There are various types of pension plans including single-employer defined benefit plans, multiemployer plans and defined contribution plans. Single-employer defined benefit plans are the most controversial in accounting. This is because the accounting for pension plans often made it difficult to compare the financial statements of one business to the financial statements of another. Significant pension related obligations were often not recognized in the financial statements.1

Defined benefit plans include a promise to compensate employees with a specified amount of pension benefits. These benefits are commonly calculated based on the employee's length of service with the company and their salary at the time of retirement. While both employers and employees typically contribute to the pension fund, the employer bears the investment risk since it must make up the difference between the value of the fund and the defined benefit obligation if there is a shortage.

Pension plan accounting is very complex, and only the basics will be discussed here. The main purpose of accounting for pension plans is to recognize the compensation cost of an employee's pension benefits over the course of the employee's career with the business. As a result, accrual accounting is a fundamental element of pension accounting. This means that a business's pension expense each year is not limited to its cash contributions to the pension fund, but must reflect the present value of the estimated cost of the pension compensation that each employee has become entitled to as a result of their service over the year.

The second purpose of accounting for pension plans is to recognize that any difference between the amount of money available in the pension fund and the amount of the company's future pension obligations is a liability for the company.

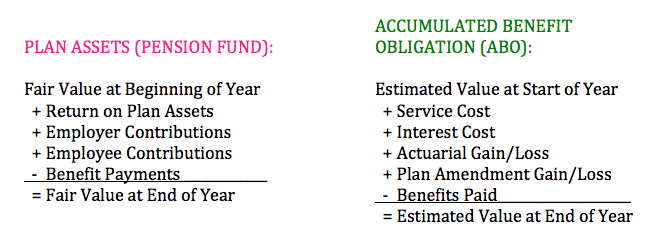

We can calculate the present value of the company's plan assets (its investment in the pension fund) and its ABO (which is an estimate of the present value of its future benefit obligation) below. ABO assumes that a company's current salaries do not rise. As a result, it typically understates the projected benefit obligation (PBO) which assumes salaries will rise; and overstates the vested benefit obligation (VBO) because it only counts service already performed. FASB Statement no. 87 requires accountants to measure the funded status of the plan using ABO.

The service cost estimate is the additional liability created because benefit obligations have accrued to each current employee for working another year. As well, because the company is now one year closer to having to pay its obligations, the present value of the obligation increases by the amount of one year's interest (ie. one year's discount must be added back). For example, if I owed you $110 next year, and the interest rate was 10%, I would record the present value of the liability as $100. After a year has passed, the present value of my obligation would be $110 to you. I would record a $10 interest expense and increase the liability account by $10 accordingly.

References:

1. FASB: Summary of Statement No. 87: Employers' Accounting for Pensions (Issued 12/85) <http://www.fasb.org/summary/stsum87.shtml>

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Long-Term Financial Liabilities

- /

Pensions

BrainMass Solutions Available for Instant Download

Indifference Curve Analysis Used on Pension System

Use indifference curve analysis to show how the Social Security pension system can reduce annual consumption for some workers who have a strong preference for current versus future consumption. What factors will influence the effect of the Social Security system on an individual's well-being and savings rate?

Vesting Years in a Qualified Pension Plan

MMC maintains a qualified defined benefit plan for eligible employees, with an effective date of January 1, 1990. The plan year for vesting and participation purposes is the calendar year. Eligibility is age 21 + one year wait + salaried status, with monthly entry dates; Vesting is the 3-to-7 graded schedule, with 1,000 hours re

Qualified Pension Plans

May an employer use the following eligibility provision under a qualified plan: "employees who customarily work less than 25 hours per week are excluded for participation in the plan"? Why or why not? If this provision presents a problem, what could be done to address the problem?

Status of a Pension Plan and Dual Presentation

The status of a pension plan as reported in its financial statements typically differs significantly from its status as presented in the required supplementary information for the plan. Why? Do you agree with providing this "dual presentation"?

Creation of a basic pension worksheet for the Rydell Corporation.

The following defined pension data of Rydell Corp. apply to the year 2010. Projected benefit obligation, 1/1/10 (before amendment) $560,000 Plan assets, 1/1/10 546,200 Pension liability 13,800 On January 1, 2010 Rydell Corp. through plan amendment, grants prior service benefits having a present value

Pension Expense, Pension Worksheet, Practice Exam Questions

1. Kathy's Kittens, In. provided information post-retirement benefits plan 2013 1. Presented below is pension information related to Woods, Inc. for the year 2013. Service cost$86,000 Interest on projected benefit obligation$52,000 Interest on vested benefits$28,000 Amortization of prior service cost due to increase

Pension expense: Kasper Inc. Kathy's Kittens

1. Presented below is pension information related to Woods, Inc. for the year 2013. Service cost $76,000 Interest on projected benefit obligation $47,000 Interest on vested benefits

Calculating Benefits, Alpha, and Pension Contribution

The group cannot come to a decision regarding which is correct. Please help. For #1 - 1 voted for $35,00, 2 voted for $89,000 and 2 voted $116,000; #2 - 3 voted for -0.75% while 2 voted for 0% and 1 voted 0.15; #3 - 3 voted for $2,756 while 2 voted for $4,443. This the the first time we have all had a difference as such. 1.

What is the pension expense?

Service cost $30,000 Interest cost $18,000 Actual return on plan assets $15,000 Beginning of year plan assets $200,000 Settlement rate 8% Expected return on plan assets 8% What is the pension expense?

