When a project is considered more or less risky than the current risk profile of a company, we can adjust WACC to reflect the greater return that equity holders of the firm would expect for undertaking the riskier project.

We do this by using a beta specific to the risk of the project. We take the beta, equal to the project’s market risk, and plot it on the security market line (SML), which gives us the expected return of the investment. The intuition is that the investment’s risk and return should reflect how it contributes to the volatility of a well-diversified portfolio.

Where,

ro = the expected return of the project or investment to the equity holders of an all-equity firm

rf = the risk-free rate

rmarket = the expected return of the market

Basset = the beta of the project or investment

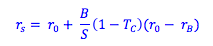

We can then adjust the all-equity expected return, ro, for the expected return to equity holders of the levered firm using the following formula.

Where,

rs = the expected return of the project or investment to the equity holders of a levered firm

Tc = the corporate tax rate

B = the proportion of the firm financed by bondholders

S = the proportion of the firm financed by shareholders

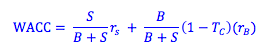

Once we have the expected return of the project to the equity holders of the levered firm, rs, we can then use this amount in our calculation of WACC for discounting the project.

It is important to note that before we use this approach, we have to consider whether the risks of the project may be already reflected in its expected cash flows. For example, if expected cash flows are already adjusted for risk, then no adjustment is needed to the discount rate to reflect the riskiness of the project.

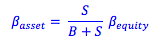

How did we find beta for the project?

Finding the beta for a project can be subjective. One approach is to find the average beta of other firms in the same industry as the new undertaking. This can be found by looking at market information for the different firms. Firms are leveraged by different amounts, so we use the following formula to get the correspnding asset-beta (or all equity beta) for each of the firms in the industry.

We can then take the average of these value for beta to estimate a suitable all-equity beta for our new project. However, we say this approach is subjective. That is because not all new projects fit neatly into one industry or another. Consider a company undertaking a project to allow consumers to shop directly through their television. Would this be a part of the e-commerce industry, the television industry, or the retail industry?

- Business

- /

- Finance

- /

- Capital Budgeting

- /

Beta and Required Return of a Project

BrainMass Solutions Available for Instant Download

Target Pricing Based on Required Return on Investment

Cary Recording Studios rents studio time to musicians in 2-hour blocks. Each session includes the use of the studio facilities, a digital recorded CD of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,000 sessions. The company has invested $2,300,000 in the studio and expects a return on

Computing and Controlling the Portfolio Beta

Mrs. Ochede has 20,000 naira saved from work, she intends to invest in shares. Ochede's friend has approached you for assistance. The data provided is as follows, Company Beta A 0.8

Computing the Value of Operations and Equity

Name______________________________________ FINC 5880 Session 9 Shares outstanding 10,000,000 FCF0 5,000,000 Target debt in capital structure 30% Constant growth rate 6% Debt interest rate 8% Beta 1.2 rRF 3% Amount of debt 5,000,000 Market risk premium 7% Tax rate 30% a. Calc

Calculate the portfolio weights and expected return

Financial Calculations: Portfolio Weights and Expected Return You own a portfolio of 250 shares of firm A worth $60/share and 1500 shares of firm B worth $40/share. You expect a return of 4% for stock A and a return of 9% for stock B. Please provide the calculations for the given problems in an Excel spreadsheet. (a) What

Capital Budgeting and Portfolio Beta

See the attached file. e. Suppose you are managing a stock portfolio consisting a mixture of high and low beta stocks. You have information which leads you to believe that the stock market is likely to be very strong in the immediate future, i.e., you are confident that the market is about to rise sharply. If you want to t

Computing the after tax cash flow given the information on investment on equipment, sales, gross margin, depreciation, selling general and administrative expenses and tax rate.

