Companies that sell to consumers, such as restaurants and retail companies, usually allow customers to pay by credit card. In fact, approximately 29 percent of all point-of-sale transactions are paid by credit card, comprising a significant proportion of these business's sales.1 Most major credit cards, that are backed by banks, handle the customer's billing, collections and related expenses. As a result, credit card companies will charge retailers a fee, typically between 2 and 5 percent of the sales price, for their services. When a business makes a credit card sale and deposits the credit card receipts with the bank, the credit card company immediately remits the amount of cash from the receipt to the business (less this small percentage charge).

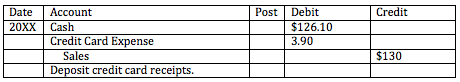

For example, a shoe store sells a customer a pair of shoes for $130. The credit card charge is 3%, or $3.90. The store would make the following journal entry:

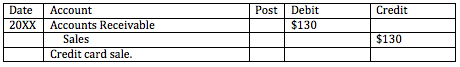

In addition to bank-sponsored credit cards, many stores (such as department stores and gas stations) provide their own 'credit cards,' that can be used in store only. If the billing, collections and related expenses of these credit cards are handled by the retailer, not a third-party, these sales must be treated as accounts receivables.

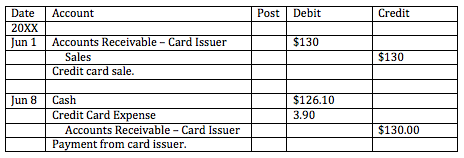

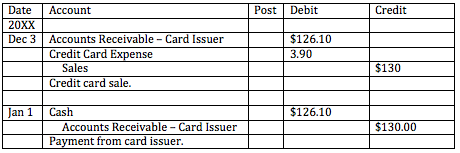

In a third case, some major credit cards are not issued by banks. Rather than depositing the credit card slips at a bank in order to get cash released to them, receipts from sales made on a credit card not sponsored by a bank must be mailed to the credit card issuer in order to receive the funds. In this case, the amount of the sale becomes an accounts receivable until the receipts are mailed away and cash is received from the credit card issuer. The credit card expense is not claimed until the payment is made by the credit card issuer.

However, we can not make a simple compound entry for cash and credit card expense in the case that the sale is made in one period, and the cash collection is made in the next. As a result, we have to make an entry today in order to recognize the credit card expense.

References:

1. Cash Dying as Credit Card Payments Predicted To Grow In Volume. Retrieved from: http://www.huffingtonpost.com/2012/06/07/credit-card-payments-growth_n_1575417.html

Credit Card Sales

BrainMass Solutions Available for Instant Download

Credit Card Case Study

The Free Credit Card As Jackson looked through his mail, he opened an envelope which contained a credit card. Jackson had not applied for this card, but he was in a hurry, so he placed the credit card, along with the rest of the mail, on the kitchen counter. He would deal with it later. That evening, Jackson's 15 year-old nep

Operations/Credit Card Risks

I need some help getting started on the following scenario: You are hired as the director of credit card operations for Western Bank. Explain to the board of directors the primary risks involved with a credit card operation and ways to deal with those risks. Be sure to address the following in your report: - Credit risk

On September 8 Maggie lost her wallet. The following four credit cards were in it, and the following charges were made before she was able to report the cards missing. How much is she legally responsible for? Visa card $195, MasterCard $25, American Express $500, Discover $300On September 8 Maggie lost her wallet. The following four credit cards were in it, and the following charges were made before she was able to report the cards missing. How much is she legally responsible for? Visa card $195, MasterCard $25, American Express $500, Discover $300

8. (TCO C) On September 8 Maggie lost her wallet. The following four credit cards were in it, and the following charges were made before she was able to report the cards missing. How much is she legally responsible for? Visa card $195, MasterCard $25, American Express $500, Discover $300

Credit Card Debt

Consumers' available credit limits on their credit cards have jumped significantly. Between 1996 and 2007, credit limits on consumer credit cards increased by nearly 100 percent to a total of $2.55 trillion dollars of available credit lines for consumers (revolving and non-revolving). As of 2007, credit card debt is one-third

Research on college students' credit card uses

I am currently working on a research project on college/university students' credit card use behavior and attitudes. First of all, I really need some suggestions on where I can find credible resources for my research, for example: useful web sites for college students credit card statistics etc. And my other questions are:

Credit Sales & Collection Policies

Please help with the following problem involving financial accounting and bookkeeping. What are your thoughts on the issues and procedures that a business must consider regarding credit sales and collections. Summarize your recommendations in memo form.

Credit Card and Liability

Would you say that a credit card could be considered a long term liability? Because although the credit balance is due every 30 days, you are then given a minimum amount to pay that is able to stretch out over a long period of time and can even extend for years?

Credit Sales Collections

Dixon company expects 650,000 of credit sales in march and $800,000 of credit sales in April. Dixon historically collects 70% of its credit sales in the month of sales and 30% in the following month. How much does Dixon expect to collect in April? Show calculations.