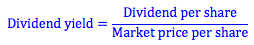

The dividend yield is calculated by taking the annual dividend (the amount of ordinary dividends paid out over the year, or the last dividend payment annualized) and dividing by the market price of the share. This informs investors how much cash return each year they can expect to receive as a percentage of their initial investment.

Like the P/E ratio, the dividend yield is related to the future growth potential of the firm. This is for two reasons. For one, investors will pay more for a stock today with higher future growth potential then one without growth. This will make the market price per share inflated when compared with earnings – giving the stock a higher price to earnings ratio. Because dividends are paid out of earnings, if the price per share is inflated relative to earnings, it is likely to be inflated relative to dividends as well.

Similarly, investors often do not want high growth firms to pay dividends. If the firm can reinvest retained earnings into high growth projects, investors would prefer that the corporation keep more retained earnings, contributing to higher future growth.

Dividend Yield

BrainMass Solutions Available for Instant Download

Symbol Two Corporation: Stock split & property dividend JEs

Stock splits and property dividend journal entries Symbol Two Corporation had the following transactions: (a) The par value of the capital stock is reduced to $0.50 with a 2-for-1 stock split. (b) A 10% stock dividend is declared and distributed at a time when the market value of the shares is $25 per share. (c) A prope

Recording federal income tax transactions and cash dividend transactions.

David Corporation: Record estimated taxes dividend declaration payment 2013 Date Transaction Mar 15 File the federal income tax return for 2012. The total tax for the year was $125,250. During 2012, quarterly deposits of estimated tax totaling $120,000 had been made. The addition

Company market ratio comparrison

Choose an industry and find four companies in that industry. Using a financial internet database such as www.marketwatch.com, calculate or locate four market ratios: earnings per common share, price to earnings ratio, dividend payout ratio and dividend yield. Write an analysis comparing the market ratios of the four companies.

Cranberry Corporation: Projected net income

See attached file for proper format. Cranberry Corporation Income Statement ($ in millions) Sales $300 Costs 250 EBT $ 50 Taxes (34%) 17 Net income $ 33 Retained earnings $ 22 Dividends $ 11 Cranberry Corporation Balance Sheet ($ in millions) Cash $5

Constant growth stocks, expected return on common and preferred stock

1. Constant growth stocks You are given the following information about three stocks: - Chapman Tech is expected to pay a $1.20 dividend at the end of the year. The required return on Chapman Tech's stock is 11% and its dividend is expected to grow at a constant rate of 7% per year. - Rust Petroleum is expected to pay a $1.50

Natsam Corporation: What is the ex-dividend price of a share in a perfect capital market?

Natsam Corporation has $250 million of excess cash. The firm has no debt and 500 million shares outstanding with a current market price of $15 per share. Natsam's board has decided to pay out this cash as a one-time dividend. a) What is the ex-dividend price of a share in a perfect capital market? b) If the board instead d

Prepare, in proper form, the journal entries required to account for the dividend transactions.

Background (prior problem data): Sixnut, Incorporated has been authorized to issue 1,000,000 shares of $1 par common stock, and 100,000 shares of 8%, $100 par, cumulative, preferred stock. During the first six months of operation, the following transactions occurred related to the stock. Jul 1st Sold 200,000 shares of comm

Parsons, Inc. Balance Sheet Problems

Parsons, Inc. is a publicly owned company. The following information is excerpted from a recent balance sheet. Dollar amounts (except for per share amounts) are stated in thousands. Stockholders equity: Convertible $17.20 preferred stock, $250 par value, 1,000,000 shares authorized; 345,000 shares issued and outstandin

Dividend Yield and Capital Gains Expected in the First Year

The club auto parts company has recently organized. It is expected to experience no growth for the next 2 years as it identifies its market and acquires its inventory. However, club will grow at an annual rate of 5 percent in the third year and beginning with the fourth year, should attain a 10 percent growth rate which will sus

Stock Dividend BrainMass Expert explains

On October 10, the board of directors of Pitcher Corporation declared a 10% stock dividend. On October 10, the company had 10,000 shares of $1 par common stock issued and outstanding with a market price of $15 per share. The stock dividend will be distributed on October 31 to shareholders of record on October 25. Journaliz

Ex-dividend stock price

Westover Electric is preparing to pay its quarterly dividend of $2.20 a share this quarter. The stock closed at $57.70 a share today. What will the ex-dividend stock price be if the relevant tax rate is 10 percent and all else is held constant?

Capital gain yield of KNF Stock

One year ago, Steven purchased 4,200 shares of KNF stock for $177,072. Today he sold those shares for $48.10 a share. What is the capital gains yield on this investment if the dividend yield is 3.3 percent?

Bonds and Stocks

1. Rick bought a bond when it was issued by Macroflex Corporation 14 years ago. The bond, which has a $1,000 face value and coupon rate equal to 10 percent, matures in six years. Interest is paid every six months; the next interest payment is scheduled for six months from today. If the yield on similar-risk investments is 14 pe

What is the current value of a share of Simtek stock to an investor who requires a 25 percent return on his or her investment?

