Options are a right, but not an obligation, to undertake some kind of business or financing activity. Financial options are the right to buy or sell an underlying asset or instrument. Real options, on the other hand, typically are not traded as securities in financial markets, nor are the underlying assets of a real option traded as securities. Real options look at business opportunities such as delaying, abandoning, expanding, staging, or contracting capital investment projects and making decisions about input and output mix or operating scale for products.

Real options valuation recognizes that there exist some disadvantages to the NPV approach. The traditional NPV approach assumes that the scale of the project is fixed and it ignores adjustments that firm can make after a project is accepted. These options help manage risk and provide opportunity for increased returns. Similarly, there is no easy way to determine the risk-adjusted discount rate.

Types of Real Options

1. The Option to Expand: If a project is successful, we should consider the possibility of expanding the project to get a larger net present value. If this option is ignored, a traditional NPV analysis will understate the net present value of the project.

2. The Option to Abandon: If a project goes south, the option to abandon will save a company money. When this option exists, the risk of the project is reduced, increasing the present value of any potential project.

3. The Option to Delay: Timing options have value when underlying variables are changing with a favorable trend. For example, when commodity prices are rising or political risk is falling, it might make sense to delay a mining operations until a future date.

4. The Contraction Option: The scale of a project is often not fixed. In good times, we might want to expand a project. If business is slow, we also have the option to reduce the scale of a project.

5. Production Options: Financial managers often have the option to make changes to the input and output mix as well as the operating scale (rate of output, for example) for the products the business creates.

Example - The Option to Abandon

The option to abandon a project has value if demand turns out to be lower than expected. Let's consider the example we've used before. Jim and Jane wish to purchase an oven for their business. The oven is going to cost them $10,000 today. If demand is good, they will make $2,500/year over the five-year life of the oven. However, there is a 10% chance that a new restaurant will open up, creating a lower than expected demand. In this scenario, there is an option to salvage the oven. If it sells the oven, they will get $5,000 next year. If they keep the new oven, it is worth nothing to the business. The discount rate is 5%.

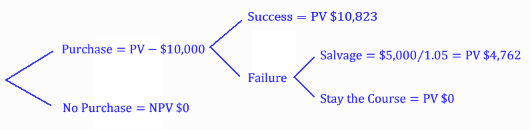

Decision Tree

The firm has two decisions to make: (1) to undertake the project or not (purchase the oven) and (2) to abandon the project or stay the course.

Under a traditional NPV analysis, managers are not seen as having the ability to make decisions after a project is undertaken. As a result, we wouldn't consider the option to salvage when calculating a traditional NPV.

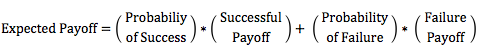

Expected Payoff (Traditional Analysis) = (0.90 x $10,823) + (0.10 x $0) = $9,740

NPV (Traditional Analysis) = - $10,000 + $9,740 = - $260

When we consider real options, we take in to account the value of the option to salvage the oven. With this option, the project is now profitable.

Expected Payoff (with Options) = (0.90 x $10,823) + (0.10 x $4,762) = $10,216

NPV (with Options) = - $10,000 + $10,216 = $216

Tools for valuing financial options, such as Black-Scholes, are also used to price real options. For example, the value of a start-up firm may be calculated using Black-Scholes to find the price of a call option.

Photo by hue12 photography on Unsplash

© BrainMass Inc. brainmass.com July 26, 2024, 7:52 pm ad1c9bdddf