At the end of each calendar month, banks typically send their customers a bank statement, a summary of all the transactions that occured in their account throughout the month, as well as a beginning balance and an ending balance typically after each transaction. Banks also provide a copy of each cheque that was written and withdrawn from the account during the month.

After receiving a bank statement, a company typically prepares a bank reconciliation. A bank reconciliation is a schedule that explains any differences between the bank's and the companys records of cash. These differences are referred to as reconciling items. If the difference results only from transactions not yet recorded by the bank, the company's record of cash is considered to be correct. However, if there still a difference, the company's or the bank's records may need to be adjuster. As a result, the bank reconciliation is a good tool to use as an internal control.

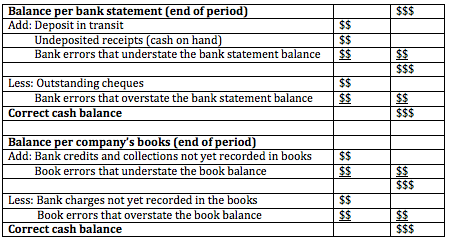

There are two forms of bank reconciliation. One form reconciles from the bank statement balance to the book balance or vice versa. The other form reconciles both the bank balance and the book balance to a correct cash balance. This latter form is more popular:

Adjusting journal entries are prepared for all the addition and deduction items the appear in the 'Balance per company's books' section of the bank reconciliation on the bank reconciliation done at the end of the period.

Bank Reconciliation

BrainMass Solutions Available for Instant Download

Non Sufficient Funds Checks

Non sufficient funds (NSF) checks would be: - subtracted from the book balance of a bank reconciliation. - subtracted from the bank balance of a bank reconciliation. - added to the bank balance of a bank reconciliation. - added to the book balance of a bank reconciliation.

How does an EFT Payment for a Bill Work?

An electronic fund transfer (EFT) for payment of a bill would be: a) subtracted from the bank balance of a bank reconciliation. b) added to the book balance of a bank reconciliation. c) added to the bank balance of a bank reconciliation. d) subtracted from the book balance of a bank reconciliation.

Identifying internal control deficiencies

18-36. Your working papers for an integrated audit being performed under PCAOB Standard No. 5 include the narrative description below of the cash receipts and billing portions of internal control of Slingsdale Building Supplies, Inc. Slingsdale is a single-store retailer that sells a variety of tools, garden supplies, lumber,

External Auditing Questions

10-27. Henry Mills is responsible for preparing checks, recording cash disbursements, and preparing bank reconciliations for Signet Corporation. While reconciling the October bank statement, Mills noticed that several checks totaling $937 had been outstanding for more than one year. Concluding that these checks would never

Evaluating Design and Effectiveness of Internal Controls

(Attached) Standard 5 of the Public Company Accounting Oversight Board (PCAOB) requires management to certify the internal controls over financial reporting. The accounting audit team must audit the internal controls to provide assurance to the design and effectiveness of internal controls. The following information repres

Sufficiency and Appropriateness of Evidence

Auditors should understand the five components of internal control that are sufficient to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and to design the nature, timing, and extent of further audit procedures. When performing the risk assessment of a potential client, audito

Fraud

Levon Helm was a kind of one-man mortgage broker. He would drive around Tennessee looking for homes that had second mortgages, and if the criteria were favorable, he would offer to buy the second mortgage for "cash on the barrelhead." Helm bought low and sold high, making sizable profits. Being a small operation, he employed one

LJB Company: Evaluate the system of internal controls

Case Study 2 -Internal Control LJB Company, a local distributor, has asked your accounting firm to evaluate their system of internal controls because they are planning to go public in the future. The President wants to be aware of any new regulations required of his company if they go public so he met with a colleague of yo

Call center data: Determine activity for shifts

See data file attached. Create graphs with an Excel spread sheet attached. I need a graph that shows time frames from the actual start time, and the actual end time. Then another that shows the categories of each application range so I can determine what the heavy applications are.