The initial investment outlay of $20 million for equipment only. Projects and equipment life is 5 years. Sales is projected to be $12 million per years for 5 years. Assume gross margin of 50% (exclusive depreciation). Depreciation for tax purposes, selling general and administrative expenses 10% of sales, tax rate of 35% for Ap

Required Return Rate

You can receive $10,000 today or $3,000 per year for the next five years. If the required rate of return is 10%, what option should be selected? (The present value of an ordinary annuity at 10% for five periods is 3.7908. The present value of one at 10% for five periods is 0.6209.) Answer A. Receive $3,000 per year for the n

Share Investment: Calculate the Net Return and Assess with the Overall Market Return

Please help with the following problem: Rosa purchases shares of a company that recently executed an IPO at the post-offering market price of $35 per share, and she holds the shares for one year. She then sells her shares for $40 per share. The company does not pay dividends, and she is not subject to capital gains taxation.

Expected Return, Standard Deviation, and Beta

1. Common stock A has an expected return of 10%, a standard deviation of future returns of 25%, and a beta of 1.25. Common stock B has an expected return of 12%, a standard deviation of future returns of 15%, and a beta of 1.50. Which stock is riskier? Explain. 2. a. Suppose you own $1 million worth of 30-year Treasury bonds.

Federal Taxation: Who is required to file a tax return?

Which of the following individuals are required to file a tax return for 2012? Should any of these individuals file a return even if filing is not required? Why or why not? a) Patricia, age 19, is self employed single individual with gross income of $4,500 from an unincorporated business. Business expenses amounted to $4,300.

Computing Required Rate of Return

Russo's Gas Distributor, Inc. wants to determine the required return on a stock with beta coefficient of 0.5. Assuming a risk free rate of 6 percent and the market return of 12 percent, compute the required rate of return.

Timberland: Target Cost to Achieve 15% Return

Timberland is considering manufacturing special crates to be used for shipping new mainframe computers. The company is working with a computer manufacturer who is thinking of using the new crates as a standard component for shipping their computers. Timberland's marketing manager has determined that mainframe computer buyers wou

Importance of Beta: Example Problem

Would you invest in a company with Beta coefficient below 1? What do you think about volatility of current market? What about low interest rates implemented by Federal Government?

Required Rate of Return for CAPM.

Kingsmen, Inc. is an all equity financed firm. The beta is .75, the market risk premium is 8% and the risk free rate is 4%. The cost of debt at companies of similar risk is 7%. What is the required return on the stock of Kingsmen?

Calculation of Beta of the portfolio

You hold a portfolio of stocks consisting of the following: Stock Beta Current Value Blackwater Gas 0.5 $10,000 Tidy Tom's Cleaners 0.7 $5,000 Globular Grabbus 1.2 $20,000 Creative Crafts

Stock Price based on dividends, growth rate and required rate of return.

The Ramirez Company's last dividend was $1.75. Its dividend growth rate is expected to be constant at 25% for 2 years, after which dividends are expected to grow at a rate of 6% forever. its required return is 12%. What is the best estimate of the current stock price? a. $41.58 b. $42.64 c. $43.71 d. $44.80 e. $45.92

Return on Total Assets - Hagerman Corporation

Hagerman Corporation reports the following items of the year 2011: Sales (all on account) $200,000 Cost of Goods Sold 120,000 Sales and Administrative Expense 40,000 Interest Expense 10,000 Hag

5-2 You purchase 100 shares of stock for $40 a share. The stock pays a $2 per share dividend at year-end. What is the rate of return on your investment for the end-of-year stock prices listed below? What is your real (inflation-adjusted) rate of return? Assume an inflation rate of 3%. (Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your "Real Rate of Return" answers to 2 decimal places.) Rate of Return Real Rate of Return a. $38 __________% _____________ % b. $40 __________% ______________% c. $44 __________% ______________%

5-2 You purchase 100 shares of stock for $40 a share. The stock pays a $2 per share dividend at year-end. What is the rate of return on your investment for the end-of-year stock prices listed below? What is your real (inflation-adjusted) rate of return? Assume an inflation rate of 3%. (Leave no cells blank - be certain to enter

A preferred stock pays a $7 dividend, and the required rate of return that investors have for this stock is 9%. Given these conditions, what is today's value of the stock? a. $63.00 b. $77.78 c. $16 d. $1.29 e. $0.78

