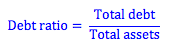

The debt ratio is calculated by dividing total debt by total assets. This gives us an idea about how much of the firm is financing its activities with debt. Other debt ratios include the debt-to-equity ration and the equity multiplier. These ratios provide information about how solvent the firm is on an asset basis. That is, if the firm’s assets had to be sold today, would the proceeds be enough to pay back the firm’s creditors, and what would be left to give to the equity holders? A firm is considered insolvent if its debt ratio is 1, and typically the proceeds from liquidated assets in bankruptcy are not enough to cover a firm’s creditors.

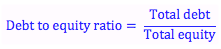

The debt-to-equity ratio is calculated by dividing total debt by total equity. It lets us know the value of the firm that is financed with debt in relation to the value of the firm financed by equity.

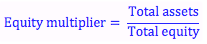

The equity multiplier is found by dividing total assets by total equity. It lets us know how many times larger the firm is in relation to the amount of equity that is invested in a firm.

Because the book value of debt is not adjusted for risk or interest rates, the book value of debt may differ substantially from its market value. We typically use the accounting or book value of debt, and this is one important thing we must take note of when using these ratios.

Debt Ratio

BrainMass Solutions Available for Instant Download

Financial and Turnover Analysis

Practice Problems 1. Consider the following information for Walgreen's: 2008 2009 Cash and Marketable Securities $10 $80 Accounts Payables $60 $30 Long Term Bonds $754 $580 Deferred Income Taxes $140 $130 Notes Payable $110 $60 Net Plant and Equip $1000 $870 Preferred Stock(400,000 shares

Ratios Analysis for General Electric

Find General Electric's Annual report. Calculate the following ratios for the company: Return on assets Return on equity Gross profit margin Debt to equity ratio Debt ratio Current ratio Quick ratio Inventory turnover Total asset turnover Price earnings ratio Using the calculated ratios, analyze the

Total Asset Turnover Discussion

1) Your company's balance sheet includes the following data for 2012: Current assets = $1 million. Cash = $100,000. Inventory = $500,000. Current liabilities = $800,000. Accounts receivable = $100,000. Accounts payable = $90,000. long-term debt = $1 million. Total liabilities and stockholders' equity = $3 million. On the

External Funding and Growth Rate

A company has the following Income Statement and Balance Sheet: Income Statement Sales $26,400 Expenses $17,300 Taxable Income $9,100 Taxes (40%) $3,640 Net Income $5,460 Dividends $ 2,300 Additional Retained Earnings 3,160 Balance Sheet Total Assets $65,000 Debt $27,400

Financial analysis and calculating current and quick ratios in a case

Review the requirements of the Chapter 3 Mini-Case, parts b through j. Then apply those requirements to do an analysis of Yum! Brands Inc., which is a real company. Don't complete the minicase itself, just Yum!. Do the analysis on the basis of the figures for the most recent year. For part g, use the 2 most recent years. Downloa

Help. Publicly traded Companies

Ford Motor Company and JPMorgan Chase & Co Evaluate the vulnerability of each company to external forces such as a recession, higher interest rates, and global competition. Based on the financial trends of each company, predict how these trends will impact financial performance in future periods. Explain your rationale for thi

Questions involving WACC

1. (Answer using Excel) Finding the WACC: Given the following information for Huntington Power Co., find the WACC. Assume the company's tax rate is 35 percent. Debt: 5,000 6 percent coupon bonds outstanding, $1,000 par value, 25 years to maturity, selling for 105 percent of par: the bonds make semiannual payments. Commo

Debt-to-Equity Ratio for Phoenix Company

1. calculate the Debt-to-Equity ratio for Phoenix Company for all five years and also calculate the Debt-to-Equity ratio applicable to Phoenix's industry sector (Industry Average) 2. Secondly, comment on the long-term debt-paying ability of this company based on the information provided. Identify items that give you concerns

Tax Shields and Debt Ratio

Which is correct? 1-Tax shields make debt financing more attractive, all else equal. 2-A firm's debt ratio falls when it uses excess cash to pay dividends 3-The cost of equity is low for firms that pay no dividends, all else equal. 4-Bankruptcy costs decrease the benefits of debt financing all else equal. 1 and 4 1,2 a

Calculate dividends paid, debt-equity ratio, and book value

36. The year-end 2010 balance sheet of Brandex Inc. listed common stock and other paid-in capital at $2,100,000 and retained earnings at $4,400,000. The next year, retained earnings were listed at $4,700,000. The firm's net income in 2011 was $1,000,000. There were no stock repurchases during the year. What were the dividends pa

Ratio Analysis Report - Understanding Financial Accounting Report

Please provide examples, to help me complete this exercise: Analyzing a company of your choice and making comparisons. This project provides an opportunity to apply ideas and concepts for each project to real world situations. This project has two parts. Part I. Select an organization for your project. You must choose a

liquidity

What is meant by liquidity? What metrics can be used to assess improvement ordeterioration in liquidity? How is liquidity influenced by debt? How do different types of debt affect liquidity? How does equity affect liquidity? How do different types of assets affect liquidity?

