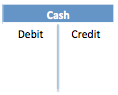

Every asset, liability and owners' equity account has what we call a "T-Account" that is recorded in the ledger. T-accounts get their name from the shape that they make. T-accounts have two sides: the left hand side for debits and the right hand side for credits. For example, we would have a T-account that looked like this for the cash account.

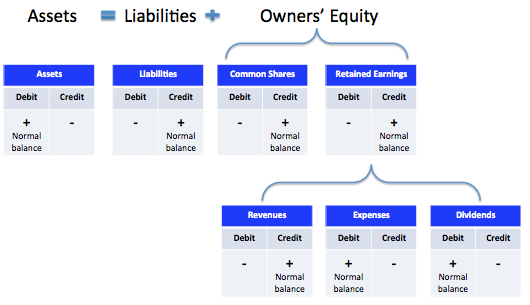

The T-accounts follow the rules of debit and credit. These rules follow the equation Assets = Liabilties + Owners' Equity. We assign normal debit balances to asset accounts - that is, accounts on the left hand side of the equation. We assign normal credit balances to liability and owners' equity accounts - that is, accounts on the right hand side of the equation.

Posting to a T-Account

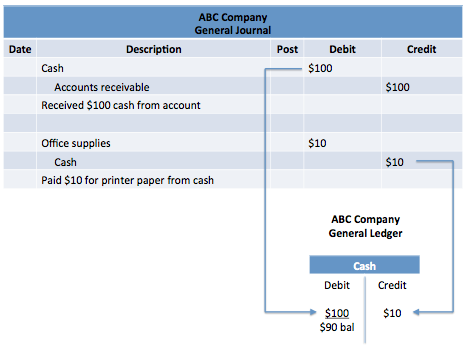

We use the rules of debit and credit to determine how a transaction should affect the balances of our T-accounts. We use these rules to first to record the transactions as journal entries in the general journal. Next, we take the recorded transactions from the journal and post them, or copy them to the ledger accounts.

For example, Cash is an asset account, so it would have a normal debit balance. Imagine we have a journal entry that shows we received $100 in cash for an accounts receivable. We would copy this transaction with a debit to cash of $100. Imagine a second entry where we paid $10 cash from our Cash account for an office supply. In this case, we would post the entry with a credit of $10 to the Cash account to reduce the amount of the cash balance.

A quick summary of how debits and credits either increase (+) or decrease (-) each type of account is provided below. Revenues, expenses and dividends are accounts that are closed out to retained earnings at the end of the period. Because expenses and dividends will decrease the amount available for retained earnings, we call these contra accounts. That is, these accounts exist on the right hand side of the accounting equation, but have a debit normal balance not a credit one. In this way they offset retained earnings, which has a credit balance. We can therefore expand the accounting equation: Assets = Liabilities + Owners' Equity + (Revenue - Expenses) - Dividends.

Accounts of the General Ledger

Posting to Ledger Accounts (T-Accounts)

BrainMass Solutions Available for Instant Download

Use of t-accounts for general ledger accounts

Why would use a T-account? Why do we use them as a students?

How to Write a Cover Letter

Please instruct me on how a cover letter for managing cash flow should be written.

Managing cash flow

Write about "How to manage cash Flow"

COGS T-account Multiple Choice Question

In the T-account cost flow diagram of balance sheet inventory accounts and the income statement cost of goods sold account: a)raw materials purchased are debited to work in process b)direct labor costs are credited to work in process c)cost of goods manufactured is debited to finished goods inventory d)cost of goods sold i

Accrual Accounting Concepts - Mudcat Realty

See the attachment. Accrual Accounting Concepts On March 1, 2008, Kara Frantz established Mudcat Realty, which completed the following transactions during the month: a). Kara Frantz transferred cash from a personal bank account to an account to be used for the business, $15,000. b). Paid rent on office and equip

Accounting - Journal Entry and General Ledger Preparation (Dustin Larkin Exercise)

For the past several years, Dustin Larkin has operated a part-time consulting business from his home. As of June 1, 2010, Dustin decided to move to rented quarters and to operate the business, which was to be known as Quixote Consulting, on a full-time basis. Quixote Consulting entered into the following transactions during June

Preparing a Balance Sheet and Reporting Total Intangible Assets

The general ledger of Younger Corporation as of December 31, 2011, includes the following accounts: Copyrights $20,000 Deposits with advertising agency (promote goodwill) 13,500 Discount on bonds payable

Nature of Reserve Accounts

The use of the term reserve in the title of a financial statement account is not acceptable in the United States, primarily because its purpose is often too vague. However, informal use of the term by chief financial officers, analysts, and the media is common when they are discussing various aspects of acceptable accrual accoun

Manufacturing Company T Accounts

Hard Core Enterprises makes peripheral equipment for computers. Emily Vit, the company's new controller, can find only the following partial information for the past two months: Account/Transaction July August Beginning Materials Inventory 52,000 ? Beginning Work in

Ledger Accounts for Grider Company

Grider Company's chart of accounts includes the following selected accounts 101 Cash 401 Sales 112 Accounts Receivable 414 Sales Discounts 120 Merchandise Inventory 505 Cost of Goods Sold 301 O. Grider, Capital On April 1 the accounts receivable ledger of Grider Company showed the following balances: Ogden $1,550,

