The allowance method in accounting attempts to estimate what a company's uncollectible accounts receviable will be when sales are made or when the balance sheet is prepared. In this way, we try to estimate bad debt expenses are and recognized in the same period that the revenues they helped earner are recognized. Similarly, when we prepare the balance sheet, this allows us to recognize accounts receivable on the balance sheet at an amount closer to their net realizable value, assuming some accounts will never be collected.

There are two main approached to the allowance method: the income statement approach and the balance sheet approach. The income statement approach better matches bad debt expenses with revenues, and the balance sheet approach does a better job at representing the true value of accounts receivable on the balance sheet. You'll understand why below. In both cases we use a contra asset account that offsets accounts receivables on the balance sheet called Allowance for Doubtful Accounts.

The Income Statement Approach

The income statement approach estimates bad debt expenses based on total credit sales for the period. Sales, we know, is found on the income statement, and only represents sales made in this period. If there is a pretty stable relationshio between the amount of credit sales a company makes in previous periods, and the amount of these sales that become uncollectible, we can estimate what are future bad debt expense will be by estimating, based on historical information and market conditions. This is called the percentage-of-sales approach, and it does an excellent job matching bad debt expenses with revenues.

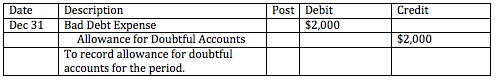

For example, if we made $100,000 of credit sales in the previous period, and we know from experience that approximately 2% of sales are uncollectible, we would record at the end of the period an estimated bad debt expense of $2,000.

The Balance Sheet Approach

Instead of the income statement approach, a company may choose to estimate their bad debt expense based on the amount of receivables outstanding. This is called the percentage-of-receivables approach, and does a good job at representing accounts receivabe at their true value on the balance sheet, even if it doesn't do as good of a job matching expenses with revenues.

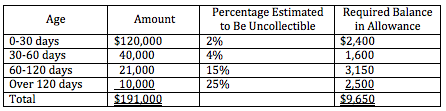

A popular approach is to set up an aging schedule, which looks at the age of each receivable and applies a different perentage based on the likelyhood that each age of receivable will be collected.

For example, based on past experience a company knows that 2% of accounts receivables under 30 days will be uncollected, 4% of accounts receivable between 30 and 60 days will be uncollected, 15% of accounts receivable between 60-120 days will be uncollected, and 25% of receivables over 120 days will be uncollected.

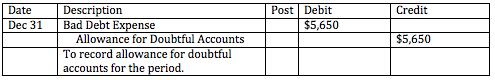

The corresponding entry at the end of the year to recognize estimated bad debt expenses would be:

Asssume, however, that the allowance for doubtful accounts already had a credit balance of $4,000. At the end of the year, we would make an entry of $5,650 in order to simply raise the credit balance in the allowance for doubtful accounts to the required $9,650.

Allowance Method

BrainMass Solutions Available for Instant Download

Revenue and Accounts Receivable

The Revenue/Receivables/Cash Cycle Question 1 Abe Company sold merchandise on credit to Bee Company for $1,000 on July 1, with terms of 2/10, net /30. On July 6, Bee returned $200 worth of merchandise claiming the materials were defective. On July 8, Abe received a payment from Bee and credited Accounts Receivable for $350.

Calculate the Charitable Contribution Allowance for 2012

JIM realizes the importance of being a good corporate citizen and makes generous contributions to worldwide charitable organizations. For 2012, JIM wants to contribute $1,500,000 to various charities. Based on 2011 tax laws, if JIM's taxable income before charitable contributions is $11,500,000 in 2012, Calculate the charitab

Contingency Allowance

Contingency Allowance: A company is developing a new cell phone and is trying to determine cost estimates for parts and labor for each phone. The target retail price for the new cell phone is $165.00 per unit and the markup required by retailers is 75%. Taking all this into consideration along with the component cost info

Allowance and Direct Write-off Method

Discuss the allowance method and the direct write-off method of accounting for bad debts. When is the expense for uncollected accounts receivable recognized under each method?

