For many small business's, especially those that make the majority of sales in cash, the amount of accounts receivables that become uncollectible is immaterial. As a result, these business's are not required to use the allowance method to value accounts receivable, which is used to better match bad debt expenses with revenues. The simpler alternative for these companies is the direct write-off method. Under the direct write-off method, when an account is determined to be uncollectible, it is simply written off as a bed debt expense at this time and no allowance account is used.

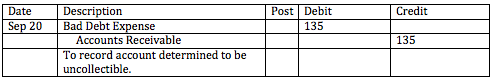

For example, imagine a local dry cleaner that does pick up and drop off service when a customer puts down their credit card. One customers credit card payment is declined after delivery. The customer had a couple suits and ties dry cleaned, totalling $135. The dry cleaner would make an accounting entry as follows.

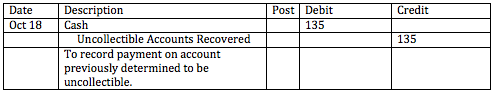

Sometimes a business will collect on an account that was originally deemed uncollectible. For example, imagine a month later this customer walks back into the dry cleaner with his suits again, and the dry cleaner takes cash from him for this previous charge. The dry cleaner would correct the bad debt expese recognized by making the following reversing entry.

The uncollectible accounts recovered account is a revenue account. The business could also simply credit bad debt expense as well to reduce the balance of the bad debt expense account.

Direct Write-Off Method

BrainMass Solutions Available for Instant Download

Methods of Cost Allocation

A2 Company has two service departments (General Factory and Repair) and two operating departments (Fabrication and Assembly). Management has decided to allocate repair costs on the basis of the area (square feet) in each department and to allocate General Factory on the basis of labor hours worked by the employees in each of the

Cost Allocation: A1 Company

A1 Company has two production departments: D and J. Stephanie also has 3 service departments: Personnel, Administration, and Shipping. Shipping costs are allocated on the basis of number of packages, while Personnel and Administration costs are allocated using number of employees. Assume that the ranking of the benefits provided

Computation of Operating Activities-Direct Method

(Computation of Operating Activities-Direct Method) Presented below are two independent situations. Situation A: Chenowith Co. reports revenues of $200,000 and operating expenses of $110,000 in its first year of operations, 2010. Accounts receivable and accounts payable at year-end were $71,000 and $39,000, respectively.

Discuss the direct method, swing weighting, and equivalence lottery, tradeoff weights.

I need help with Tradeoff Weights I need help with what are the advantages and disadvantages of the various methods for developing tradeoff weights? Discuss the direct method, swing weighting, and equivalence lottery. Evaluate how to determine when each method would yield the optimal results. Evaluate the qualitative

Dallas Cleaning: Allocating Costs, Direct method and step down method

Please see attached file. (questions below yellow highlighted line) Chapter 12 Decision Guideline Dallas Cleaning Cost Allocations from Service Departments to Producing Departments July 17, 2011

12-47 12-48 Step down & Direct Method - Wheelick Controls

see attached for better formatting of data 12-47 Direct Method for Service Department Allocation Wheelick Controls Company has two producing departments, Mechanical Instruments and Electronic Instruments. In addition, there are two service departments, Building Services and Materials Receiving and Handling

Joint Cost, Called Physical Output and Net Realizable Value

What are the pros and cons of the joint cost allocating method, called physical output method, and net realizable value method? Describe what industries would use either job costing or process costing and explain why.

Direct Method versus Step Down Method -- Electricity & Water

- Allocate Service department costs to profit centers using the step-down method and direct method. Water is the first service department allocated. Compute the cost of electricity per kilowatt-hour using step-down method and direct method. - Critically evaluate this allocation method (see data in file for better formatting)

Allocate service department costs to operating departments by the step-down method.

Total Square ft Number Machine Direct Labor of Space of hrs Labor Hrs occupied Employees Hrs Cafeteria....... 16,000 12,000 25 Custodial Srvs.. 9,000 3,000 40 Machinery Main 15,000 10,000 60 Milling............ 30,000 40,000 100 160,000 20,000 Finishing......... 100,000

Step-down method examined

The step-down method allocates more costs to the producing departments than does the direct method. Do you agree? Explain.

direct method of entry

Can anyone provide a credible source that a software company that wants to pursue global expansion should use the direct method of entry? Thank you.

The direct and step-down method of costing

See attached file. 12-59 Allocating Costs Using Direct and Step-Down Methods Goal: Create an Excel spreadsheet to allocate costs using the direct method and the stepdown method. Use the results to answer questions about your findings. Scenario: Antonio Cleaning has asked you to help them determine the best method for

Direct method of cost allocation

Auro national bank has two service department, the Human Resources Department and the Computing Department. The bank has two other department that directly service customers, the Deposit Department and the Loan Department. The usage of the two service departments output for the year is as follows: User of service

Bad Debt Expenses, Write-Off Method

P9-2A Information related to Dekalb Company for 2006 is summarized below. Total Credit Sales $1,640,000 Accounts Receivable at Dec. 31 620,000 Bad debts written off 26,000 Instructions a.) What amount of bad debts expense will Dekalb Company report if t uses the direct write-off method? b.) Assume that DeK

Direct Method of Service Department Cost Allocation

Bay State Community College enrolls students in two departments, Liberal Arts and Sciences. The college also has two service departments, the Library, and the Computing Services Department. The usage of these two service departments' output for the year is as follows:

Direct Method Calculation of Cash Payments

Calculate the amount of cash payments for operating expenses in 2003 using the direct method. Cone Company had total operating expenses of $150,000 in 2003, which included Depreciation Expense of $20,000. Also, during 2003, prepaid expenses increased by $5,000 and accrued expenses decreased by $8,700.

Petro Tech Company refines a variety of petrochemical products

Petro Tech Company refines a variety of petrochemical products. The following data are from the firm's Amarillo plant. Work in process, July 1 1,900,000 liters Direct material 100% complete Conversion 30% complete Units started in process during July 750,000 liters Work in process, July 30 250,000 liter

Direct write off

The direct write off method certainly is the most 'accurate' method. While the lecture addresses the lack of the matching principal, what other reason might give you concern to use the direct write off method?

Dreamworks International Operating section of Cash Flows, Direct Method

The income statement of Dreamworks International Co. for the year ended December 31, 2002, reported the following condensed information. Morgan Erin Corporation Corporation Cash provided by operations $300,000 $300,000 Average current liabilities 50,000 100,000 Average total liabilities 200,000 250,000 Net income 200,000