Dividends payable are dividends that are owed to shareholders because the company's board of directors has declared a dividend. Cash dividends are typically paid within one year of declaration (usually within three-months). As a result, these dividends, once declared, should be included on the balance sheet as a current liability.

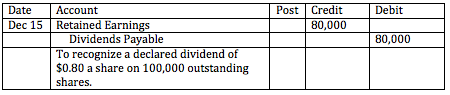

When the company's board of directors declares a dividend, a journal entry should be recorded that increases the Dividend Payable account and simultaneously decreases the company's Retained Earnings. For example, the following entry would be made for a company that has 100,000 outstanding shares and has declared a dividend of $0.80 per share.

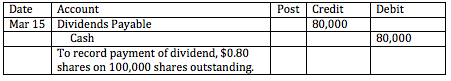

When the company actually pays the dividend, the Dividend Payable account is reduced and Cash of the Bank account is reduced.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Liabilities

- /

- Current Liabilities

- /