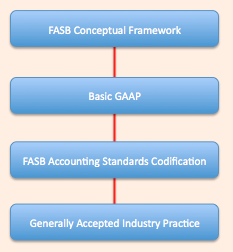

Levels in the Accounting Framework

The discipline of accounting can be broken down into a framework with three general levels. First is the conceptual framework which outlines the theory behind accounting rules. Second is a set of basic generally accepted accounting principles (Basic GAAP) that helps guide decision making when applying GAAP. Basic GAAP includes principles (such as the cost principle or the entity assumption) which are introduced to most accountanting students right at the start. Thirdly, is the FASB Accounting Standards Codification - the complete source of authoritative GAAP, including specific rules set out by FASB and the SEC. For example, the accounting standards codification outlines how depreciation based on the declining balance method is performed. Fourthly, and lastly, is a set of generally accepted industry standards that arise from practice. Firm's within the same industry typical mimic eachothers significant accounting policies that are chosen. This makes financial reports more consistent between firms, thus aiding in their comparability and making them more useful for users.

The Conceptual Framework

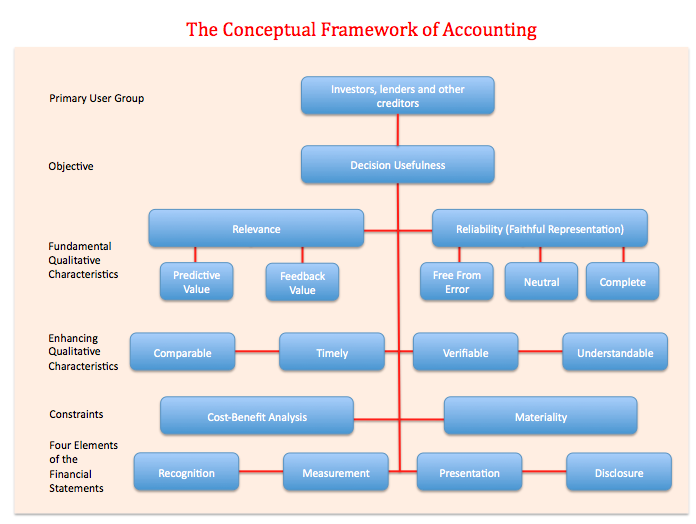

The conceptual framework of accounting is outlined in a series of "Concept Statements" put forth by the FASB. These statements are not 'GAAP' per say, and existing GAAP in certain areas may conflict with the conceptual framework outlined by the Board. The conceptual framework is the theory behind US GAAP. It is important to learn because US GAAP allows significant leeway for accountants to make decisions about how to apply GAAP in different circumstances. Understanding the theory behind US GAAP will allow accountants, and accounting students, to develop useful decision making skills for when they encounter this ambiguity. Similarly, it is tempting for students to view accounting rules as inevitable, and convert "what is" into "what ought to be." The SEC allows accountants to depart from GAAP when its strict application could be misleading, thus an accountant cannot blindly apply the rules of GAAP without understanding the theory behind it.

The Objective of Financial Reporting

According to the FASB, financial statements aim to provide useful information to one primary user group of financial statements: these are investors, lenders and other creditors who need financial information to make resource allocation decisions (FASB CON8 OB1). There are many different potential users of financial statements, with competing information needs. However, we must focus on making general purpose financial reports useful to this one primary group to allow for a clearly defined conceptual framework.

In order for information to be useful to investors it must have two fundamental qualitative characteristics: relevance and reliability (FASB CON8 QC17). We also try to maximize four enhancing characteristics: comparability, timeliness, understandability, and verifiability. Accounting information is then subject to two constraints: materiality (which affects relevance) and the cost vs. benefits of preparing accounting information. Ultimately, we use the conceptual framework to guide us in applying GAAP to the four elements of the financial statements: recognition, measurement, presentation, and disclosure.

Fundamental Qualitative Characteristics

Relevance: Relevant financial information is information that is capable in making a difference in the decisions made by investors, lenders and other creditors (FASB CON8 QC6). To be relevant, information must had a predictive value (can predict future outcomes) and must have a confirmatory value (it provides feedback) (FASB CON8 QC6).

Reliability: "To be reliable, information about an item must be representationally faithful, verifiable, and neutral, [and] reliability may affect the timing of recognition [when] the first available information about an event ... is sometimes too uncertain to be recognized" (FASB CON5-20). In FASB Concept Statement No. 8 (which replaced Concept Statements 1 and 2), reliability is replaced by "faithful representation." Faithful representation is described as information that is complete, neutral and free from error (FASB CON8 QC12).

