Employee-related liabilities are amounts that are owed to employees (that haven't yet been paid) for work performed during the period. These amounts are typically reported in expense accounts called 'wages payable', "accrued wages payable' or 'salaries payable'. Other amounts that may be included as employee-related liabilities include payroll taxes, payroll deductions, compensated absences and bonuses.

Payroll reductions: Payroll reductions may include both mandatory and voluntary deductions authorized by the employee. These amounts are withheld by the employer from the employees income, and may include federal, state and local income taxes, social security and medical taxes (as required by the Federal Insurance Contributions Act or FICA), retirement and savings investments, health-care premiums, union dues, alimony, stock purchase plans, and charitable contributions.

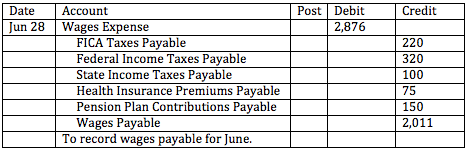

Payroll deductions are not an expense to the employer; rather, the employer acts as an intermediary collecting these amounts from an employee's wages and remitting them to the appropriate third parties. An employee's wages after deductions is often referred to as 'net wages'. The journal entry for accrued wages expenses may look something like the following. Wages payable, you will notice, is only credited by the amount of net wages.

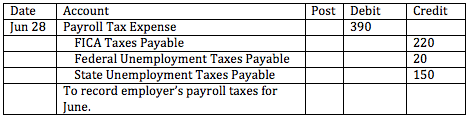

Payroll taxes: Payroll taxes include social security and medical taxes (often referred to as FICA taxes), federal unemployment tax (FUTA) and state unemployment tax (SUTA). These taxes are not deducted from an employee's wages, rather, they represent an additional expense to the employer. GAAP requires that employers recognize these expenses at the same time as the payroll is recorded. Therefore, the following journal entry would also need to be made on June 28th.

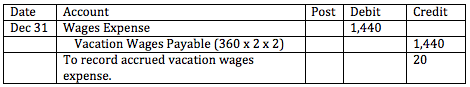

Compensated absences: Compensated absences refer to things such as vacation pay or sick pay that is earned by employees over the period. An employee has a vested right to redeem the amount for compensated absences if that right doesn't lapse and the amount is owed regardless if he or she resigns. An employee has an accumulated right to redeem the amount for compensated absences if that right doesn't lapse (ie. it can be carried forward to future periods), even if they are not necessarily vested. In both cases the employer is required to expense the right to compensated abscences in the period that it is earned.

When sick-pay is a vested right (ie. employees can take sick days even if they are not ill, and they are paid for unused sick pay when they leave the company) the company should expense the sick pay in the period it is earned. If an employer requires that an employee only receives sick-pay for absences that result from illness (even if unused sick-days accumulate), it will be difficult to estimate the number of sick days that will be used. As a result, this type of sick-pay is usually expensed as it is used, rather then when it is earned.

When a compensated absence expense is accrued, its value is typically estimated based on the employees current rate of pay (rather than estimated future pay). For example, the above firm has 2 employees who each make $360 a week and who are each owed two weeks vacation pay at the end of the year. The entry for recording this accrued expense would look like as follows.

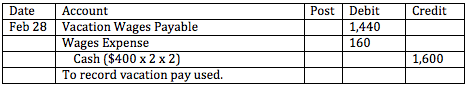

If the two employees take vacation in the following year, when they each make $400 a week, the following entry would be recorded.

However, if the business recorded the original liability based on an estimate of future wages, and that estimate was correct, the amount of wages payable and the amount of cash paid out would be the same, and no additional expense would be recorded.

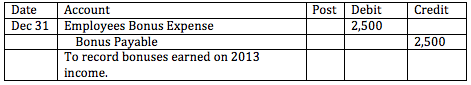

Bonuses: If bonuses arise as a right from an employment agreement, and the amount owed as a bonus has already been earned by the employee (or has arisen as a right based on a certain event that occured, such as a certain sales target that was surpassed) then the bonus owed must be recorded as a liability. A typical journal entry for recording accrued bonus expenses is as follows.

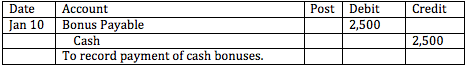

When bonuses are paid out, another simple journal entry is made.

Often bonuses are calculated based on after-tax income. However, because bonuses themselves are tax-deductible, a system of equations may be needed to solve simultaneously for the amount of the bonus and of the after-tax income.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Current Liabilities

- /