Debt Instrument Transaction

1. A debt instrument with no ready market is exchanged for property whose fair market value is currently indeterminable. When such a transaction takes place: a) The present value of the debt instrument must be approximated using an imputed interest rate. b) It should not be recorded on the books of either party until the f

Please choose 3 terms from the following list for this paper

Review the objectives from Week Three, and discuss additional insights and questions. Please choose 3 terms from the following list for this paper. Avoid Financial analysis. Financial analysis Sustainable income Irregular items Discontinued operations Extraordinary items Changes in accounting principle Comprehensive

Calculating the Amount that Beranek Corporation Can Borrow

Beranek Corp, has $410,000 of assets, and it uses no debt - it is financed only with common equity. The new CFO wants to employ enough debt to bring the debt/assets ratio to 40%, using the proceeds from the borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debt ratio?

Starbucks had a Total Assets Turnover (TAT) ratio of 1.2 in 2007, which was an improvement over a TAT of 0.96 in 2006. If Starbucks had the exact same level of sales, debt, and profit in 2007 as they did in 2006, how did their TAT improve?

Starbucks had a Total Assets Turnover (TAT) ratio of 1.2 in 2007, which was an improvement over a TAT of 0.96 in 2006. If Starbucks had the exact same level of sales, debt, and profit in 2007 as they did in 2006, how did their TAT improve?

Discuss the firm's ability to service the fixed charges of the debt

For a firm in your industry, discuss the firm's ability to service the fixed charges of the debt. Integrate in your discussion what you consider to be a good times interest earned ratio given the cyclical nature of the industry and the firm's operating risks.

What is the primary objective of the corporation?

Question 1 What is the primary objective of the corporation and why is it the objective? Question 2 How would you determine or measure the ability of a company to pay its bills? Question 3 What are 3 limitations of ratio analysis? Questio

T.P. Jarmon Company - 4.11

A) Calculate the financial ratios for 2010 corresponding to the industry norms provided. B) Which of the ratios reported in the industry norms do you feel should be most crucial in determining whether the bank should extend the line of credit? D) Use the information provided by the financial ratios and the cash flow statem

Short term debt and quick ratio for small firm

Organic Fuels has $1,312,500 in current assets and $525,000 in current liabilities. The company's initial inventory level is $375,000, and it will issue notes payable and use the proceeds to increase inventory. a. How much can Organic Fuels' short-term debt (notes payable) increase without pushing its current ratio below

liquid ratio

Comments the ratio analysis should include ratios for the years 2008 and 2009. Also should include comparisons between Tootsie Roll and Hershey Foods. Please see attached Hershey Liquid 2008 Tootsie Roll Liquid 2008 current ratio = current assets/current liability current ratio = current assets/current

Expanded Analysis on Financial Statements for Wal-Mart

1. Do an expanded analysis of the financial statements (horizonal and vertical analysis, selected liquidity, profitability, and solvency ratios) of Wal-Mart. 2. Write an executive summary for Wal-Mart that defines its financial health, as well as calculation and appendices completed in Excel for an opinion of Wal-Mart's forec

Dividend Payout Ratio, Price/Earnings Ratio, Financial Leverage

Choose the correct answer: 1. The dividend payout ratio describes: a. the proportion of earnings paid as dividends. b. dividends as a percentage of the price/earnings ratio. c. the percentage change in dividends this year compared to last year. d. the relationship of dividends per share to market price per share. 2

Two Problems

12.19 Various capital structures Charter Enterprises currently has $1 million in total assets and is totally equity-financed. It is contemplating a change in its capital structure. Compute the amount of debt and equity that would be outstanding if the firm were to shift to each of the following debt ratios: 10%, 20%, 30%, 40%

Five Problems: debt ratio, new fixed assets, receivable turnover, book & market value

1. Crystal Lake, Inc., has a total debt ratio of 0.23. (a) What is its debt-equity ratio? (b) What is its equity multiplier? 2. For the year just ended, Ypsilanti Yak Yogurt shows an increase in its net fixed assets account of $645. The company took $190 in depreciation expense for the year. How much did the company

Debt ratio Multiple Choice

An increase in the debt ratio will generally have no effect on . Business risk. Total risk. Financial risk. Market risk. It will not affect any measure of risk.

Sprint Cost Accounting: Ratio calculation for each division

Sprint Company has the following data for 2011: Division A Division B Sales $400,000 $300,000 Contribution margin 160,000 125,000 Operating income 80,000 30,000 Average operating assets 320,000 200,000 Weighted average cost of capital 15% 15% Sprint Company has a target ROI of 20 percent.

Financial ratio development evaluation for Anheuser Busch over the past five years

See attached file. Based on the financial growth ratios of Anheuser Busch data attached in this post, please answer the following questions: a. What has been the trend in debt usage by the company over the past 5 years? b. What has been the trend in "asset turnover" over the past 5 years? c. What has been the trend in "a

Prime Company's Performance Summary

See attached file. I need assistance preparing a performance review I've attached some financial figures and additional company info. Please explain how I would analyze the data for this company.