There are three main sources of equity for corporations. The three sources are contributed capital, retained earnings and accumulated other comprehensive income.

Contributed capital: Contributed capital or paid-in capital refers to money or assets received from shareholder's in exchange for an ownership interest (in the form of shares) in the corporation.

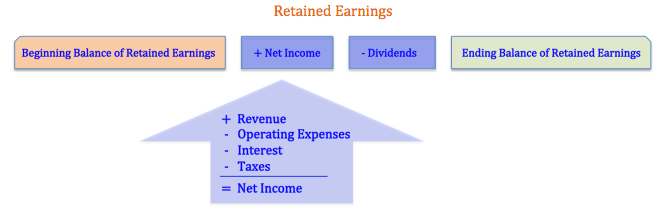

Retained earnings: Retained earnings come from the corporation operating profitably. When a corporation earns an income, it has a choice. It can distribute its income to shareholders in the form of dividends or it can keep the income in the corporation and invest it in future operations. Most corporation do a little bit of both. The retained earnings account represents the amount of net income that the firm decides to keep in the firm and invest. It is equal to the corporation's net income less any dividends it pays out to its shareholders.

Accumulated other omprehensive income: Accumulated other comprehensive income refers to sources of income that have not yet been recognized. When other comprehensive income is recognized, it is moved from the accumulated other comprehensive income account to net income and is closed out at the end of the period to retained earnings.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Corporations

- /

- Shareholders' Equity

- /

Retained Earnings

BrainMass Solutions Available for Instant Download

Accounting for Detachable Warrants

Vernon Corporation offered detachable 5-year warrants to buy one share of common stock (par value $5) at $20 (at a time when the stock was selling for $32). The price paid for 600, $1,000 bonds with the warrants attached was $615,000. The market price of the Vernon bonds without the warrants was $540,000, and the market price of

Managerial Finance

1. ABC company had sales of $100,000, operating costs of $10,000, depreciation of $5,000. It has $20,000 of bonds outstanding carrying an interest rate of 8%. If the tax rate is 35%, compute the net income. 2. ABC company had CA of $18,000 and CL of $10,000. If the long term debt and equity was $20,000 and $30,000 respectively,