Garrels Company's Allowance for doubtful accounts

Appearing next is information pertaining to Garrels Company's Allowance for doubtful accounts. Examine this information and answer the following questions. 2011 2010 2009 Allowance for doubtful accounts Balance, beginning of year ? ? 1324 Provision charged to expense ? 502 1

Preparing Journal Entries: Doubtful Accounts

On December 31, 2010, when its Allowance for Doubtful Accounts had a credit balance of $1,500, Leeds Company estimates that 7% of its accounts receivable balance of $95,000 will become uncollectible. On March 3, 2011, Leeds Company determined that Megan Jost's account of $950 was uncollectible. On May 15, 2011, Jost paid the amo

Balance in Allowance for Doubtful Accounts at Year End

Bayside Company operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in the Company's Accounts Receivable account was $4,965,000 and the Allowance for Doubtful Accounts had a credit balance of $360,000 The year-end balance reported in the balance sheet for the Al

Problem Involving Allowance for Doubtful Accounts

Please help with the following problem. Age Interval Balance Percent Uncollectible Not past due $567,000 1/2% 1-30 days past due 58,000 3 31-60 days past due 29,000

bad debt expense and year end balance for allowance

The following information relates to a company's accounts receivable: accounts receivable balance at the beginning of the year, $319,000; allowance for uncollectible accounts at the beginning of the year, $25,400 (credit balance); credit sales during the year, $1,506,000; accounts receivable written off during the year, $15,200;

Puretz Consulting: Uncollectible accounts using percent of revenue allowance method

Survey of Accounting Problem 5-17 Accounting for uncollectible accounts, two cycles, using the percent of revenue allowance method The following transactions apply to Puretz Consulting for 2010, the first year of operation. 1. Recognized $75,000 of service revenue earned on account. 2. Collected $62,000 from accounts r

Cash equivalents, allowance method, bad debt estimate

1. Cashmere Soap Corporation had the following items listed in its trial balance at 12/31/09: What amount will Cashmere Soap include in its year-end balance sheet as cash and cash equivalents? A. $ 9,450. B. $12,450. C. $ 7,450. D. $19,650. 2. A company uses the allowance method to account for bad debts. W

Bad Debt Expense in Producing Coffee

A company producing coffee began the year with an allowance for Bad Debts at $22,000. During the year, $25,000 of accounts receivable were written off. The adjusted balance in allowance for Bad Debts on the end-of-year balance sheet was $27,000. Question: What is the amount of bad debt expense for the year? Ple

Entry to write off uncollectible accounts, allowance method

Under the allowance method of recognizing uncollectible accounts, the entry to write off an uncollectible account: A) increases the allowance for uncollectible accounts. B) has no effect on the allowance for uncollectible accounts C) has no effect on net income D) decreases net income please explain the answer.

Three Point Estimate Contingency Allowance

1. Basic Estimating Problem Given the following information, develop a base cost estimate by grouping costs by (Equipment / Material) (items 1 - 4), (Installation / Labor) (items 5 and 6), and (Overhead). 1. Two pieces of equipment costing $ 15,000 and $ 35,000 2. Material required for electrical hook-up is 400 feet at $ 25

Allowance for bad debt expense

Monro Inc. uses the accrual method of accounting for tax purposes. Here is a reconciliation of Monro's allowance for bad debts for the current year. Beginning allowance for bad debts $61,150 Actual write-offs of accounts receivable during the year (80,000) Addition to allowance

Prepare the adjusting entry for the allowance for uncollectible accounts.