Ghosts on the Payroll

Read the section entitled Ghosts on the Payroll on p. 563. How could the company reasonably have prevented the issues presented in the case? GHOSTS ON THE PAYROLL fictitious checks were white, but the file copies of legitimate checks were green. Several additional clues indicated the presence of the fraud: - Multiple dire

Segregation of Duties in a Company with 11 Employees

One of my former clients had 11 employees in total; President, Controller/Treasurer, VP of Claims, VP of Underwriting, Asst. Controller/Treasurer, AP clerk, AR clerk and then 4 office staff personnel. Do you think its possible for segregations of duties to exist when there are only 4 people in the Accounting/Finance department a

Trex Co. Balance of Cash Accounts

Please find attached the XCEL file containing the questions. The following information is available for Trex Co.: a) Balance per the bank staement dated March 31, 2007, is $32,950. b) Balance of the Cash account on the company books as of March 31, 2007 is $31,396 c) Included with the bank statement was a $

Internal Controls at The Beat Company

E8-5 Listed below are five procedures followed by The Beat Company. 1. Several individuals operate the cash register using the same register drawer. 2. A monthly bank reconciliation is prepared by someone who has no other cash responsibilities. 3. Ellen May writes checks and also records cash payment journal entries. 4. On

Horizontal Analysis: Internal Controls

Financial information for Blevins Inc. is presented below: December 31, 2009 December 31, 2008 Current assets $125,000 $100,000 Plant assets (net) 396,000 330,000 Current liabilities

Bank Reconciliation for Lee.com

Prepare a bank reconciliation using the following information: Bank Statement Date Checks Deposits Balance 7/1 Balance $4,500.75 7/18 $133.50 4,367.25 7/19

Solve

I have attached the problems. 1. The basic accounting equation may be expressed as: A. Assets = Equities. B. Assets - Liabilities = Owner's Equity. C. Assets = Liabilities + Owner's Equity. D. all of the above. 2. Owner's Equity is increased by: A. drawings. B. revenue. C. expenses. D. liabi

E7-4 Albina, P7-3A Hanlon, PA6-3 Big Corporation

E7-4 Albina attached. P7-3A Hanlon attached. PA6-3 Preparing a Multistep Income statement with Sales Discounts and Sales Returns and Allowances and computing the Gross Profit Percentage. Big corporation is a local grocery store organized seven years ago as a corporation. The store is in an excellent location, and sa

Describe some ways that variation impacts your everyday life.

Describe some ways that variation impacts your everyday life.

Identifying outstanding checks and deposits in transit

Please help with the attached file.

401K - Fidelity

All employees are eligible to participate by enrolling onto the Fidelity file once a record has been set up for them. After receiving the participants data, Fidelity sets up the record. How can a company tell when a record has been set up on Fidelity? Hardship Withdrawals: What are the acceptable hardship reasons? What sou

Identify internal controls

Anita Theater is located in the Zurbrugg Mall. A cashier's booth is located near the entrance to the theater. Two cashiers are employed. One works from 1-5 P.M., the other from 5-9 P.M. Each cashier is bonded. The cashiers receive cash from customers and operate a machine that ejects serially numbered tickets. The rolls of ticke

Internal Controls of Ernesto's Pizza (Culotti's Pizza)

Sue Ernesto is the owner of Ernesto's Pizza. Ernesto's is operated strictly on a carryout basis. Customers pick up their orders at a counter where a clerk exchanges the pizza for cash. While at the counter, the customer can see other employees making the pizzas and the large ovens in which the pizzas are baked. Instructions

Proper implementations of reconciliation controls

Proper implementations of reconciliation controls would be effective in detecting all of the following errors except: a. Transactions were appropriately posted to individual subsidiary accounts, but because of a computer malfunction, some of the transactions were not posted to the master account. b. The client has experience

Internal Controls?Office Service Client

5-61 (Internal Controls?Office Service Client) Brown Company provides the following office support services for more than 100 small clients: 1. Supplying temporary personnel 2. Providing monthly bookkeeping services 3. Designing and printing small brochures 4. Copying and reproduction services 5. Preparing tax reports