June 30, 2024, 10:08 am ad1c9bdddf