P17-35 Mascare Pension Work Sheet; Case 17-56 Pension in Foreign Countries Writing Assignment

17-35 Name: Enter the appropriate amounts/formulas in the blue-shaded cells. For the purposes of this work sheet, positive amounts are debits and negative amounts are credits. MASCARE COMPANY Pension Work Sheet for 2013

Defined Benefit Pension Cost Schedule for 2011

Two-hundred employees of a corporation are provided with a noncontributory defined benefit plan. What would a schedule for pension costs look like for 2011, taking the data below into consideration? 12/31/2010 Fair value of plan assets 1,347,500 Projected benefit obligation (1,587,500) Unrecogni

Compute pension expense for 2010 and 2011.

PBO 1/1/10...........................................60,000 Discount Rate..........................................10% Fair value of plan assets 1/1/10...............24,000 Initial prior service cost value from amendment on 1/1/02...........................40,000 unrecognized prior service cost 1/1/2010...........

Suing the ERISA

Please help answer the following problem. Include a reference in the solution. Cindy Johnson graduated from Podunk University at the age of 18. Cindy immediately began working in the office of Mars Maintenance Company. After meeting the 1-year requirement, she wanted to participate in the pension plan. Mars rebuffed her due

Brunson Corporation Pension Plan: ending balance, PBO, over or underfunded

Please see attached file for proper format of the table. Brunson Corporation Pension Plan Information for Current Fiscal Year Beginning balance of plan assets at market value $1,560,000 Actual return on plan assets 210,000 Employer's contribution 150,000 Distributions to beneficiaries 75,000 Service cost

Reporting Paper (Pension Plan Executive Memo)

You are a controller in a midsized manufacturing company that has acquired 100% of another company. The acquired company includes two segments and two different pension plans. Both of these reporting issues are new to your CEO, and your CEO wants to eliminate the segments. Write a 700- to 1,050-word executive memo that explai

Pension Funding

Penny Pincher Company has a defined benefit pension plan for its employees. The following pension data are available at year end (in millions): Accumulated benefit obligation $142 Projected benefit obligation 205 Fair value of plan assets 175 There is no balance in prepaid/accrued pension costs. Required: a. Calculate the

Long-Term Financial Liabilities: Pension Plan

Differentiate between a defined contribution pension plan and a defined benefit pension plan. Explain how the employer's obligation differs between the two types of plans. Identify the five components that comprise pension expense. Briefly explain the nature of each component Discuss briefly the three approach

Social Security and pension funds: History and future

What is the viability and history of Social Security and pension funds. What does the future look like for both?

Pension Benefit Guaranty Corp: Implications of record deficit of 33 billion!

Discuss the implications of this headline: 'The Pension Benefit Guaranty Corp, the agency that insures the pensions of 44 millions Americans, has amassed a record deficit of 33 billions. If this was a real headline there could be some implications caused by this, but not as many as... If you want more information, download

Penny Pincher Co defined benefit pension plan: Calculate funded status, obligation

Penny Pincher Company has a defined benefit pension plan for its employees. The following pension data are available at year end (in millions): Accumulated benefit obligation $142 Projected benefit obligation 205 Fair value of plan assets 175 There is n

Defined benefit Pension Plan

Erikson Company sponsors a defined benefit pension plan. The corporation's actuary provides the following information about the plan. (First number Jan 1 2010, 2nd Dec 31, 2010) Vested benefit obligation $1,500 $1,900 Accumulated benefit obligation 1,900 2,730 Projected benefit obligation 2,500 3,300

Analyzing and Interpreting Pension Disclosures for Campbell Soup

a. What type of pension plan does Campbell Soup offer its employees? b. Does Campbell Soup have a net pension asset or a net pension liability at July 28, Year 11? What is the amount? c. Identify the amounts of the vested, accumulated, and projected benefit obligations at July 28, Year 11. What do those amounts represent?

Green Company's Benefit Pension Plan

The following information relates to Green Company's defined benefit pension plan during the current reporting year: Plan assets at Fair Value 01/01 600,000,000 Expected rate of return on plan asset 50,000,000 Actual return on plan asset

Pension and Post Retirement Benefits

After reading the attached article, "Two states approach retirement security from opposite directions," discuss: 1. How does the article relate to pensions & post retirements benefits? 2. What are your thoughts?

Defined Contribution vs. Defined Benefit Plan & Pension Expense

1. What are the differences and similarities between a defined contribution plan and a defined benefit plan? As an employee, would you rather have a defined contribution plan or a defined benefit plan? Why? As an employer, would you rather offer a defined contribution plan or a defined benefit plan? Why? 2. What are the compo

defined benefit pension plan and a defined contribution plan

Distinguish between a defined benefit pension plan and a defined contribution plan. Why does a defined benefit plan present far more complex accounting issues than a defined contribution plan?

Bethlehem Steel's Pension Plan

What is the economic importance of the pension plan, relative to the operations of Bethlehem Steel?

Overfunded Pension Benefits

Who is entitled to overfunded pension assets, the retirees or the company? Please answer the following question. Include a reference in the solution.

Zimmer Inc: Comprehensive Pension Plan Problem

Presented below is information related to the pension plan of Zimmer Inc. for the year 2011. 1. The service cost related to pension expense is $240,000 using the projected benefits approach. 2. The projected benefit obligation and the accumulated benefit obligation at the beginning of the year are $300,000 and $280,000, re

Kane Co's defined pension plan for 2008: cost

The following information pertains to Kane Co's defined pension plan for 2008: cost Pension Asset/Liability Jan 1 2,000dr Service cost 19,000 Interest cost 38,000 Actural return on plan asset 22,000 Amortization of unrecognized prior service 52,000 Employer contributions 40,000 Expected return on plan assets 18,000 In i