Enhancing Qualitative Characteristics

There are four enhancing qualitative characteristics of financial information: comparability, verifiability, timeliness, and understandability (FASB CON9 QC19). Accountants try to maximize these characteristics in financial information.

Comparability: Because financial statements provide information that needed by primary users to make capital allocation decisions, it should be able to be compared with similar information about other entities, and with similar information about the same entity for another period or another date (FASB CON8 QC20). "Consistency, although related to comparablity ... refers to the use of the same methods for the same items, eithr from period to period within a reporting entity or in a single period across entities. Comparability is the goal, consistency helps to achieve that" FASB CON8 QC22). Comparability makes financial information more relevant.

Verifiability: Verifiability means that different people looking at the same information either directly (by looking at a contract, or counting cash), or indirectly (by knowing the inputs to a model, formula or other technique) would come to a consensus that the financial information presented was correct (FASB CON8 QC27). As a result, normally it is necessary for a business to disclose the underlying assumptions, the methods of compiling the information, and other factors and circumstances that support the information (FASB CON8 QC28). Verifiability makes financial information more reliable.

Timeliness: Financial information should be availabe to investors, lenders and creditors in time for it to be capable of influencing their decisions. Timeliness makes financial information more relevant (FASB CON8 QC28).

Understandability: "Classifying, characterizing, and presenting information clearly and concisely makes it understandable. Understandability makes financial information more relevant. Sometimes there is a trade-off between accurate representing complex accounting, or simplifying it to make it more understandable (but perhaps less accurate). In this case, we should always ensure that financial information is accurate, even if a user of a financial statement must seek an advisors help to understand them fully (FASB CON8 QC32).

Constraints

Materiality: Materiality is a threshold that information about an economc phenomenon must pass in order to be recognized or disclosed on the financial statements. Materiality means that information that is included is capable of influencing a decision made by a primary user of the financial statements. When items are non-material, the accountant is allowed to depart from GAAP.

Cost-Benefit of Information: The FASB recongizes that there are cost contraints to reporting financial information, and that the costs of preparing financial statements are typically incurred by its shareholders. There is therefore a cost-benefit analysis for producing accounting information: what is the cost of providing accurate financial information, and what is its related benefit to primary users? (FASC CON8 QC39)

Elements of the Financial Statements

We apply the GAAP to the four elements of the financial statements:

Recognition: Recognition is the process of incorporating information about an asset, liability, revenue, expense or the like into the financial statements.

Measurement: Measurement looks at how we value, and how we allocate, the items we want to recognize on the financial statements.

Presentation: Presentation addresses how we prepare and present the balance sheet, income statement, statement of owner's equity, and cash flow statement.

Disclosure: Many items are material but are not recognized on the financial statements. Disclosure looks at what type of additional information we need to provide along with the financial statements in order to help the users of the financial statements make decisions. Typical things that are disclosed in the notes to the financial statements include sgnificant accounting policies and lawsuits.

The Conceptual Framework of Accounting

BrainMass Solutions Available for Instant Download

Max Maxfield was just hired by your town as a new controller

Max Maxfield was just hired by your town as a new controller. He has a love for golf, and was able to convince the town's people to provide city funds for the construction of a new golf course (Max gets free golf year round). The city funds the construction of the golf course by issuing $100 million in general obligation bond

Income Statement Disclosure in Financial Reporting

This solution looks at components of a firms Sales and determines Income Statement contribution of each of these components: Sales Revenue Cost of Goods Sold Operating Expense Total Expense Operating Profit Identifiable Assets

Assistance with Accounting Problems 6

Please see attachment; all solutions must be in excel format; show how solutions were derived...Thanks.

