Straight-line depreciation is the most common method used by companies for depreciating long-term tangible assets for financial reporting. The straight-line depreciation method benefits from simplicity, since the same amount of depreciation is expenses each period. This method is also promotes matching when creeping obsolescence contributes to a constant loss of value each period from the long-term asset.

Calculating Straigh-Line Depreciation

Step 1: Calculate the depreciable amount. The depreciable amount is typically equal to the amount that the asset's book value or historical cost exceeds its estimated salvage value. An asset's book-value or historical cost is often referred to as its "cost-basis" when we are talking about depreciation.

Step 2: Calculate the depreciation rate. We can calculate what is know as the straight-line rate by dividing the value "1" by the number of years in the operating asset's useful life. This gives us a percentage-rate for depreciation each year. For example, imagine we purchased a van with a useful life of 4 years; under the straight-line method we would depreciate 25% of the asset's value each year. 25% is called the straight-line rate and is calculated from dividing "1" by "4", where 1/4 = 0.25.

Step 3: Calculate the annual depreciation expense. We can calculate the annual depreciation expense by multiplying our straight-line rate and our depreciable amount. For example, assume our van has a cost-basis of $20,000 and a salvage value of $4,000. We know our straight line rate is 25% from above. Our depreciable cost is $16,000 (equal to $20,000 - $4,000). Our annual depreciation will therefore be $4,000 (equal to 25% of $4,000).

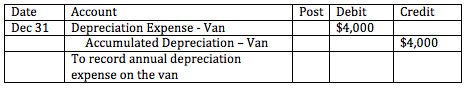

Step 4: Record depreciation expense. To record depreciation, we debit an expense account for depreciation for the period and credit a contra-asset account typically called accumulated depreciation. The depreciation expense account is closed each year during the closing entries. The accumulated depreciation account is a permanent account that equals the value of all the depreciation expense recognized to date. The carrying amount of the asset is equal to the debit value of the asset in its asset account minus the credit value of accumulate depreciation in the contra asset account.

When other methods of depreciation are used, the same accounts are debited and credited, but the amounts may be different.

General Formula

A general formula can be used for straight line depreciation. This formula combines our calculations in our first three steps into one formula.