Simtek currently pays a $2.50 dividend (Do) per share. Next year's dividend is expected to be $3 per share. After next year, dividends are expected to increase a a 9 percent annual rate for three years and a 6 percent annual rate thereafter. a. What is the current value of a share of Simtek stock to an investor who requires a

Before Tax Dividend Yield

As a bank investor paying a marginal tax rate of 34 percent, if 70 percent of dividends are excludable, what would be your after-tax dividend yield on preferred bank stock with a 16 percent before tax dividend yield?

Financial Analysis

Please see the attached file. Sam Strother and Shawna Tibbs are senior vice presidents of Mutual of Seattle. They are co- directors of the companys pension fund management division, with Strother having responsibility for fixed income securities (primarily bonds) and Tibbs responsible for equity investments. A major new clien

The Effect of Dividend Payouts on Additional Funds Needed

Which of the following statements is correct about the effect of the dividend payout ratio on the Additional Funds Needed (AFN)? A. A smaller dividend payout means less retained earnings so AFN would decrease B. A smaller dividend payout means more retained earnings so AFN would decrease C. A smaller di

Percentage increase in cash dividend

Winkie Baking has just announced a 100 percent stock dividend. The annual cash dividend per share was $2.40 before the stock dividend. Winkie intends to pay $1.40 per share on each of the new shares. Compute the percentage increase in the cash dividend rate that will accompany the stock dividend.

Planetary Travel Co. has $240,000,000 in stockholders' equity.

Planetary Travel Co. has $240,000,000 in stockholders' equity. Eighty million dollars is listed as common stock and the balance is in retained earnings. The firm has $500,000,000 in total assets and 2 percent of this value is in cash. Earnings for the year are $40,000,000 and are included in retained earnings. a. What is

Different types of dividend policies ..

Discuss the different types of dividend policies that an organization may adopt. Discuss the factors that should determine this policy and the effect each have on shareholder wealth.

Under what circumstances would you not pay a dividend? Under what circumstances would you pay a dividend?

Under what circumstances would you not pay/not pay a dividend?

A firm has a current stock price of $15.32. The firm's annual dividend is $1.14 per share.

A firm has a current stock price of $15.32. The firm's annual dividend is $1.14 per share. The firm's dividend yield is

Constant growth valuation formula for stocks

You are given the following information about three stocks: Chapman Tech is expected to pay a $ 1.20 dividend at the end of the year. The required return on Chapman Tech's stock is 11% and its dividend is expected to grow at a constant rate of 7% per year. Rust Petroleum is expected to pay a $ 1.50 dividend a

Microsoft's One Time Dividend

"Finally, in July 2004 Microsoft announced a plan to return cash to stockholders, by paying a special one-time $32 billion dividend in December 2004 . . . . Microsoft also doubled its regular annual dividend to $3.50 per share. Further, it announced that it would spend another $30 billion over the next four years buying treasury

Earnings per share, dividend payout & price-earning ratio, etc.

Financial statements for Praeger Company appear below: Praeger Company Statement of Financial Position December 31, 19X6 and 19X5 (dollars in thousands) 19X6 19X5 Current assets: Cash and marketable securities $100 $100 Accounts receivable, net 170 170 Inventory 110 110 Prepaid

Financial solution

One year ago, you bought 500 shares of Webster, Inc., stock at $37 per share. You just received a dividend of $1,000 and Webster stock now sells for $38. a. How much did you earn in capital gains? b. What was your total dollar return? c. What was your percen

Cash needed to pay dividend

5. Stephanie's Café, Inc. has declared a dividend of$1.30 per share for shareholders of record on Tuesday, May 2. The firm has 200,000 shares outstanding and will pay the dividend on May 24. How much cash will be needed to pay the dividend? When will the stock begin selling ex dividend?

If you require a 13 percent return on your investment, how much will you pay for the company's stock today? If it's the company's policy to always maintain a constant growth rate in its dividends, what is the current dividend per share?

1). Stock values: Warren Corporation will pay a $3.60 per share dividend next year. The company pledges to increase its dividend by 4.5 percent per year indefinitely. If you require a 13 percent return on your investment, how much will you pay for the company's stock today? 2). Stock Valuation: suppose you that a company's st

Cash Flow Statement disclosures, compute dividend yield, sales trend percent

A company purchased equipment for $150,000 by paying $50,000 and signing a $100,000 note payable. The entire transaction is disclosed to users on the statement of cash flows and/or in its notes a. true b. false A company that has days' sales uncollected of 30 days and days' sales in inventory of 18 days implies that invento

Krell Industries Dividend Calculation

Krell Industries has a share price of $22.00 today. If Krell is expected to pay a dividend of $.88 this year, and its stock price is expected to grow to $23.54 at the end of the year, what is Krell's dividend yield and equity cost of capital?