A preferred stock pays a $7 dividend, and the required rate of return that investors have for this stock is 9%. Given these conditions, what is today's value of the stock? a. $63.00 b. $77.78 c. $16 d. $1.29 e. $0.78

Calculating the required rate of return in the given cases

Referring to the TMCC Security who promised to repay $100,000 in 30 years for a loan of $24,099 on March 28, 2008. a. Based on the $24,099 price, what rate was TMCC paying to borrow money? b. Suppose that, on March 28, 2020, this security's price is $38,260. If an investor had purchased it for $24,099 at the offering and so

Alpha Corporation is considering buying Beta Corporation for $2,400,000 cash. Beta Corporation has a $600,000 tax loss carryforward that could be used immediately by Alpha Corporation. Alpha Corporation pays tax at the rate of 35%. Beta Corporation will provide $300,000 per year in cash flow (in after tax income plus depreciation) for the next 20 years. If Alpha Corporation has a cost of capital of 11%, should Alpha Corporation go forward with the acquisition? (Show your work/calculations/formulas)

Alpha Corporation is considering buying Beta Corporation for $2,400,000 cash. Beta Corporation has a $600,000 tax loss carryforward that could be used immediately by Alpha Corporation. Alpha Corporation pays tax at the rate of 35%. Beta Corporation will provide $300,000 per year in cash flow (in after tax income plus depreciatio

Finance: Expected return on a stock; Beta vs standard deviation; Required return on common stock

The stock of Uptown Men's Wear is expected to produce the following returns given the various states of the economy. What is the expected return on this stock? Probabilities: Recession:0.2 Normal:0.5 Boom:0.3 Returns: Recession:-12% Normal:13% Boom:25% Answer 12.6 percent 10.4 percent 7.9 percent 11.6

Calculate the Required Return on a common stock

A company you are researching has common stock with a beta of 1.35. Currently, Treasury bills yield 2.5%, and the market portfolio offers an expected return of 11.5%. What is the required return on this common stock? 1. 10.93% 2. 11.86% 3. 21.43% 4. 14.65%

Calculate annual return and rate of return; price of a stock given market rate of return

A. Mr. Darden sold his house for $165,000. He bought it for $55,000 nine years ago. What is the annual return on his investment? B. An issue of common stock has just paid a dividend of $3.75. Its growth rate is 8%. What is its price if the market's rate of return is 16%?

Finance: Return on stock, expected portfolio return, return probability, beta

36. Ahmed purchased a stock for $45 one year ago. The stock is now worth $65. During the year, the stock paid a dividend of $2.50. What is the total return to Ahmed from owning the stock? a. 5% b. 44% c. 35% d. 50% 37. If you were to compare the returns of an individual stock to a market index, select the answer be

Calculate required rates of return given beta of stock

Assume that the risk free rate is 3.5% and that the market risk premium rate is 7%. What is the required rate of return on a stock with a beta of 0.8%. round answer to two decimal places. ______________% What is the required rate of return on a stock with a beta of 1.6? round answer to two decimal places. ________________

Calculate Beta and rate of return for a stock

A stock has a required return of 11%, the risk-free rate is 7%, and the market risk premuim is 4%. A. What is the stock's beta? B. If the market risk premium increased to 6%, what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged.

Required Return and Growth Rate of Stocks

Scenario: Chase and I are looking at Publix's stock because we are both very wealthy stock market investors. We agree on the expected dividend Publix will be paying. Chase has come up with an ironclad formula for projecting future dividend growth. He has franchised this information and made over $50 million on the formula in the

Why Investors Demand Higher Expected Rates of Return on Stocks

Why do investors demand higher expected rates of return on stocks with more variable rates of return?

Assets with Negative Risk

Suppose Rf is 5% and Rm is 10%. According to the SML and the CAPM, an asset with a beta of -2.0 has a required return of negative 5% [=5-2(10-5)]. Can this be possible and does this means the asset has negative risk?