Financial Accounting: General Ledger

Problem 1. At the beginning of 2010, Gonzales Company's accounting records had the general ledger accounts and balances shown in the table below. During 2010, the following transactions occurred: 1. received $80,000 cash for providing services to customers 2. paid rent expense, $10,000 3. purchased land for $9,000 cash 4. paid $

Oct. 2 - Received membership dues for the month of October total $7,500

Oct. 2 - Received membership dues for the month of October total $7,500 Oct 5 - Issue common stock in exchange for cash, $10,000 Oct 9 - Purchase additional boxing equipment for $8,600, paying one-half of the amount in cash and the other one-half due by the end of the year Oct 12 - Pay $1,000 for advertisi

General Ledger and T-Accounts

I need some help with the below accounting problem. ----------- I plan to incorporate a sole-proprietorship business entity, which will be a service organization a residential group home for boys. After you decide on a business, envision the core activities that will be performed at the start of operations. These can incl

Accounts Receivable using a Subsidiary Ledger

In at least 200 words, describe how accounts receivable arise and how they are accounted for, including the use of a subsidiary ledger and an allowance account.

The ledger of Elburn Company

The ledger of Elburn Company at the end of the current year shows Accounts Receivable $110,000, Sales $840,000, and Sales Returns and Allowances $28,000. Instructions (a) If Elburn uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Elburn determines t

Creating T Accounts

Creating T-accounts John started his bike dealership, a sole proprietorship, on April 1, 2004, selling new and used bikes. The gross profit earned on new bike sales is 40%. John used $40,000 of his personal funds to start the business. On April 1, the business buys $30,000 worth of new bikes from his supplier with cash. On A

Accounting: Sample Mid-term questions

Can you help me get started with this assignment? Please see ** ATTACHED ** file(s) for complete details!!

The ledger accounts given below, with an identification number for each, are used by Tyler Company.

Problem # 1 The ledger accounts given below, with an identification number for each, are used by Tyler Company. Instructions: Prepare appropriate adjusting entries for the year ended December 31, 2005, by replacing the appropriate identification number(s) in the debit and credit columns provided and the dollar amount in the

General Ledger Accounts - Dave's Wildlife Resort

Dave's Wildlife Resort 101 Cash 401 Sales 111 Accounts Receivable 451 Sales Returns and Allowances 231 Sales Tax Payable May 1. Sold Merchandise on credit; the transaction involved sales tax. 2. Received checks from credit customers on account. 3. Accepted a return on mercha

The Purpose of Subsidiary Ledgers

Please help with the following problem. What is the purpose of subsidiary ledgers? What are the possible ramifications of not using subsidiary ledgers?

Subsidiary Ledger - Yu Suzuki Company

Could not for the life of me figure this one out. I'm sure I'm missing something simple. Please explain the steps made to get the solutions. Yu Suzuki Company has a balance in its Accounts Receivable control account of $11,000 on January 1, 2008. The subsidiary ledger contains three accounts: Smith Company, balance $4,000; Gr

Analyzing the Effects of Transactions in T-Accounts

Mulkeen Service Company, Inc., was organized by Conor Mulkeen and five other investors. The following activities occurred during the year: a. Received $60,000 cash from the investors; each was issued 1,000 shares of capital stock. b. Purchased equipment for use in the business at a cost of $12,000; one-fourth was paid in cash

XYZ Company Ledger Accounts

Please see attached word document. For questions 1, 2 and 3, XYZ Company shows the following general ledger accounts: • Revenue $2,000,000 • Expenses $1,000,000 • Cash $400,000 • Accounts Receivable $600,000 • Land $2,000,000 • Inventory $1,000,000 • Accounts Payable $500,000 • Notes Payable $500

Journal, Ledger and Trial Balance for Howard Lighthouse

I have attached copies of the ledger, journal and trail balance sheets that I have created, along with the summary of the first year accounts. I am having trouble posting them in the correct place. Could really use some help. Complete the ledger for Howard Lighthouse Manufacturing using the business transactions transpi

T ACCOUNTS

Set up the following in T-account form and determine the ending balance insofar as these accounts are concerned. BEGINNING BAL. ACCOUNT Dr. Cr.

Journalize and Post Ledger Accounts

Judi Dench is a licensed architect. During the first month of the operation of her company, Judi Dench, Inc., the following events and transactions occurred. April 1 - Stockholders invested $25,000 cash in exchange for common stock. 1 - Hired a secretary-receptionist at a salary of $300 per week payable monthly. 2 - Paid

T-accounts / finding beg. balance

Find the beg. balance of Work in Process - Refining Department. The book says the balance was in the given information. I put the given info. in gray.

Understanding general ledgers

How would I go about opening the following general ledger accounts using the following account numbers: cash 111 sales revenue 411 accounts receivable 112 sales discount 412 supplies 116 sales returns & allowances 413 prepaid insurance 117

Intro Accounting: General Journal / Ledger, Trial Balance

Textbook Review: J. Miracle, an expert art and furniture restorer buys a studio where he has opened Like New, a sole proprietorship. His accountant has prepared the following chart of account {see attachment} Following are the transactions for May May 1. Miracle deposited $100,000 in a bank account in the name of bu