Can you help me get started with this assignment? At the end of Year 2, the unadjusted trial balance of Alaska Company includes $1,500,000 of outstanding accounts receivable and an Allowance for Uncollectible Accounts of $14,600. Total sales for the year are $22,200,000 and 85% of the sales were on account. The company estima

The Allowance for Doubtful Accounts

Please help me understand this problem. I do not understand the mythology when talking about Accounts Receivable and the Allowance for Doubtful Accounts. On December 31, of the current year, a company's unadjusted trial balance revealed the following: Accounts receivable of $185,600; Sales Revenue of $1,280,000; (75% were on

Allowance for Doubtful Accounts: Burnett Corporation

Burnett Corporation had a 1/1/07 balance in the allowance for doubtful accounts of $15,000. During 2007, it wrote off $10,800 of accounts and collected $3150 on accounts previously written off. The balance in accounts receivable was $300,000 at 1/1 and $360,000 at 12/31. At 12/31/07, Burnett estimates that 5% of accounts receiva

Purchase Returns and allowance accounts

You are a bookkeeper at a small merchandising firm. You are comparing the income statements from the last three years. You notice the purchases Returns and Allowances account has been increasing at an alarming rate. If you were a manager, who would you speak to in the organization to help you understand why so much merchandise i

Cash Balance Per Books/Allowance for Doubtful Accounts

Marcus Company developed the following reconciling information in preparing its September bank reconciliation: Cash balance per bank, 9/30 $11,000 Note receivable collected by bank 6,000 Outstanding checks 9,000 Deposits-in-transit 4,500 Bank service charge 75 NSF

Direct Write-Off Versus Allowance Method

The vice president for Tres Corporation provides you with the following list of accounts receivable written off in the current year. (These accounts were recognized as bad debt expense at the time they were written off; i.e., the company was using the direct write-off method.) Date Customer Amount March 30 Rasmussen C

Allowance for Doubtful Accounts.

At the end of the period, the Allowance for Doubtful Accounts has a debit balance of $4,600. What does this mean? What are implications of this balance if I am using the Percentage of Sales method? What if I am using the Percentage of Receivables method?

Personal Allowance and Individual Tax Return

Can you please define the "personal allowance" given to individual taxpayers. What is the 2007 amount that can be deducted? Is this amount is more beneficial to a single person (no dependents) who earned $10,000 or a single person (1 dependent) who earned $10,000.

Allowance for Doubtful Accounts

Please provide calculations: 15. ABC company uses the estimate of sales method of accounting for uncollectible accounts. ABC estimates that 3% of all credit sales will be uncollectible. On January 1, 2005, the Allowance for Doubtful Accounts had a credit balance of $2,400. During 2005, ABC wrote-off accounts receivable tot

Journalize entires to record allowance for doubtful accounts using two different bases

The ledger of Elburn Company at the end of the current year shows Accounts Receivable $110,000, Sales $840,000, and Sales Returns and Allowances $28,000. a. If Elburn uses the direct write off method to account for uncollectible accounts, journalize the adjusting entry at Dec. 31st, assuming Elburn determines that Copp's $1,

Allowance for Uncollectible Accounts

On December 31, 2005, Vale Company had an unadjusted credit balance of $1,000 in its allowance for uncollectible accounts. An analysis of Vale's trade accounts receivable at that date revealed the following: Age Amount Estimated Uncollectible 0-30 days $60,000 5% 31-60 days $4,000 12% Over 60 days $2,00

Kay Shin Co: Prepare Schedule of Allowance for Doubtful Accounts

At January 1, 1993, the credit balance in the Allowance for Doubtful Accounts of Kap Shin Co. was $400,000. For 1993, the provision for doubtful accounts is based on a percentage of net sales. Net sales for 1993 were $70,000,000. On the basis of the latest available facts, the 1993 provision for doubtful accounts is estimated to

Calculation of Bad Debt Expense

A company has $110,000 Accounts Receivable, $840,000 Sales and $40,000 Sales and Return Allowances. How would I journalize the following for December 31: Allowance for Doubtful Account credit balance of $2500 in the trial balance, assuming bad debts are 1% of net sales and 10% of accounts receivable.

Allowance for Doubtful Accounts

Please check the attached problem and tell me if i had worked it out correctly. Thank you The income statement approach to estimating uncollectible accounts expense is used by Dexter Company. On February 28, the firm had accounts receivable in the amount of $437,000 and Allowance for Doubtful Accounts had a cre

Collectable accounts

The allowance for collectable accounts is a(n): A. Asset B. Contra Current Asset C. Expense D. Contra Revenue