PARNERS' EQUITY

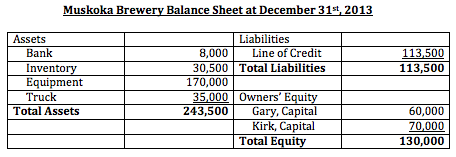

The partners' equity section of the balance sheet shows the value of the partners' investment in the business. Mathematically it is equal to the assets minus the liabilities of the business. In a partnership, each partner will have a seperate capital account for his or her contributions to the company. In both a sole proprietorship and a partnership withdrawal accounts are used to measure the amount that the partners have with taken out for their personal use.

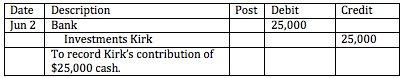

PARTNERS' CONTRIBUTIONS

When a business is formed the business's partners will contribute assets, either in the form of cash or physical assets, to help get the operations of the business up and running. A new partner may also contribute capital to an existing business. Capital that is contributed should be measured at its fair value and added to the contributing partner's capital account.

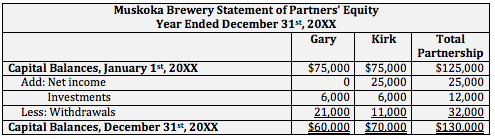

STATEMENT OF OWNERS' EQUITY

The ending balance in the owner or partners' capital accounts is calculated based on the "statement of owner's equity" or the "statement of partners' equity". The two statements follow the same format; however, the statement of partners' equity will have multiple columns for each partner. In order to arrive at a value for owners' equity at the end of the year, we take the beginning balance, add investments and net income and subtract withdrawals.

Investments: the amount of capital an owner contributes to the business during the year.

Withdrawals: the amount of money that an owner takes out of the business for his or her own personal use.

Ending balance: the ending balance from the statement of partners' equity would be the amount shown in the equity section of the business's balance sheet.

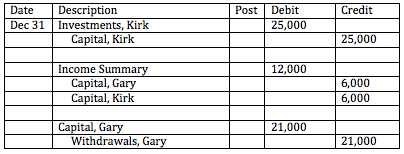

CLOSING ENTRIES

For a sole proprietorship or partnership, the net income/loss, investments and withdrawals are closed to the capital account during the closing process. As a result, only the capital accounts appear on the balance sheet at the time of the financial statements.

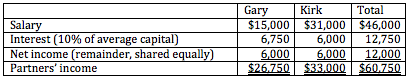

ALLOCATION OF NET INCOME

The allocation of net income in the partnership is determined based on the partnership agreement. For most partnerships, and by default if the partnership agreement is silent on the issue, net income is shared equally between the partners.

The partners of a business may also earn a salary or interest in addition to being allowed to withdraw some of the earnings from the business for their own personal use. Salaries and interest are included as an expense when calculating net income. There is no tax benefit to paying an partner a salary instead of simply letting the partner withdraw the business's earnings. This is because sole proprietorships and partnerships are not taxed as seperate legal entities; rather, their income is taxed as part of the owners' personal income.

However, it may happen that the partners of a business feel that an active partner should be remunerated more than a passive partner (who contributes money but not time). On the other hand, a partner who contributes more capital may deserve a larger share of net income than a partner who does not. In theses cases, the partners may decide to remunerate partners with a salary or interest in addition to his or her share of net income.

To calculate the amount of income each partner received from the partnership during the year and should claim as personal income we make the following calculations. Salary and interest will be paid to the partners in cash. Although the partners do not have to withdraw their total share of net income, their share of net income will be attributed to their capital account increasing the value of their investment in the partnership.