Both corporations and other forms of business will have a section on the balance sheet devoted to owners' equity. Owners' equity represents the value of the owners' investment in the business at the financial statement date. It is equal to the amount of capital that the owners of the firm have invested in the business as well as the amount of income the firm has generated over the years and has retained in the business.

The owners' equity in a corporation is typically called "shareholders' equity" or "stockholders' equity." A corporation can issue debt in order to raise capital to purchase assets or finance the operations of the corporation. However, debt is not the only source of financing. Shareholders also invest to provide a source of capital for the corporation. However, if the corporation goes bankrupt, creditors must be paid before shareholders. As a result, we say that shareholders have a "residual claim" on the assets of the corporation. The book value of the shareholders' claim is what is referred to as shareholders' equity. The ending balance of shareholders equity is calculated based on the "statement of shareholders' equity."

SHAREHOLDERS' EQUITY

Shareholders' equity is a section on the balance sheet whose total vaue is equal to the total assets minus the total liabilities of the corporation. On the balance sheet, shareholders' equity is typical broken up in to several sections. Shareholders' equity accounts have a normal 'credit' balance. They are broken up into two sections, 'paid-in capital' which is the amount that shareholder's provide to the corporatin and 'earned capital' which is the amount contributed by the corporation operating profitably.

Paid-in capital (or contributed capital): Is equal to common shares and preferred shares as well as additional paid-in capital.

Common shares (and preferred shares): This balance sheet account recognizes the value of capital contributed to the corporation from the sale of commo or prefered shares in the primary market. It includes the value received from shares issued during an IPO and through additional issues.

Additional paid in capital: This is often called contributed surplus in other countries. Additional paid in capital recognizes other sources of income from the corporation other than from operations. It includes items such as selling shares for greater than par value (often referred to as capital surplus), and gains and losses from tax related and conversion related adjustments.

Earned capital: Earned capital is generated from the corporations operating activities. It is equal to retained earnings and accumulated other comprehensive income.

Retained earnings: Retained earnings measures the recognized income or losses of the business less any income that is paid out as dividends to shareholders. A corporation is not allowed to pay dividends greater than its retained earnings. As a result, the common share and additional paid in capital accounts must be preserved for the protection of creditors.

Accumulated other comprehensive income: In addition to retained earnings, accumulted other comprehensive income is an equity account that measures the business's gains and losses that are yet to be recognized. It typically occurs as a result of unrealized pension costs and unrealized gains and losses on investments in securities and derivatives, among others.

STATEMENT OF SHAREHOLDERS' EQUITY

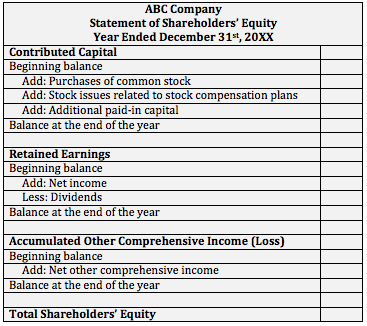

The statement of shareholders' equity shows how the book value of shareholders' equity changed over the year. It starts with the balance in the shareholders' equity account at the beginning of the year. To get the balance of shareholders' equity at the end of the year, that statement adds contributed capital, retained earnings and accumulated other comprehensive income to the beginning balance.

Unlike owners' and partners' equity which only show the owner or partners' capital accounts in the equity section of the balance sheet, the ending balances of common shares, preferred shares, additional paid-in capital, retained earnings, and acumulated other comprehensive income all appear as separate lines in the equity section of a corporation's balance sheet

Shareholders' Equity

BrainMass Categories within Shareholders' Equity

Retained Earnings

Retained earnings measures the recognized income or losses of the business less any income that is paid out as dividends to shareholders. A corporation is not allowed to pay dividends greater than its retained earnings. As a result, the common share and additional paid in capital accounts must be preserved for the protection of creditors.

BrainMass Solutions Available for Instant Download

Ensor Materials Corporation: Share-based compensation

On October 15, 2015, the board of directors of Ensor Materials Corporation approved a stock option plan for key executives. On January 1, 2016, 20 million stock options were granted, exercisable for 20 million shares of Ensor's $1 par common stock. The options are exercisable between January 1, 2019, and December 31, 2021, at 80

Share buyback: Compare retirement treasury & stock treatment

See attachment. The shareholders' equity section of the balance sheet of TNL Systems Inc. included the following accounts at December 31, 2015: Shareholders' Equity ($ in millions) Common stock, 240 million shares at $1 par $240 Paid-in capital—excess of par 1,680 Paid-in capital—share repurch

Financial Forecasting of Required Additional Equity Financing

Please post only the formulas to come up with the solution and not the actual solution. Financial Forecasting. Small Motors Inc, which is currently operating at full capacity, has sales of $29,000, current assets of $1,600, current liabilities of $1,200, net fixed assets of $27,500, and a 5 percent profit margin. The firm has

Merger Premiums per Share

Brown's, Inc. and Greystone, Inc. are all-equity firms. Brown's has 1,500 shares outstanding at a market price of $21 a share. Greystone has 2,500 shares outstanding at a price of $38 a share. Greystone is acquiring Brown's for $36,000 in cash. What is the merger premium per share? a. $3.00 b. $4.00 c. $6.50 d. $8.00 e. $

Earnings Per Share and Investment

Earnings per share (EPS) is the amount of net income a company earns for every share of stock held (Harrison, et al. 2013). The ratio is determined after paying taxes and dividends to stockholders (QFinance). This ratio is extremely important when comparing two companies because it allows for a direct "apples-to-apples" comp