A quick glance at the information listed about particular stocks on a stock exchange will show you that the price-to-earnings ratio (P/E) is considered one of the most important. Financial analysts rely on the P/E ratio because earnings are what drive dividends and capital gains, and provide the fundamental value of a business.

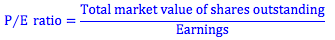

The P/E ratio compares the market price of the stock to the earnings per share, or the total value of the equity outstanding to the total income after tax.

The P/E ratio fluctuates based on the market price of the stock. A high price to earnings ratio suggests that investors think the firm has high growth potential. That is, they will pay more for the share today relative to today’s earnings because they expect higher earnings in the future. We often call P/E ratios multiples. We say that high-tech firms, those that have higher future potential earnings, trade at higher multiples, than low-growth firms like Xerox.

That being said, the P/E ratio is negatively correlated with the riskiness of a stock. An investor will want to pay less for a stock that has uncertain future cash flows than a stock that is guaranteed to make money. As a result, we pay less today for more risky stocks, and risky stocks should have a lower P/E ratio. This points out a trade off. Think of a lottery. It has a high risk – but a high future payoff if you win. On the other hand, stocks in a company, say Coca Cola, have a low risk but not as much growth. Their P/E ratio will reflect the trade off between risk and future returns.

Price-to-Earnings (P/E) Ratio

BrainMass Solutions Available for Instant Download

Calculation of Share Ratios

P7.9-Financial Learning Systems has 2.6 million shares of common stock outstanding and 74,908 shares of preferred stock. (The preferred pays annual cash dividends of $5.63 a share, and the common pays annual cash dividends of 33 cents a share.) Last year, the company generated net profit (after taxes) of $ 6,709, 324. The comp

Stock, PE Ratio, ROE, Price/Book Value, & Profit Margin

GEC Corporation, which markets cleaning chemicals, insecticides and other products, paid dividends of $2.4 per share in 2006 on earnings of $4.00 per share. The book value of equity per share was $40.00. Starting from 2007 earnings are expected to grow 6% a year steadily and ROE will remain on the current level. The stock has a

Price to Earnings Ratio

Please compare CPI's current PE ratio to our competitors to see where we stand in the market. Compare with Proctor & Gamble, Johnson & Johnson and Colgate.

Earnings Per Share and Price Earnings Ratio

1. Burger Palace had earnings after taxes of $900,000 in the year 2009 with 301,000 shares outstanding. On January 1, 2010, the firm issued 32,000 new shares. Because of the proceeds from these new shares and other operating improvements, earnings after taxes increased by 28 percent. (a) Compute earnings per share for the year

Plot P/E on Excel

Follow one stock and record its price every day (Open, high, low, close), number of share traded, and its P/E ratio. Construct a chart of the above variables. Then use the and estimate its value and compare your estimated value with the market price of the stock. The number of share traded and P/E ratio should be recorded ea

Price Earnings Ratio in the United States

I need some help with the following case: Consider Pacific Energy Company and U.S. Bluechips, Inc both of which reported earnings of $750,000. Without new projects, both firms will continue to generate earnings of $750,000 in perpetuity. Assume that all earnings are paid as dividends and that both firms require a 14 percent r

Calculating price and price earning ratio in the given cases

Castles in the Sand generates a rate of return of 15% on its investments and maintains a plowback ratio of .20. Its earnings this year will be $2 per share. Investors expect a 12% rate of return on the stock. a. Find the price and P/E ratio of the firm. (Do not round intermediate calculations. Round your answers to 2 decim

Price earnings ratio using two different discount rates

No-Growth Industries pays out all of its earnings as dividends. It will pay its next $3 per share dividend in a year. The discount rate is 12%. a. What is the price-earnings ratio of the company? (Do not round intermediate calculations. Round your answer to 2 decimal places.) P/E ratio = b. What would the P/E rat

Multiples Valuation: Google

Use comparable firms for a PE analysis. Find 3 firms that can serve as comparables for your firm, Google, Inc. Prepare a PowerPoint presentation (using both the slides and instructor's notes sections of PowerPoint) to do the following: 1. Explain why you selected these firms. 2. Explain why the comparable firms are not

Murphy's, Inc: Balance in retained earnings after dividend; market price per share

10) Murphy's, Inc. has 10,000 shares of stock outstanding with a par value of $1.00 per share. The market value is $8 per share. The balance sheet shows $32,500 in the capital in excess of par account, $10,000 in the common stock account, and $42,700 in the retained earnings account. The firm just announced a 10% (small) stock d

Percentage Change in P/E Ratio

The following table shows the Price to Earnings ratio for a stereo equipment manufacturing between 1998 and 2002. Determine the percentage change in the P/E ratios from 1999 to 2000. Year P/E Ratio 1998 12.4 1999 14.6 2000 11.1 2001 8.2 2002 6.8 =

Financial and Ratio Calculations for Industrial Company #1 and #2

See attached file for proper format. Industrial Company #1 (in millions) 2008 2009 2010 Sales $4,250 $4,500 $4,750 Operating Income $400 $445 $480 Net Income $200 $225 $250 Current Assets $2,500 $2,750 $2,850 Current Liabilities $2,300 $2,450 $2,500 Shares Outstanding 100 100 100 Avera