Inventory Accounting

Inventory accounting Below are excerpts from the 2009 annual report of Daimler AG, a German company that manufactures luxury automobiles. Inventories Inventories are measured at the lower of cost and net realizable value. The net realizable value is the estimated selling price less any remaining costs to sell. The cost

Accounting Change

2011 Rate Authorization Allowed operating costs $ 1,120 million Assets in service $3,200 million (times) Allowed rate of return X 8.75% = 280 million Revenue requirement $ 1,400 million (divided by) Estimated energy demand / 14,000 million Rate a

Please use Introduction to Governmental and Not-for-profit accounting book by Martin Ives, Terry K.Patton and Suesan R Patton

P6-1) (Journal entries and financial statements---Capital Project Fund) The following transactions occurred during 2012. 1) The City of Watersville approved the construction of an enclosed concert arena for a total cost of $75,000,000 in order to attract professional events. On the same day, a contract with a 6 p

Transaction analysis

Analyze the following scenario: The Unified Path is an umbrella organization that solicits donations to support its many charitable suborganizations. One of these is the Millbridge Family Service (MFS). All transactions for MFS are handled through the MFS special purpose fund. For both the United Path general operating fund and

Accounting for Goodwill

Accounting rules have a substantial effect on financial statements. How do companies account for and apply goodwill? Consider the article "Talbots Inc. and Subsidiaries: Accounting for Goodwill" (Bruns, 2008). Next, using outside sources that you may seek and your professional experience, develop and write a 3 page paper concise

Intermediate Accounting II - Choose based on stock rights, Accounting Changes vs errors vs change in methods

Question 1 You own a small publically held company and are in need of raising new capital. You want to issue new shares of stocks but are unsure which type of stock to issue. You currently have 1,000,000 shares of common stock and 200,000 shares of preferred stock authorized. As of today, only 250,000 shares of common stock a

accounting

The cash account for Fit Bike Co. at August 1, 2014, indicated a balance of $12,190. During August, the total cash deposited was $28,100 and checks written totaled $33,010. The bank statement indicated a balance of $12,550 on August 31. Comparing the bank statement, the canceled checks, and the accompanying memos with the record

ABC accounting and value stream accounting

Describe accounting ABC (Activity Based Cost) in 250 words Describe value stream accounting in 250 words.

Sears Accounting for uncollectible Accounts

Companies must consider how accounting standards, within the current accounting framework, can have a variety of economic consequences on the company. Consider the article "Sears: Accounting for Uncollectible Accounts" (Hoyt & Nelson, 2000). Next, using outside sources that you may seek and your professional experience, devel

Lean accounting and GAAP principles

Define lean accounting and how it could be recognized by GAAP. Compare it to traditional accounting and describe situations where lean accounting is the preferred method.

A Purchase Impact on the Accounting Equation

A business purchases $5,000 of supplies on credit. How does this impact the accounting equation? Assets Liabilities Owner's Equity A) Decrease Increase Increase B) Increase Decrease No effect C) Increase Increase No effect D) Increase No effect Increase.

Accounting for an activity in an internal service fund

The differences in accounting for an activity in an internal service fund rather than the general fund may be striking. A school district establishes a vehicle repair shop that provides service to other departments, all of which are accounted for in its general fund. During its first year of operations, the shop engages in the

Accounting Procedures and Security Surveys

Why should accounting procedures be a part of a security survey? Why are security files significant in protection planning? (Intro to Security class).

Managerial Accounting: Computing Costs

Please help me answer the following Sheltie Manufacturing and Trimline Frames questions. See attached file.

Managerial accounting for Mountain Dew

The standards for one case of Mountain Dew are: Direct materials . . . . . . . . . . . . . . . . . . . . 6 lbs. @ $ 5.00/ lb. $ 30 Direct labor . . . . . . . . . . . . . . . . . . . . . . . 5 hrs. @ $ 12.00/ hr. 60 Variable overhead ( based on direct labor hours). . . . . . . . . .. . . 5 hrs. @ $ 6.00/ hr.= 30 During

Internal Controls and Importance

Could you please help me with this topic?: What are internal controls? Why are they important? Provide some examples of internal controls.

Do business controls create resentment; Is absolute IT security possible?

Some people believe that, instead of producing tangible benefits, business controls create resentment and loss of company morale. Discuss this position. Is it possible to provide absolute security for an organization's information system? Why or why not?

Internal Controls: Example Problem

Discuss some of the differences in internal controls between merchandising, manufacturing and service organizations. Use examples to help illustrate these differences.

Internal controls

Would like some assistance writing a 800 word paper discussing what defines internal controls and list some examples that might help a small business owner.

Who is responsible for establishing internal controls within the organization?

3.Who is responsible for establishing internal controls within the organization? What are some examples of effective internal controls? How can a company determine if the internal controls are effective?

General and Application Controls

10-16. Identify one or more control procedures (either general or application controls, or both) that would guard against each of the following errors or problems. a. Leslie Thomas, a secretary at the university, indicated that she had worked 40 hours on her regular time card. The university paid her for 400 hours worked t