IRR, or internal rate of return, is often interpreted as the annual equivalent rate of return for a project. As a result, IRR is a popular and it seems intuitive approach for managers to evaluate a project. It is easy to look at a project with an IRR of 15%, and see this as favorable compared to a weighted average cost of capital of 12% or a mortgage of 8%. If you were a financial manager, you would accept this project.

However, let's say you invested $100 today in order to receive two payments in the future: $60 at the end of one year and $60 at the end of two years. We can find the internal rate of return by setting the net present value equal to zero, and determining the discount rate that solves this equation.

NPV = 0 = -$100 + 60/(1 + r) + 60/(1 + r)2

IRR = 13%

Critics suggest that that IRR intrinsically overstates a project's actual return. Let's look at this claim. If we can borrow the initial $100 at 5%, how much money would have from the project after the two years to pay back the $100 we borrowed? If we use the IRR of 13%, we get a future value of $127.80. (If we discount this back using 13%, we also get the present value of $100).

FV = $60(1.13) + $60 = $67.80 + $60 = $127.80

However, we know that that first cash inflow of $60 is unlikely to be reinvested at 13%. To be accurate, we should assume that this $60 is put towards the money we borrowed, and actually only saves us 5%. If we calculate the future value using this assumption, we find that the project will only make us $123 in two years.

FV = $60(1.05) + $60 = $63 + $60 = $123

As a result, we will want to use this new number to calculate a modfied internal rate of return (MIRR) that more accurately reflects the returns of the project.

PV = FV/(1+r)n

100 = 123/(1 + r)2

(1 + r)2 = 123/100

1 + r = √($123/$100)

r = √($123/$100) - 1

r = 10.91%

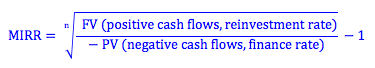

While we worked this last question step-by-step, we can use the formula for the modified internal rate of return for longer investments. This formula, in general, is:

Where,

n = the number of periods at the end of which a cash flow occurs (not the number of cash flows)

FV = the future value of the positive cash flows at the end of the last period, calculated using the reinvestment rate, or what the company could earn by reinvesting the cash flows externally

PV = the present value of the negative cash flows discounted to the beginning of the first period, using the finance rate or what it would cost to raise capital from external sources

Because the modified internal rate of return (MIRR) seperates negative and positive cash flows, it also avoids the problem of multiple answers (the IRR formula may have multiple rates of return as solutions). It is often reasonable to use the weighted average cost of capital for the reinvestment or finance rate.

Photo by marianne bos on Unsplash

© BrainMass Inc. brainmass.com July 26, 2024, 8:20 pm ad1c9bdddf