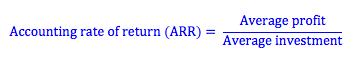

The accounting rate of return or average rate of return (ARR) is a tool used in capital budgeting to give managers a rough idea about how much money a project is expected to make for every dollar invested.

The accounting rate of return is equal to the average profit from an investment (or the incremental revenue less the incremental expenses (including depreciation)) divided by the average investment (or initial investment, in the case of incremental analysis). For example, a new machine has a book value of $100, costs $5 a year to run, and creates sales of $10/year. The incremental profit is $5 ($10 - $5) and the average rate of return is 5% ($5/$100).

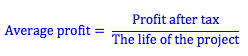

The average profit is equal to the total profit after tax averaged over the life of the project. For example, if the project makes $5/year over its useful life, the average profit would be $5. If the project makes $9 the first year, $5 the next year, and $1 in its last year, the average profit would still be ($9 + $5 + $1)/3 = $5. As you can see, ARR does not take into account the concept of time value of money.

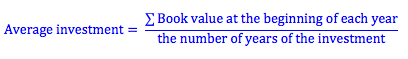

The average investment is determined by adding up the book value of the project at the beginning of each year (or period) and dividing this total by the number of years of the investment. For example, if a new machine is worth $100 today, but depreciates to $80 next year and $0 after five years, the average value of the investment would be ($100 + $80 + $60 + $40 + $20)/5 = $60.

ARR is often used to determine if the rate of return of a project is higher or lower than the required rate of return or to compare projects. The widespread use of ARR, despite its limitations (namely, it does not consider the time value of money) suggests that ARR is valuable for managers when making decisions because it is easy to conceptualize and communicate to others.

Photo by Nathan Dumlao on Unsplash

© BrainMass Inc. brainmass.com July 26, 2024, 4:03 pm ad1c9bdddf