Finance: PE ratio, common size percentage, current ratio, effective interest rate, CD

21. A high price-earnings ratio can best be interpreted to mean that a firm: a. pays higher dividends per share than most comparable firms. b. has relatively high earnings per share as compared to their peers. c. currently provides less net income per dollar paid for one share of stock than most other firms. d. is guaran

Finn Resources Inc. EPS PE ratio Dividends per share Yield

The following information was taken from the financial statements of Finn Resources Inc. for December 31 of the current fiscal year; Common stock, $20 par value (no change during the year) $5,000,000 Preferred stock $10 Stock, $40 par (no change during the year) $800,000 The net income was $600,000 and the declared divid

Ratios used by Company's Financial Statements

Explain how ratios can be used to review a company's financial statements. Select a public company, and using price earning ratios, explain how the company is performing from a financial standpoint. Company picked: GE

Accounting Ratios: Earns per share, Price earning Ratio,

Based upon the following/attached information please review the attached ratio calculations. I am having difficulty identifying the specific items on the income statement related to the ratio calculations. Please determine the following ratios and explain your answers for review: 1. Earnings per share of common stock. 2.

Compare the ratio of the fundamental value per share that you computed in the previous question to Palm's market price per share (for February 23, 2001). 3. Compare Palm's market P/E on February 23, 2001, with the fundamental P/E you derive. 4. Analyze the approach that Palm's CFO took in trying to ascertain whether or not Palm was fairly valued in February 2001.

See attached worksheet. In 2000, the firm 3Com spun out its personal digital assistant division as Palm Inc. On February 23, 2001, the financial services firm Telerate reported the following information about Palm. The closing price for a share of Palm was $21.69. Palm had 565,946,000 shares outstanding. Its book valu

Price-Earnings Ratio for ABC, Inc.

ABC, Inc. has total assets of $642,000. There are 60,000 shares of stock outstanding with a market value of $19 a share. The firm has a profit margin of 6.4 percent and a total asset turnover of 1.36. What is the price-earnings ratio?

Price/Earnings ratio and managing earnings

1. The price/earnings ratio is often viewed as a measurement of future earning power. Do you agree? Why or why not? 2. Corporations have been criticized for "managing earnings." What does this mean? Do you agree that it is a problem? What can be done to prevent this practice?

P/E ratios, strengths, weaknesses, differences between company abc & xyz

I cannot figure out the P/E ratios to tell what the differences between the two companies would be and what the strengths and weaknesses are of both companies. I'm having a final tomorrow and will have a problem similar to this one. Can someone please help?

PE Ratio

A company has a net income of $850,000. It has 125,000 weighted average common shares outstanding and a market value per share of $115. The company's price earnings ration equals.

High P/E Ratios Imply High Growth

Please comment on the following statement: High P/E ratios imply high growth. Do you agree or disagree with this statement? Why?

Earnings and P/E ratio

Stock in Rich Corporation is currently selling for $25.00 per share. The firm's dividend yield is 10%. A. If the firm distributes 40% of its earnings, what are its earnings? B. What is the firms P/E ratio?

Expected sustainable growth rate, market P/E, price increase

Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percent. 1. What is the expecte

Dividend yield/P-E ratio

The stock of Pills Berry Company is selling at $60 per share. The firm pays a dividend of $1.80 per share. a. What is the annual dividend yield? b. If the firm has a payout rate of 50 percent, what is the firm's P/E ratio?

Capital Structure Analysis - Forecast of next year's earnings per share and P/E ratio

Given the following situation, complete the analysis and prepare a 4-5 page report showing the computations and conclusions. A company needs $ 36 Million to finance a major project in the company. The company is expected to generate a total of $ 81 Million in earnings next year with the addition of this project. The company c

Business Risk for Stock Price of IBM: CAPM, CGM, PE ratio model, market risk premium

See attached file. U.S. 10-Year Treasury is now 3.63 -0.05, please recalulate with this # By walking you through a set of financial data for IBM, this assignment will help you better understand how theoretical stock prices are calculated; and how prices may react to market forces such as risk and interest rates. You will

Manufacturing company's annual report

Find a manufacturing company's annual report. Calculate the following ratios for the company ( company selected below) selected: Return on Assets Return on Equity Gross Profit Margin Debt/Equity Ratio Debt Ratio Current Ratio Quick Ratio Inventory Turnover Total Asset Turnover Price Earnings Ratio Usin

Price to earnings ratio calculations

Foster Corp is considering the acquisition of Regis Corp. Foster has 2 million shares outstanding selling at $30 (or 7.5 times its earnings per share) Regis has 1 million shares outstanding selling at $15 (or 5 times its earnings per share) Fosters would offer to exchange 2 shares of Regis Corp. for 1 share of Foster Corp.

The stock listing for a company shows a P/E of 18, a dividend yield of 2.4%, and a closing price of $23.76. What is the amount of dividends per share?

The stock listing for a company shows a P/E of 18, a dividend yield of 2.4%, and a closing price of $23.76. What is the amount of dividends per share?