Defining Mortgage

Mortgages are a type of long-term financing used to purchase property. It is a type of secured financing, and the property they are used to finance serves as collateral for the mortgage itself. Mortgages typically require equal payments over the life of the mortgage. Bonds and notes payable require interest payments over their life and one lump sum repayment of principal upon maturity. Mortgages, on the other hand, require equal payments throughout their life composed of both an interest portion and a principal portion. As a result, payments made at the beginning of the life of the mortgage usually consist of a high proportion of interest and a lower proportion of principal. As the principal itself gets paid off, the amount of interest due each period decreases. Thus the portion of the fixed payment that is made up of interest decreases and the portion of the fixed payment that is principal increases. Mortgages are therefore paid off much faster as they near the end of their life.

Calculating the Principal and Interest Portions

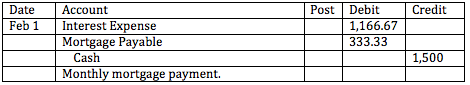

Let's work with an example. Imagine you obtained a mortgage for $200,000 at a fixed annual interest rate of 7% and with monthly payments of $1,500 on January 1st. On February first you make your first payment. The interest portion would be 1166.67 (equal to 7% x 1/12 x $200,000). We multiply the interest rate, 7%, by 1/12 to get the annual interest rate stated monthly.

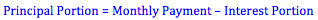

The principal portion is equal to the amount that the monthly payment exceeds theinterest portion. Thus this principal payment would be $333.33 (equal to $1,500 - $1166.67).

Recording a Payment

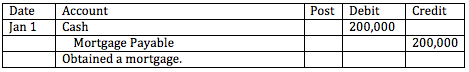

To record receipt of a new mortgage we would debit cash and credit a new liability account called mortgage payable. Even though we know that the cash from the mortgage is going to be used to pay for the property, we still debit cash at this stage (and when we purchase the property we would credit cash and debit the new property account).

To record a monthly payment, we recognize the interest portion of the payment as an interest expense and the principal portion of the payment as reducing our mortgage payable long-term liability account.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Long-Term Financial Liabilities

- /

Mortgage Payable

BrainMass Solutions Available for Instant Download

For a Home Mortgage

You plan to buy a $220,000 house with a 30 year mortgage with a 4.8% nominal annual rate (=A.P.R.) Payments are monthly, interest is monthly compounded, and you did not make a down payment. Assume you make all payments on time, at the end of the month. Answer the following questions. a) How much is each monthly payment? [2 d

Long-Term Financial Liabilities: Mortgage Payments

I just bought a home and put $20,000 down but had to take a mortgage for the remaining 170,000 of the purchase price. My bank offered a standard 30 year mtg. with 5.5% nominal interest rate. I figure my monthly mortgage payment will be around $965.24. Now suppose I decide not to do the 30 year mortgage. If I can get a 15 yr.