Equivalent annual annuity is a capital budgeting tool based on the net present value analysis. Net present value calculates the total value of a project to a business, in present dollars. However, projects with the same net present value may have uneven cash flows, and the length of the investments may vary. Even if two projects have the same net present value, a shorter project may be preferable. That is, if cash flows from a project can be realized sooner, this money can be reinvested.

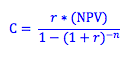

The equivalent annual annuity formula takes the net present value of a project and calculates what the cash flows from this project would look like if they occurred evenly over the length of the investment. The formula is derived from the present value of an annuity formula.

Where r = the discount rate

NPV = net present value

n = the length of the investment

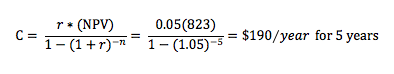

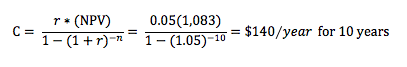

Consider the net present value example we introduced before. Jim and Jane own a bakery, and are considering buying a new oven. The main oven they have looked at will cost them $10,000 and generate cash flows of $2,500 a year over the five-year life of the oven. The net present value of this oven is $823. Imagine they have a second option. They can buy this same oven, as well as a yearly maintenance package that will extend the life of the oven to ten years. The oven will cost $10,000 today plus $500 for a warranty, and the annual maintanence costs will cost $1,000/year (reducing the annual cash flows from $2,500 to $1,500 a year). The net present value of this second option is $1,083. What should Jim and Jane do?

We can use the equivalent annual annuity formula to look at these investments as if their net present value was in even annual payments. Let's use the same 5% discount rate we used for calculating the net present value.

As you can see, Jim and Jane may prefer to purchase the oven without maintenance, even though it has a lower NPV. Without maintenance, they will make more money per year in the first five years. Companies that choose to do this will reinvest these earlier cash flows. For example, Jim and Jane could buy another oven at the end of five years (as a matter of fact, buying one oven today and another oven five years from now would have a net present value of $1,467 - higher than the net present value of the ten year oven). Using the equivalent annual annuity formula is a good way to compare projects and identify these types of cases.

Photo by Christophe Hautier on Unsplash

© BrainMass Inc. brainmass.com July 25, 2024, 8:35 pm ad1c9bdddf