Long-Lived Assets "Held and Used"

When a long-lived asset is disposed of, all of the accounts related to the asset should be remoced from the balance sheet, such as the asset account and the contra-asset account 'accumulated depreciation.' The amount that the asset's historical cost exceeds its accumulated depreciation is called the asset's 'net bok value' or 'carrying amount.' Because the proceeds from the sale of a retired asset rarely equal the asset's exact net book value, GAAP requires that a gain or loss be recognized at the time of the sale (FASB ASC 360-10-40-5). Losses

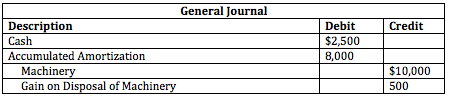

For example, consider an asset with a historical cost of $10,000, accumulated depreciation of $8,000 and a net book value of $2,000. If that asset is sold for $2,500, a journal entry would be made removing the asset and contra-asset account, recognizing the cash received, and recognizing a gain of $500 from the sale.

It is important to note that long-lived assets that are classified as "held-and'used" should continue to be depreciated until they are disposed of.

Long-Lived Assets Held-For-Sale

Long-lived assets that are no longer being used are reclassified as held-for-sale. Assets that are held-for-sale are presented separately on the balance sheet under long-term assets. Like assets that are held and used, when an asset that is held-for-sale is actually sold, a gain or loss must be recognized on its sale. However, when assets are classified as held-for-sale, they are measured based on the lower of net book value or net realizable value rule (like inventory). This means that a loss may be recognized at the time that it is beleived the asset will be sold for less than its net book value (and before the asset is actually sold). Gains may also be recognized if the asset's net realizable value increases (but cannot be recognized if this would make the value of the asset more than its original net book value at the time that it was reclassified as held-for-sale). These losses and gains are reported under 'income from operations' on the income statement; however, if the long-lived asset is part of a discontinued operation, losses and gains are reported as part of 'discontinued operations'.

Assets that are held-for-sale should not be depreciated, since depreciation is a way of spreading the cost of an asset over useful life (ie. allocating this cost to periods in which the asset is actually being used).

Involuntary Conversion

When an asset is disposed of through an involuntary conversion, such as a fire, flood, theft or expropriation, a gain or loss is still recognized when the proceeds from insurance or the government (if applicable) recognized and the asset is removed from the balance sheet. However, gains and losses from involuntary conversions are normally reported as extraordinary items on the income statement.

Donations

When a company donates an asset (other than money), the donation is expensed at the assets fair value. That means that the difference between the assets fair value and its book value must be recognized as a gain or a loss.

Scrapped or Abandoned Assets

When assets are scrapped for very little cash recovery (or abandoned for none), the entity recognizes a loss that is equal to the asset’s book value less any cash recovery.

Fully Amortized Assets Still In Use

When an asset has been fully amortized, its accumulated amortization will equal its historical cost and its book value is therefore zero. If the asset is still being used, both of these accounts should be kept on the balance sheet.

- Business

- /

- Accounting

- /

- Financial Accounting & Bookkeeping

- /

- Accounting for Long-Term Assets

- /

- Property, Plant and Equipment

- /