In a general sense, accounting profits are the difference between revenues and expenses. Profit margins are calculated by dividing profits by total operating revenue (the revenue we collect directly from sales). We exclude revenues from other sources because what we are really interested is the repeatable earnings from ongoing day-to-day, profit-seeking business activities.

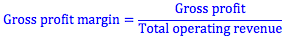

The two most common profit margins calculated are the gross profit margin and the net profit margin. The gross profit is found by subtracting the cost of goods sold from total operating revenue (or sales). The gross profit margin is therefore the gross profit divided by total operating revenue.

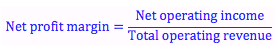

The net profit or net income is found after subtracting all other operating expenses, interest and taxes from the gross profit. The net profit margin is therefore the net operating income divided by the total operating revenue.

For example, imagine the following accounting numbers for ABC Co.

|

Sales Revenue (Total Operating Revenue) |

$10,000 |

|

Less: Cost of Goods Sold |

$7,500 |

|

Gross Profit |

$2,500 |

|

Less: Overhead |

$1,500 |

|

Less: Taxes |

$350 |

|

Net Profit (Net Operating Income) |

$650 |

Gross profit margin = $2,500/$10,000 = 25%

Net profit margin = $650/$10,000 = 6.5%

Profit margins are not direct measures of profitability because they are based on operating revenue, opposed to the value of the firm. However, it gives us a sense of how well a firm is able to produce or sell products and services at a lower cost or a higher price. Profit margins vary between industries, with service industries typically having a high profit margin, and manufacturing industries with lower ones.