Accounting for petty cash is based significantly on generally accepted industry practices. That is, the standards that govern the accounting techniques for petty cash are not specifically laid out in U.S. GAAP, but have been developed in accordance with GAAP by practicing acocuntants in different industries.

Companies typical pay for items through bank transfers or chequens, in order to mantain a proper record of each payment. However, many companies also maintain a petty cash fund to pay for small, or miscellaneous expenditures such as emergency supplies, cabs and coffee runs. Different business's will keep different amounts of petty cash on hand depending on their needs.

There are two considerations when determining the size of the petty cash fund. For one, the fund should be large enough to avoid the burden of constantly replenishing and accounting for it. However, it should also be small enough that it does not tie up assets that the firm could use elsewhere and, perhaps more importantly, that it doesn't become a target for theft.

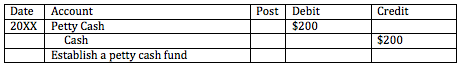

To create a petty cash fund, a cheque is written and cashed by a petty cash custodian or petty cashier. This person will cash the cheque and keep the cash in a locked file or cash box. The following shows the journal entry for establishing a petty cash fund in the general journal. In practice, a firm would typically record this transaction in a cash disbursements journal, a form of a checkbook ledger for all practical purposes.

During the ordinary course of business, many occasions will arise for which a person in the company will need to use the petty cash fund. At this point, this person would request cash from the custodian, who would prepare a voucher to record the date, amount, recipient, and reason for the cash disbursment. The voucher serves as a cash control, and is typically signed by both the custodian and the recipient. When the cash is spent, the recipient is required to return any receipts to the custodian, who will file them along with their related voucher.

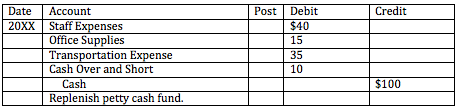

Expenses paid through the petty cash fund are not recognized until the fund needs to be replenished. At this point, we would debit each expense incurred, and credit our bank account by the amount of cash withdrawn to increase the fund. The petty cash fund itself is only debited or credited when it is established or the size of it changes.

In our example above, the petty cash fund needed $100 in order to be replensihed to its previous balance of $200. However, the custodian only had vouchers for $95 worth of expenses - a receipt for someone's starbucks was missing (perhaps). In this cash, cash shortages are debited to an account titles Cash Over and Short (similarly, cash overages would be credited). Cash over and short is a miscellaneous expense on the income statement.

Petty Cash

BrainMass Solutions Available for Instant Download

Crediting for Cash

A company with a petty cash box with $200 when replenished has petty cash receipts of $15 for gas expenses, $23 for postage expenses, $18 for supplies expenses and $12 for miscellaneous expenses. In the journal entry, cash would be credited for: -$68 -$132 -$200 -Cash would not be affected.

John Smith, Petty Cash Custodian and Internal Weaknesses

John Smith is the petty cash custodian. John approves all requests for payment out of the $200 fund, which is replenished at the end of each month. At the end of each month, John submits a list of all accounts and amounts to be charged and a check is written to him for the total amount. John is the only person ever to tally the

Petty cash fund

The petty cash fund was created on an imprest basis at $250 on March 1. On March 31, a physical count of the fund disclosed $18 in currency and coins, vouchers authorizing meal allowances totaling $148, vouchers authorizing purchase of postage stamps of $31, and vouchers for payment of delivery charges of $50. Please help